Altcoin

Wil Polkadot [DOT] rise to $32 in the long run? The most important signals indicate…

Credit : ambcrypto.com

- The weekly chart indicated that DOT may quickly see a considerable improve to $32 if sure situations are met.

- Each particular person buyers and large-scale holders referred to as whales are anticipated to drive the worth of DOT to new long-term highs.

Though Polkadot [DOT] combating a day by day decline of 4.35% and a marginal weekly decline of 0.23%, the altcoin’s prospects stay promising.

In accordance with the weekly time-frame, on the time of writing, DOT was at a essential assist degree, on the verge of breaking a falling wedge, concentrating on a peak at $32.

Why DOT may rise to $32

A mix of a falling wedge and robust historic assist units the stage for a possible rally.

On the time of writing, DOT was buying and selling at a big assist degree at $4,001, a degree from which costs have beforehand risen to increased areas. This degree can be accompanied by important shopping for strain.

The bullish sentiment was additional supported by the formation of a falling wedge at this assist degree. Usually, a falling wedge means that an asset’s value is prone to rise as soon as it crosses the higher restrict of the sample.

Supply: TradingView

Ought to DOT preserve assist and efficiently breach the higher area, three key long-term targets are focused: $11,810 on the peak of the falling wedge, $23,850 and $32,780, the place important liquidity is predicted.

Conversely, if assist fails to carry and the falling wedge breaks down, DOT may doubtlessly hit a brand new all-time low under $2,000.

Bullish runs across the nook

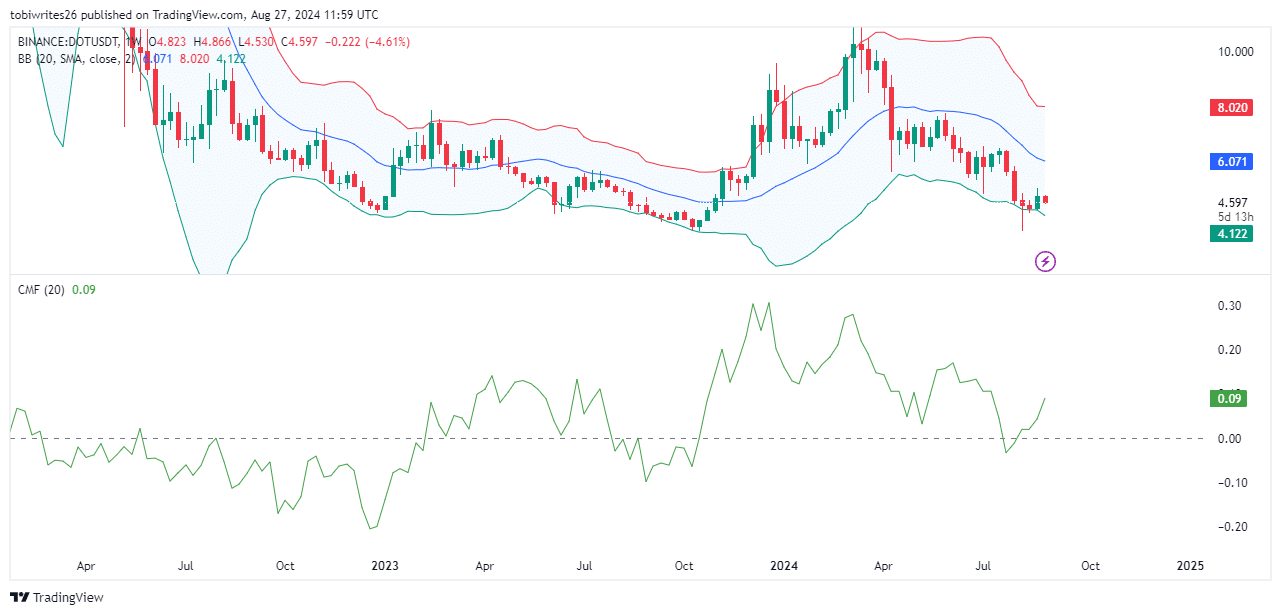

AMBCrypto’s technical evaluation suggests a possible bullish run for DOT, utilizing instruments just like the Chaikin Cash Circulate and Bollinger Bands to trace potential value actions.

The Bollinger Bands, outlined by pattern strains that plot two customary deviations from a easy shifting common (SMA) of the asset’s value, function indicators of market actions.

When the worth approaches the decrease (inexperienced) band, it usually signifies an impending rally, whereas its proximity to the higher (purple) band suggests a possible value decline.

On the time of writing, the DOT was close to the decrease band, indicating {that a} rally could also be in retailer and the assist degree at $4.0001 is prone to maintain.

Supply: TradingView

Moreover, the Chaikin Cash Circulate, which assesses whether or not cash is flowing into or out of an asset by indicating shopping for or promoting strain, confirmed investments shifting in the direction of DOT.

An inflow of cash often indicators growing shopping for strain, growing market confidence within the asset and certain pushing the worth increased.

The market outlook for DOT stays bullish

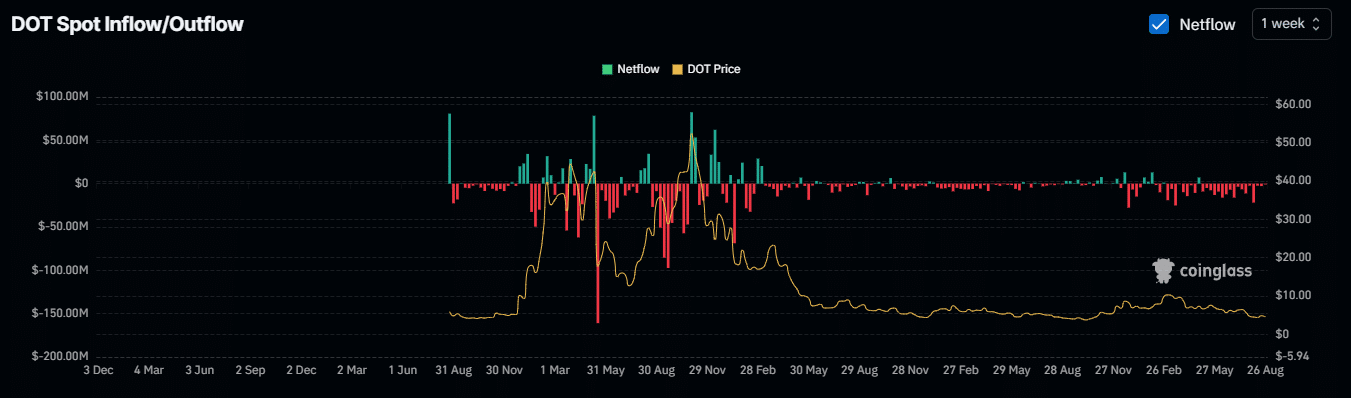

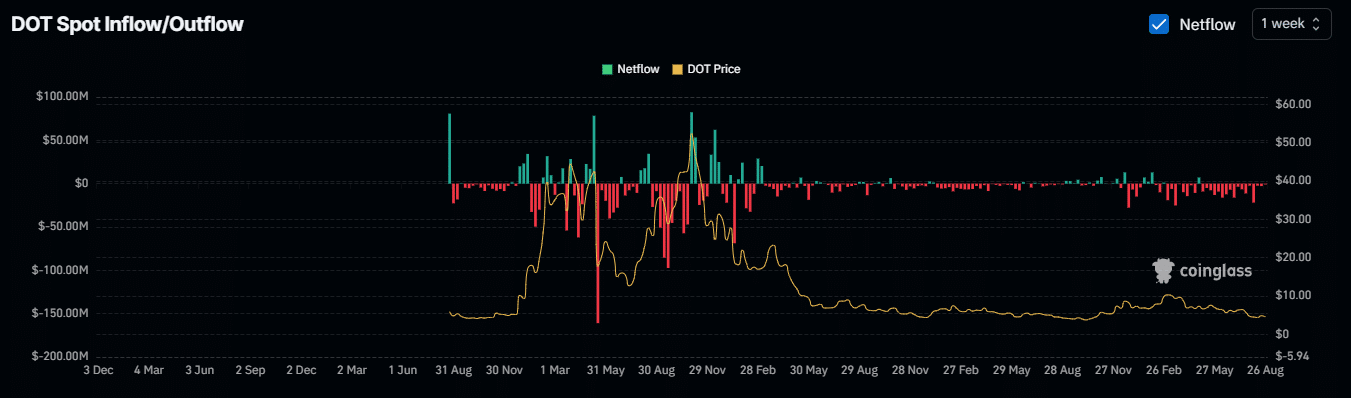

According to data analyzed by AMBCrypto utilizing Coinglass over the previous week, there was a big outflow from the exchanges, with roughly 2.833 million DOT withdrawn.

This destructive Netflow means that DOT holders are shifting their property from exchanges – the place they will simply promote – to safer wallets.

Supply: Coinglass

The motion typically displays bullish sentiment, indicating that buyers are optimistic about future value will increase and like to carry on to their property.

Learn Polkadots [DOT] Worth forecast 2024–2025

At the moment, this pattern underlines rising confidence amongst market members, indicating {that a} rally is imminent.

General, indicators level to a bullish outlook for DOT, with expectations that it may rise to a long-term value goal of $32.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now