Analysis

Will Bears Dominate ETH Price?

Credit : coinpedia.org

The Federal Reserve determined to not change the rates of interest on 7 Might, in order that they maintain 4.25% to 4.50%. This made Crypto activa extra engaging for buyers. Consequently, the market is rising at the moment, with Bitcoin that touches $ 100,000. Ethereum can also be going up, however consultants imagine that STHS might quickly promote to make a revenue. That is supported by a lower in crucial exercise on the chain, which may quickly result in a worth reverse.

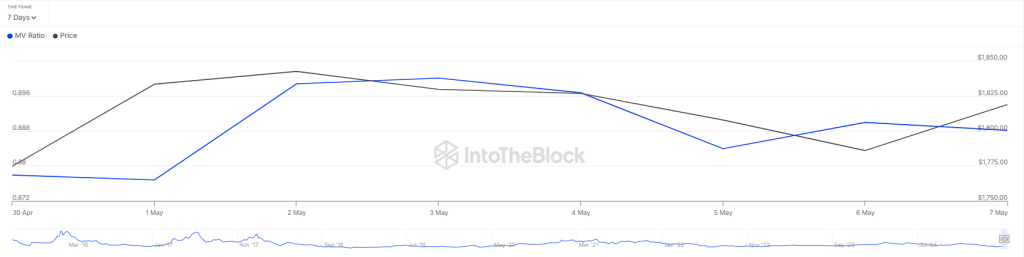

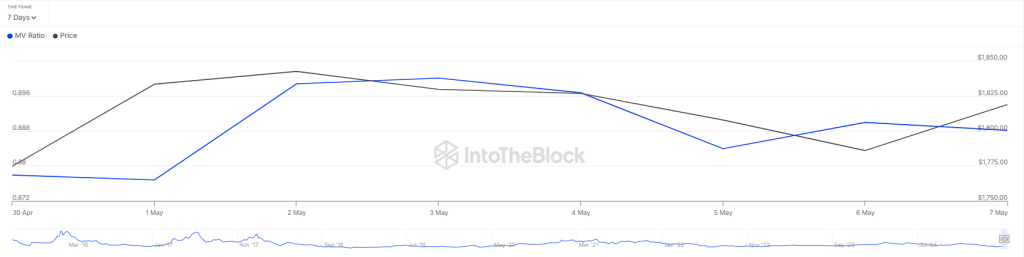

ETH’s MVRV ratio to activate reversal

The cryptomarkt has seen a robust enhance within the final 24 hours. Bitcoin was again to the $ 100,000 stage, which it final reached in February. Ethereum additionally rose above $ 2,000 and restored losses associated to earlier tensions between the US and China.

In response to Coinglass, greater than $ 175 million have been liquidated by $ 175 million in $ 175 positions. Of those, consumers closed $ 27 million in positions, whereas sellers noticed $ 148 million in pressured liquidations. The rise in Ethereum’s worth additionally led to a soar of 18% in open curiosity, now a complete of $ 24.8 billion.

Learn additionally: Altcoin season is right here: XRP, Ada, Sui, ETH Rally

Ethereum’s latest revenue is partly attributable to extra curiosity from massive buyers since April. Coinshares reported cash for 2 consecutive weeks that flowed in ether-based ETFs. Some additionally imagine that the Pectra -upgrade, launched on 7 Might, has contributed to the worth.

The present buy demand within the Cryptomarkt could not take lengthy. Knowledge from Intotheblock present that the MVRV ratio has fallen to 0.888, which signifies that many buyers promote with losses, though costs are rising. This sort of panic sale can encourage extra gross sales and result in a recession.

But some main gamers (‘good cash’) purchase. Wintermute has made massive purchases over the previous 24 hours, presumably to benefit from the rise within the enhance and incomes market prices. Equally, Lookonchain reported that Abraxas Capital attracted greater than 41,000 ETH (value $ 75 million) from Binance and Kraken. Regardless of the worth enhance, virtually half of all Ethereum portfolios, round 65.5 million, nonetheless have loss.

What’s the subsequent step for ETH worth?

Sellers are struggling to push Ether below the advancing averages, which suggests that there’s not a lot stress to promote throughout the Winner Rally. Patrons maintain the worth across the direct resistance line. From writing, ETH worth acts at $ 2,048 and greater than 13percenthas risen over the previous 24 hours.

Patrons can use this as a possibility to interrupt the resistance to $ 2,109. In the event that they succeed, the ETH/USDT -PAAR Momentum can win and go above the extent of $ 2,500. There’s a smaller impediment on the FIB stage of 23.6%, however it’s anticipated to be overcome.

Then again, sellers will in all probability attempt to drag the worth among the many advancing averages. If that occurs, ETH can fall to $ 1,734. Patrons will in all probability step in, but when they can not maintain that stage, the worth can fall additional to essential assist at $ 1,542.

For the reason that RSI is traded at stage 78 within the Overbought area, the ETH worth is prepared for short-term correction within the brief time period.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024