Altcoin

Will Beerish metrics push BTC price under $ 80k?

Credit : coinpedia.org

The latest restoration of the cryptomarkt light on Friday, as a pointy sale, knew nearly all weekly revenue. Traders have been cautious within the midst of concern about President Trump’s upcoming charges earlier than 2 April, together with stronger than anticipated core PCE knowledge. With Bitcoin confronted with rising gross sales stress underneath $ 85,000, it’s on its means for the worst quarter since 2018, in order that analysts can speculate or the Mars might finish under the vital stage of $ 80,000.

Bitcoin to make the worst Q1 since 2018

The worth of Bitcoin has fallen sharply in latest hours. In keeping with Coinglass knowledge, nearly $ 90.56 million have been liquidated in BTC positions, together with $ 79.3 million from consumers and round $ 11.25 million from sellers.

Bitcoin has been heading in the right direction due to the worst Q1 efficiency since 2018. Information Coinglass Signifies that Bitcoin fell round 11.86% in Q1 2025, barely worse than the lack of 10.83% in Q1 2020, though removed from the drastic lower of 49.7% seen in Q1 2018.

The open curiosity of Bitcoin has fallen by round 4.5% within the final 24 hours and is getting nearer to a low of round $ 54 billion. The lower in open curiosity signifies the falling buying and selling exercise at BTC merchants, which may result in diminished volatility and extra cautious market conduct within the brief time period.

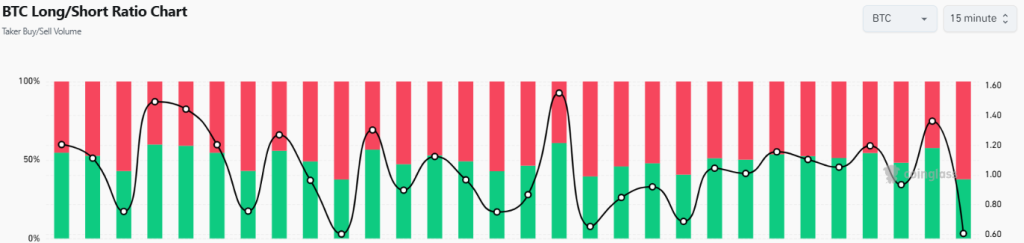

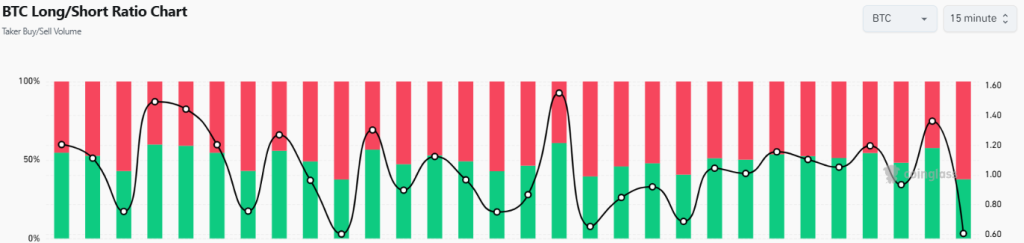

Furthermore, the lengthy/brief ratio has skilled a noticeable decline, which is at the moment 0.6051. This metric reveals that about 62.3% of merchants now guess on an additional value lower for Bitcoin, whereas solely about 38% is hopeful a few potential rebound. Basically, these figures level to an rising bearish sentiment amongst merchants.

Learn additionally: Bitcoin ETF Influx Streak breaks after a 10-day rise

Add to Beerarish sentiment, Bitcoin ETFs skilled outstanding outskirts, in order that BTC probably pushed nearer to the extent of $ 80k. The FBTC Fund of Constancy alone noticed $ 93.16 million out on Friday, ending a 10-day line within the influx-the longest this 12 months. Particularly, FBTC had solely obtained $ 97.14 million in influx the day before today, in response to Sosovalue. The commerce quantity in all American Bitcoin ETFs rose barely on Friday, a complete of round $ 2.22 billion.

What’s the subsequent step for BTC value?

Bitcoin not too long ago skilled an elevated gross sales stress, which diminished the value underneath vital help ranges from Fibonacci and reached a low level of roughly $ 81,644. Bitcoin is at the moment appearing close to $ 82,289, about 1.7% falling within the final 24 hours.

Sellers actively maintain the essential resistance to $ 85,000, in order that the value doesn’t bounce again. Nonetheless, consumers stay decided they usually appear ready for a brand new push to reclaim this vital stage.

If consumers reach regaining the extent of $ 85,000, the market sentiment can shift positively, in order that the highway could also be launched for additional upward momentum towards the subsequent main resistance close to $ 90,000.

Nonetheless, if consumers are usually not profitable in overcoming this vital barrier, Bitcoin may be confronted with an elevated gross sales stress, in order that the value could also be towed to the help zone between $ 80,000 and $ 78,000.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024