Bitcoin

Will Bitcoin Price Crash Below $70k

Credit : coinpedia.org

Since February 20, the Nasdaq Composite Index has fallen by 11.34%, whereas the Nasdaq 100 has fallen by 10.94%. Bitcoin, typically referred to as ‘digital gold’, has fallen much more – a lower of 13.52%, indicating that the BTC market is presently following the development of the US inventory market.

Gold lawyer Peter Schiff doesn’t cease herself – he states that Bitcoin has failed as a retailer of worth, particularly in instances of disaster. He even warns {that a} deeper Nasdaq -Crash BTC might ship even decrease.

So, is Bitcoin actually the way forward for protected port activa, or is gold nonetheless king? Let’s dive into it.

Nasdaq’s sharp drop shouts worries

At first of 2025, the Nasdaq Composite Index was $ 19,401. From January 1 to February 27 it moved between $ 20,087.23 and $ 18,902.75. On 27 February, nevertheless, the market fell sharply, misplaced 3.46% in someday and fell under this attain. Since February 20, the index has misplaced greater than 11.34%.

Bitcoin displays the decline of the inventory market

Bitcoin began the yr at $ 93,587.07 and remained inside a variety of $ 92,540.01 to $ 106,151.77 to 24 February. On January 20, consumers briefly pushed to BTC to $ 109,568.48, however by the day it was agreed to $ 102.294.18. Then, on 24 February, a significant sale prompted a lower of 4.97% in a single day, which broke the earlier vary of Bitcoin. Since February 20, BTC has fallen by 13.52%, which reveals that it’s synchronized with the inventory market as a substitute of performing as a hedge.

Peter Schiff compares the present market circumstances with earlier monetary crashes, together with the DOT-Com bubble, the 2008 disaster and the COVID-19-Crash 2020. He predicts that if the Nasdaq drops 20%, Bitcoin might fall to $ 65,000. If the Nasdaq drops 40%, he warns that BTC can crash as much as $ 20,000 and even decrease.

Bitcoin is presently being traded at $ 83,559.98-31.39% under the all time.

Gold rises like Bitcoin Falls

Whereas Bitcoin and shares are struggling, gold costs have risen. Schiff factors out that though the Nasdaq has decreased, at the very least 13percentwon, in order that his status is strengthened as a protected port lively.

At first of 2025, gold was priced at $ 2,624.65. Since then it has elevated 13.86%, with a rise of 12.46% alone between January 1 and February 24. Even through the decline of the market since 20 February, Gold elevated by 1.83%.

At present, Gold is $ 2,989.38 and Schiff believes that if the inventory costs proceed to fall, gold can rise past $ 3,800.

- Additionally learn:

- Bitcoin -Worth forecast for this week [17th – 23rd March]

- “

Bitcoin’s credibility in peril?

By exposing how Bitcoin has not risen to the standing of gold as a dependable worth storage and a powerful cowl towards financial uncertainties, Schiff supplies concern concerning the feasibility of the Bitcoin Strategic Reserve proposal.

He states that if BTC crashes throughout financial uncertainties, governments could haven’t any motive to maintain it of their reserves.

He warns that Bitcoin ETF traders can panic and promote their firms. He even factors out that if BTC drops sharply, even technique could need to promote its pursuits.

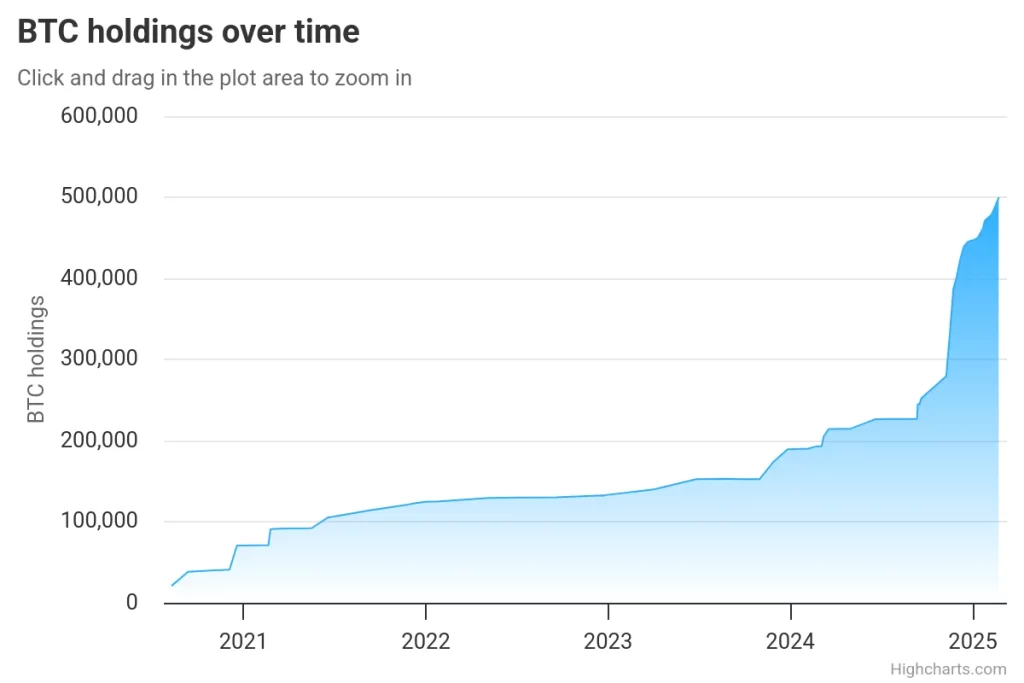

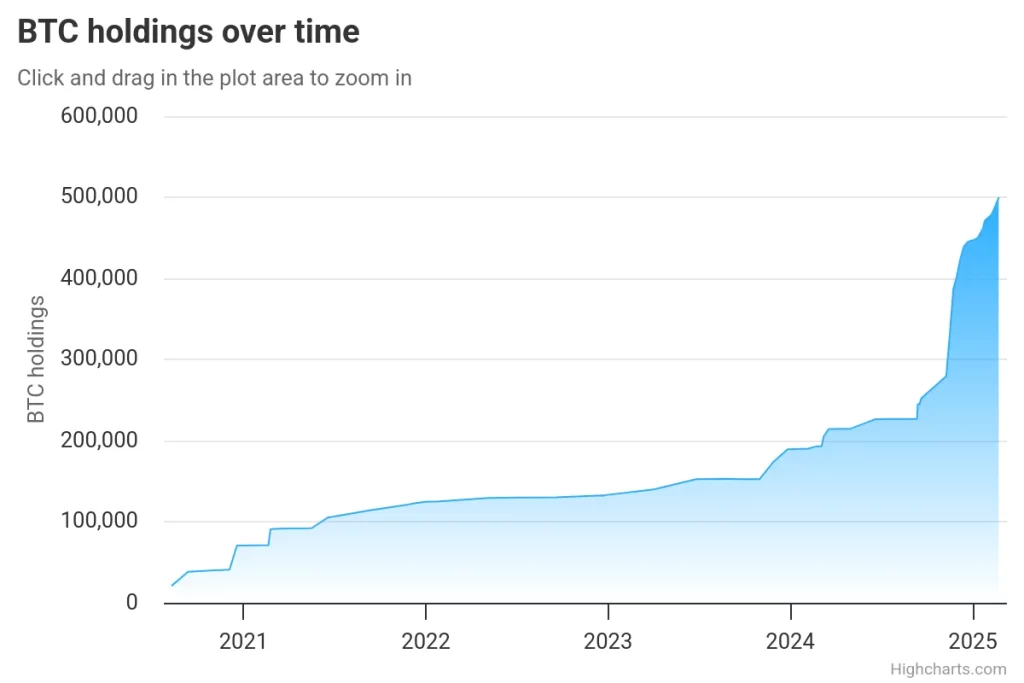

Technique is the listed firm that has the biggest variety of BTC tokens. It has a minimum of 499,096 BTC -Tokens, with a worth of $ 41,682.990.650.

The corporate has been a devoted advocate of the adoption of enterprise crrypto. In November 2024 it even suggested tech giants comparable to Microsoft’s aggressive crypto-buying technique. It is necessary that the brief -term success of this public firm has inspired many different firms to reverse their place on the acceptance of crypto.

Plainly the age -old debate between digital and bodily belongings takes a brand new flip.

By no means miss a beat within the crypto world!

Proceed to interrupt up information, knowledgeable evaluation and actual -time updates on the newest developments in Bitcoin, Altcoins, Defi, NFTs and extra.

FAQs

In line with the BTC value prediction of Coinpedia, 1 BTC might fear this yr at $ 169,046 if the Bullish Sentiment maintains.

With an elevated acceptance, the worth of 1 Bitcoin might attain a peak of $ 610,646 in 2030.

In line with our newest BTC value evaluation, the Bitcoin can attain a most value of $ 5,148,828.

By 2050 a single BTC value might go as excessive as $ 12,436,545.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024