Bitcoin

Will Bitcoin Price Defy Diminishing Returns This Cycle?

Credit : bitcoinmagazine.com

Each Bitcoin Value Bull market thus far has adopted a nicely -known sample of explosive the other way up, adopted by sharp drawings, whereby every cycle yields decrease share revenue than the earlier one. This phenomenon, often called declining returns, has turn out to be one of the crucial persistent tales in Bitcoin. The query now could be whether or not this cycle will comply with the identical course of or that the maturation of Bitcoin might bend the sample as an asset class.

Bitcoin -price and lowering returns

Thus far we have now witnessed this cycle of round 630% BTC growth since cycle low To the latest of all time. That’s in comparison with greater than 2,000% within the earlier bull market. To match the dimensions of the final cycle, Bitcoin ought to attain round $ 327,000, a chunk that appears more and more unlikely.

Evoluing Bitcoin -Value dynamics

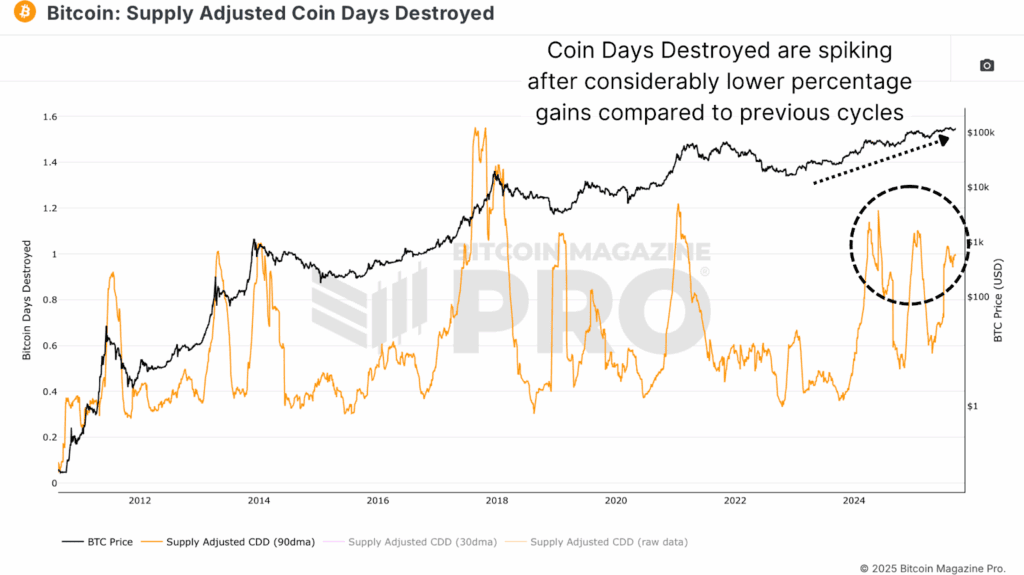

One purpose for the much less explosive upward income will be seen within the Custom coin days destroyed (CDD) Metric, which retains monitor of the pace of older cash that strikes within the chain. In earlier cycles, such because the Bull market from 2021, long-term holders tended to promote after Bitcoin had already appreciated his native lows. On this cycle, nonetheless, related ranges of revenue circumstances came about after solely 2x actions. Extra not too long ago, peaks in CDD are activated by even smaller worth will increase of 30-50%. This displays a ripening investor base: Lengthy -term holders are extra keen to realize extra revenue, which dampens parabolic progress and smoothes the market construction.

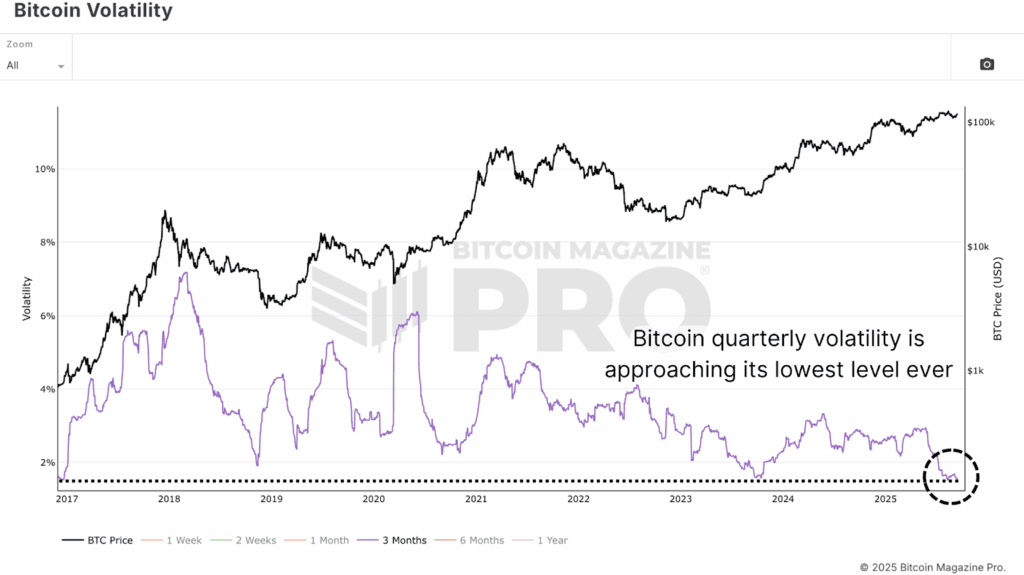

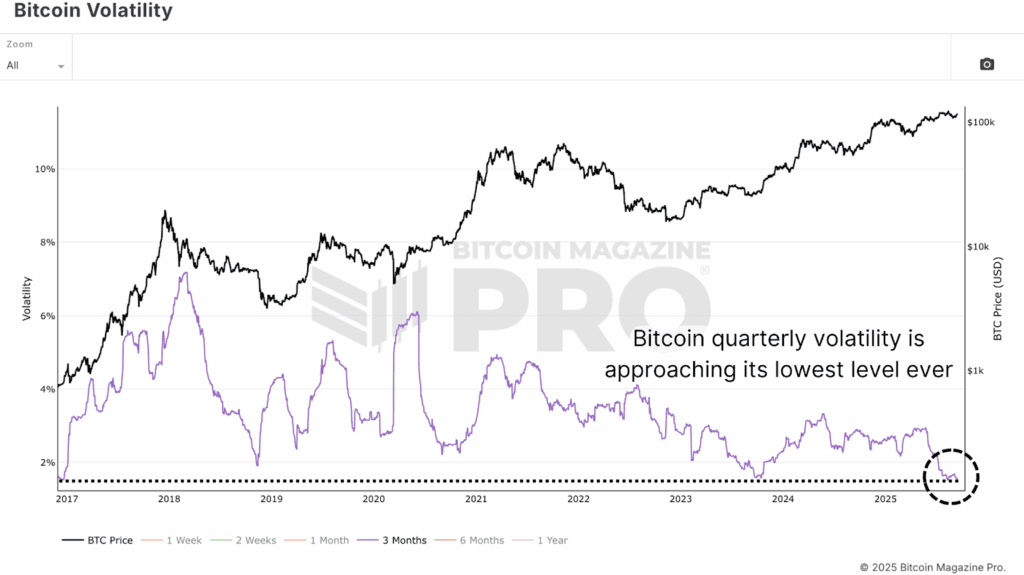

One other issue is Bitcoin -Volatility. The quarterly volatility of Bitcoin is steadily decrease. Though this reduces the prospect of utmost blowing tops, it additionally helps a more healthy lengthy -term funding profile. Decrease volatility implies that the capital flows wanted to extend the worth, nevertheless it additionally makes Bitcoin extra engaging for establishments on the lookout for risk-corrected publicity.

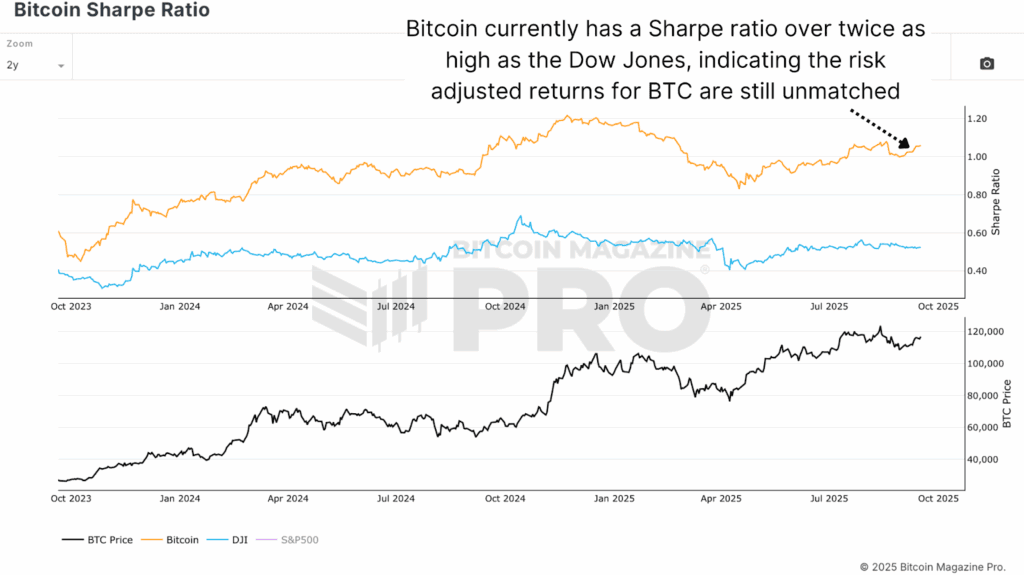

This seems within the Bitcoin Sharpe ratioThe place Bitcoin at present scores greater than double the commercial common of Dow Jones. In different phrases, Bitcoin nonetheless gives superior returns in comparison with its danger, even when the market stabilizes.

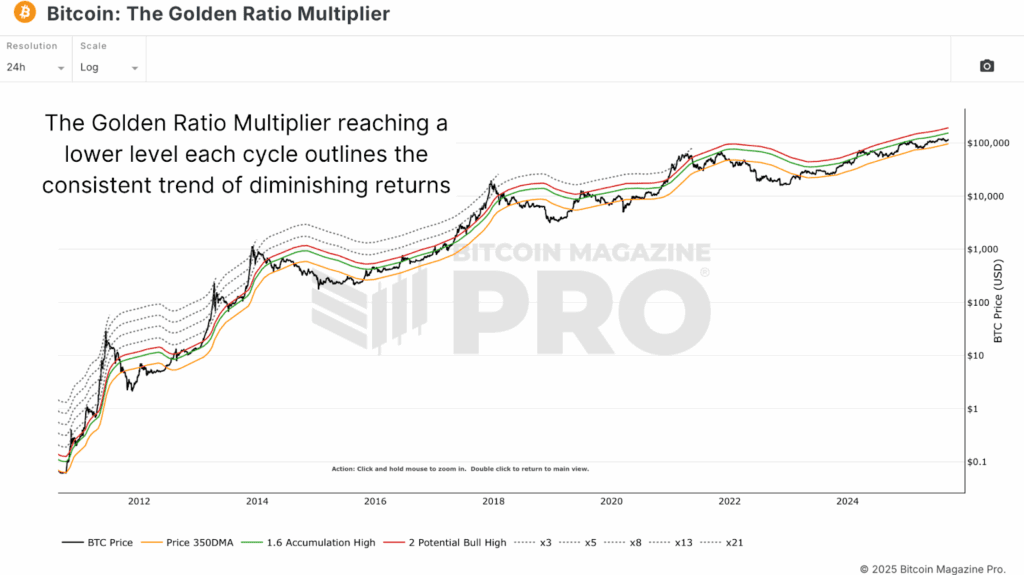

Bitcoin -price and the gold ratio

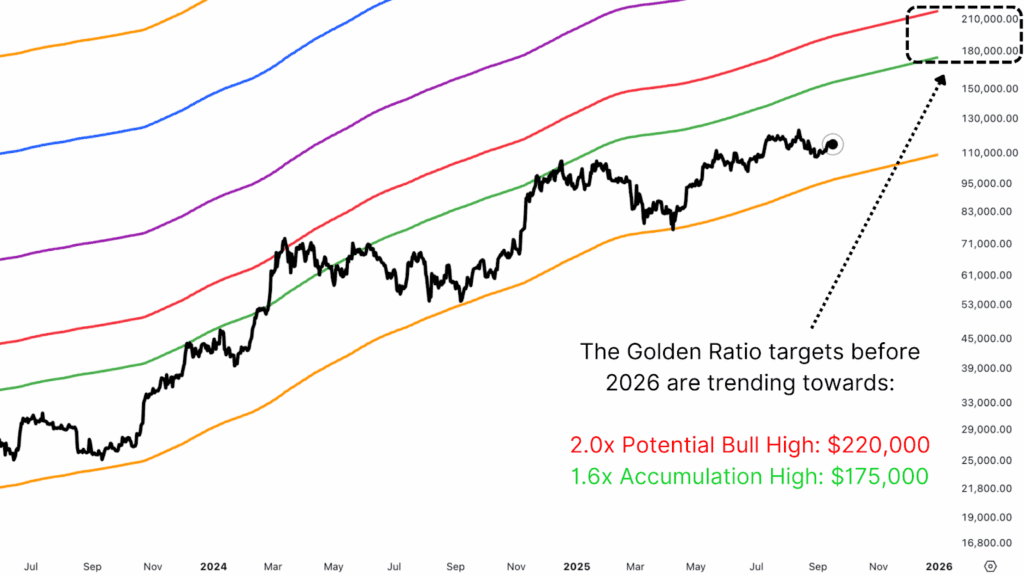

From a technical perspective, The Golden Ratio Multiplier Provides a framework for projecting lowering returns. Every Cyclustop is aligned with step by step decrease Fibonacci-pliers of the advancing common of 350 days. In 2013 the worth reached the 21x band. For the highest of 2017 it reached the 5x band, and in 2021 the 3x band. This cycle has thus far tagged Bitcoin the 2x and 1.6x tires, however a push again to the 2x ranges stays potential.

Projecting these 1.6x and 2x ranges forward, primarily based on their present course of, suggests a goal between $ 175,000 and $ 220,000 earlier than the tip of the yr. In fact the information won’t play precisely the best way, as a result of we’d see the 350DMA shifting exponentially to the highest whereas we have now closed these higher targets. The purpose is that these ranges consistently change and consistently level to larger targets because the bull’s cycle progresses.

Bitcoin -price in a brand new period

Lowering returns don’t scale back the attractiveness of Bitcoin; If there’s something, they enhance it for establishments. Much less violent drawings, probably intensive cycles and stronger risk-corrected efficiency all contribute to creating Bitcoin to a extra sedible property. Even when Bitcoin turns into mature, the profit stays extraordinary in comparison with conventional markets. The times of two,000%+ Cycli could also be behind us, however the Bitcoin period as a mainstream, saved institutionally lively has solely simply begun and can most likely nonetheless provide an unparalleled effectivity within the coming years.

Go to deeper knowledge, graphs {and professional} insights in Bitcoin -Perrends Bitcoinmagazinepro.com.

Subscribe to Bitcoin Magazine Pro on YouTube For extra skilled market insights and evaluation!

Disclaimer: This text is just for informative functions and shouldn’t be thought of as monetary recommendation. All the time do your individual analysis earlier than you make funding choices.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now