Bitcoin

Will Bitcoin reach $67K as major liquidation levels loom?

Credit : ambcrypto.com

- The very best liquidation degree for Bitcoin was $67,000.

- There was a generational change amongst these main buyers in Bitcoin.

The cryptocurrency market is at all times inquisitive about the important thing ranges for Bitcoin [BTC]particularly during times of excessive volatility.

At the moment, it’s anticipated that Bitcoin might see a major transfer resulting from massive liquidation ranges, which might pressure merchants to take decisive actions.

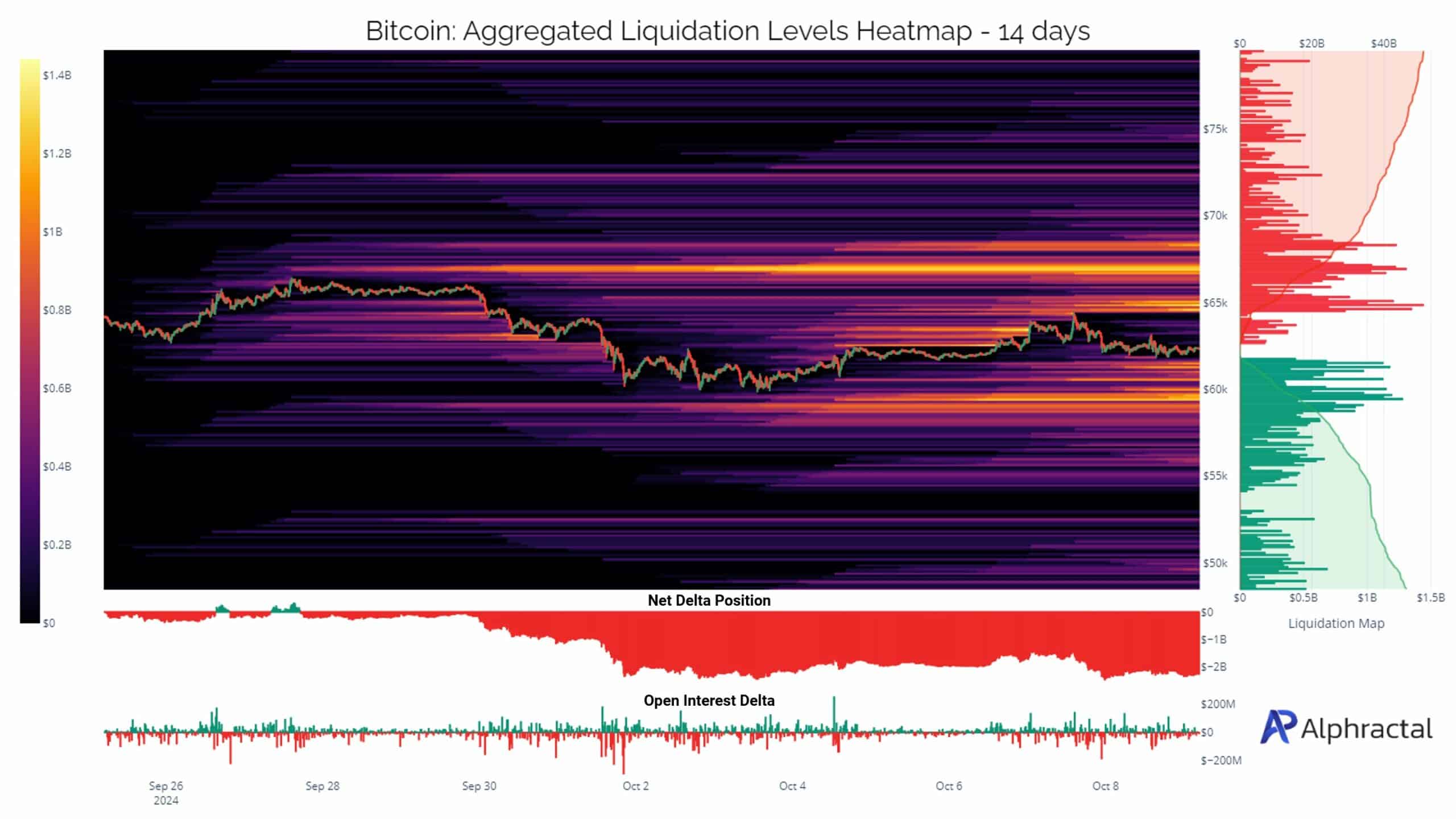

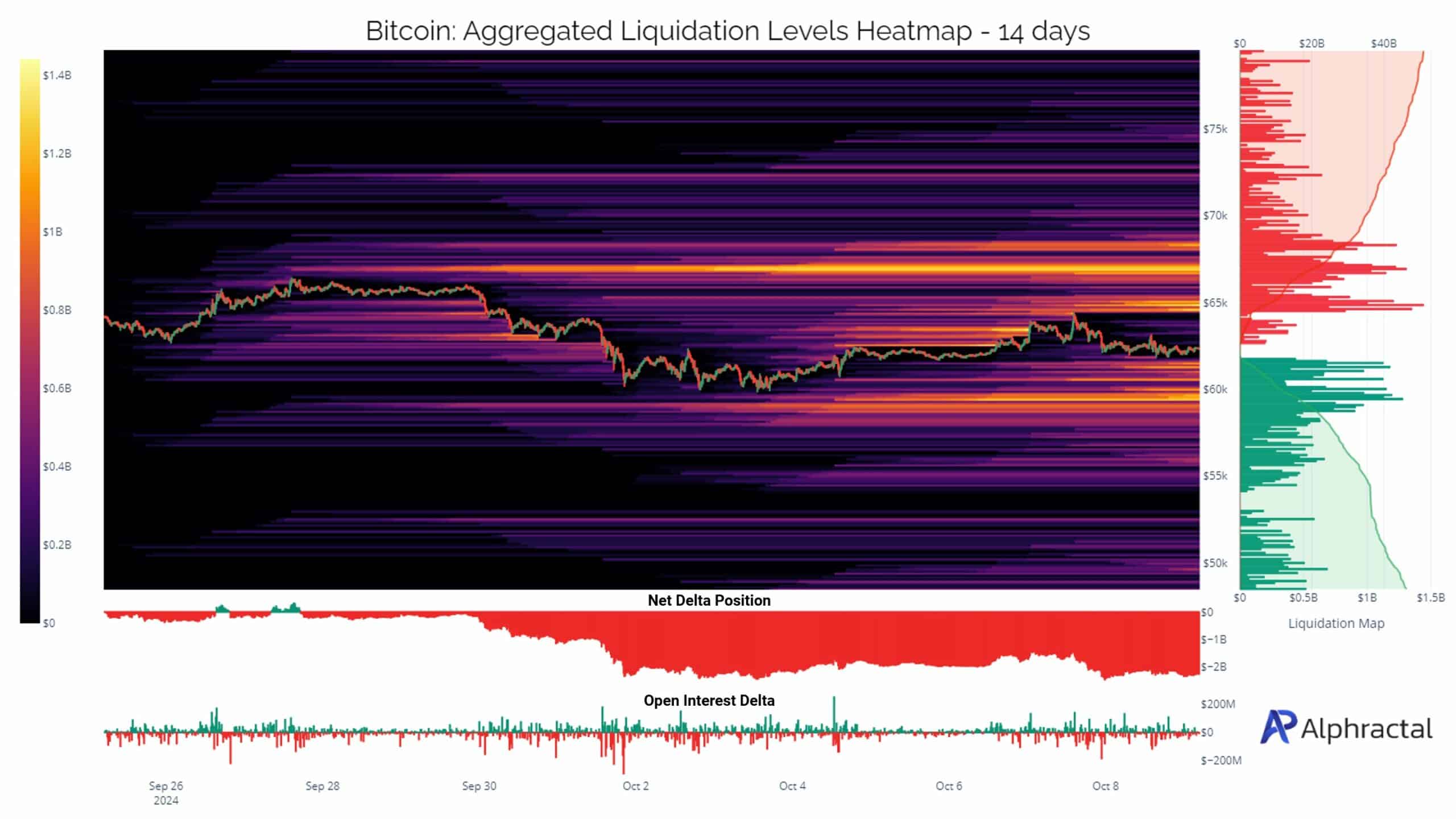

Over the previous week, BTC has seen a notable focus of lengthy positions on main exchanges, creating massive liquidation swimming pools.

The important thing Bitcoin degree is at $60,000, however when the evaluation was prolonged to 2 weeks, the $67,000 zone emerged as the best liquidation degree.

Supply: Alpharactal

This means that Bitcoin might doubtlessly transfer into this zone as its worth tends to development in the direction of areas of excessive liquidity over time.

Bitcoin has additionally proven resilience when analyzing technical indicators. The cryptocurrency has managed to keep up its place above the bull market help band for an additional week.

It has not achieved three consecutive weekly closes above this degree since Might, however there may be hope that bulls can push the value farther from right here. That is particularly essential given the latest consolidation out there.

Supply: TradingView

Bitcoin can be comparatively sturdy in comparison with shares, making the $67,000 goal look more and more attainable.

BTC whales and energetic addresses

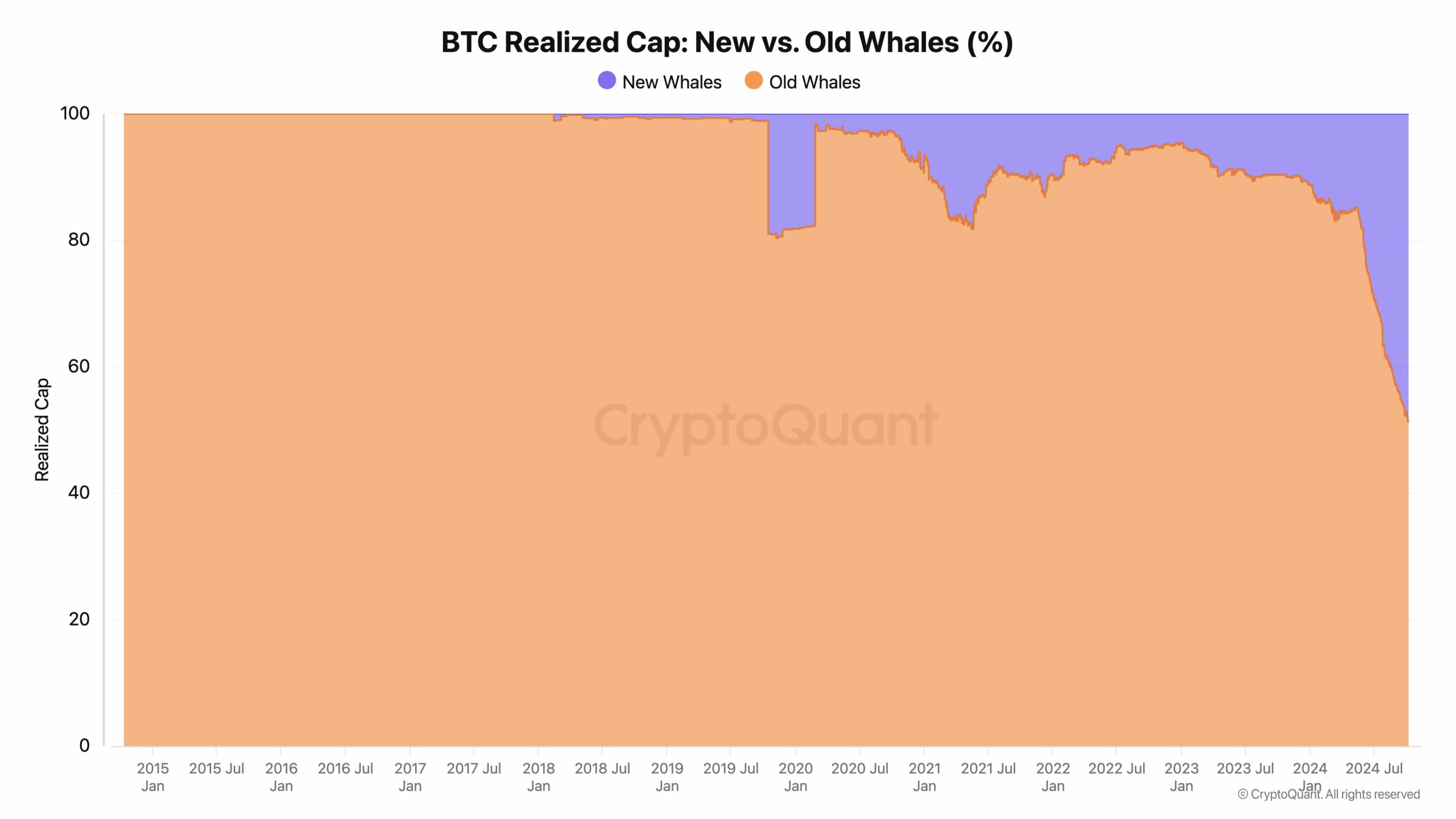

One other issue to contemplate is the altering panorama of Bitcoin whales. There’s presently a generational change happening amongst these main buyers.

New whales have invested $108 billion in Bitcoin since its inception, whereas older whales maintain $113 billion.

The ratio between these teams is reducing and new whales are slowly gaining affect.

This shift suggests new cash is getting into the market, which might push the value of BTC greater over time, though the market stays unpredictable.

Supply: CryptoQuant

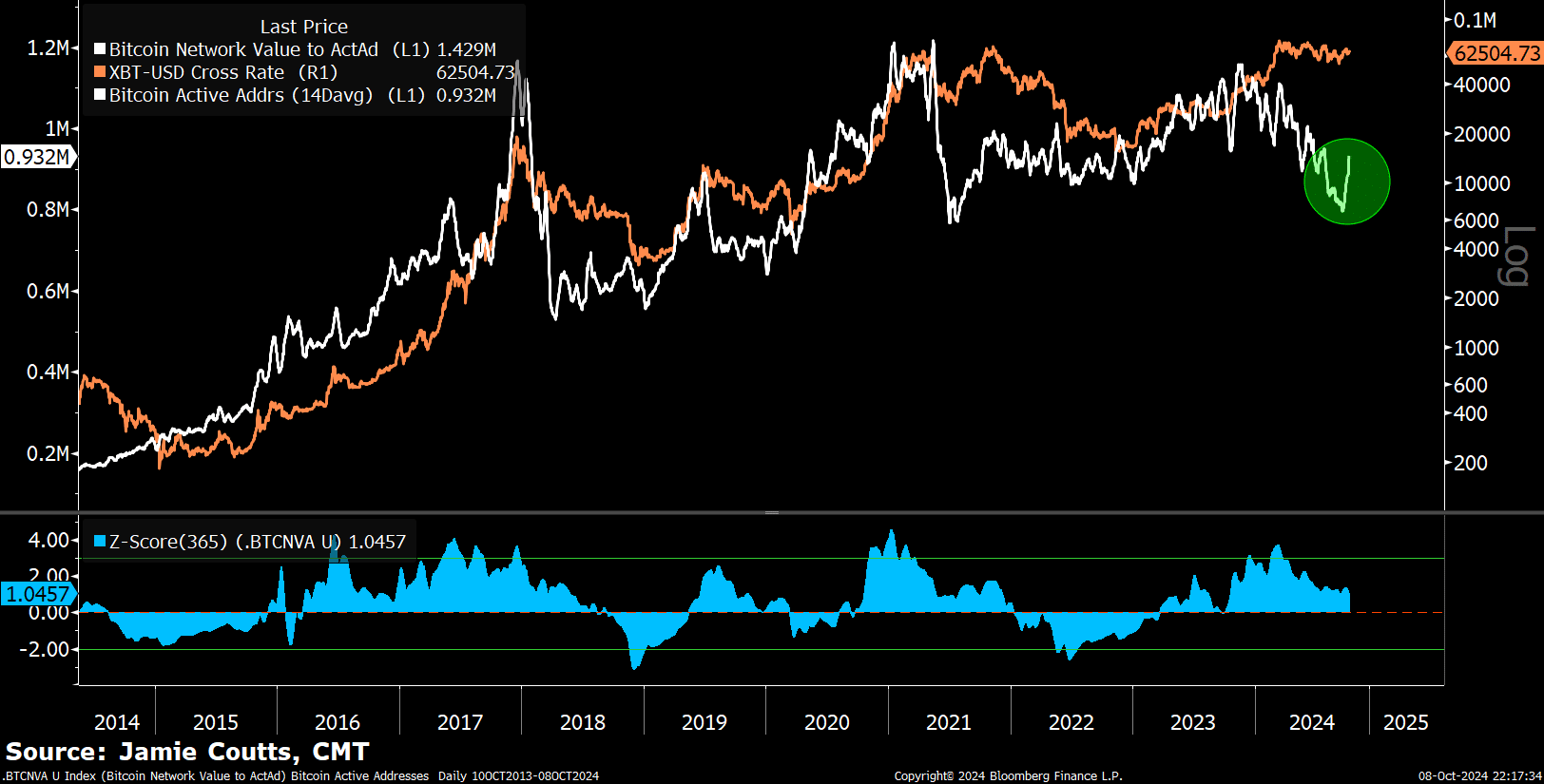

By way of on-chain metrics, Bitcoin’s variety of energetic addresses has just lately seen a resurgence after an 11-month downward development.

Though the predictive energy of this measure has declined over the previous 4 years, it stays an essential indicator of community exercise.

The decreased correlation between energetic addresses and worth is probably going resulting from a number of elements.

This consists of the rise of ETF flows as a key worth driver, elevated cost exercise on L2s such because the Lightning Community, and adjustments in on-chain conduct pushed by improvements akin to Ordinals and NFTs.

Supply: Jamie Coutts, CMT

Learn Bitcoin’s [BTC] Value forecast 2024–2025

Whereas there may be optimism that Bitcoin might surpass its all-time excessive throughout this cycle, a corresponding improve within the variety of energetic addresses on the bottom chain would assist validate the rising worth of the community.

As a result of Bitcoin capabilities as a world financial community, it reveals natural community progress throughout all metrics. With the fitting situations, BTC might quickly be on its strategy to testing the $67K degree.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024