Bitcoin

Will Bitcoin’s liquidity and whale activity drive it past $100,000 again?

Credit : ambcrypto.com

- Bitcoin possession seems to have stabilized, with notable shopping for exercise noticed at outstanding addresses

- Whales are positioning themselves for a possible rally as liquidity inflows into the crypto market improve

Regardless of a market-wide decline, Bitcoin stays [BTC] has managed to remain above the $90,000 degree for weeks. This stability has restricted latest losses, with the identical losses being simply 3.97% for the week and 5.49% for the month.

With market sentiment displaying indicators of shifting and merchants ramping up their shopping for exercise, BTC could possibly be poised to rise once more.

Accumulation is gaining momentum

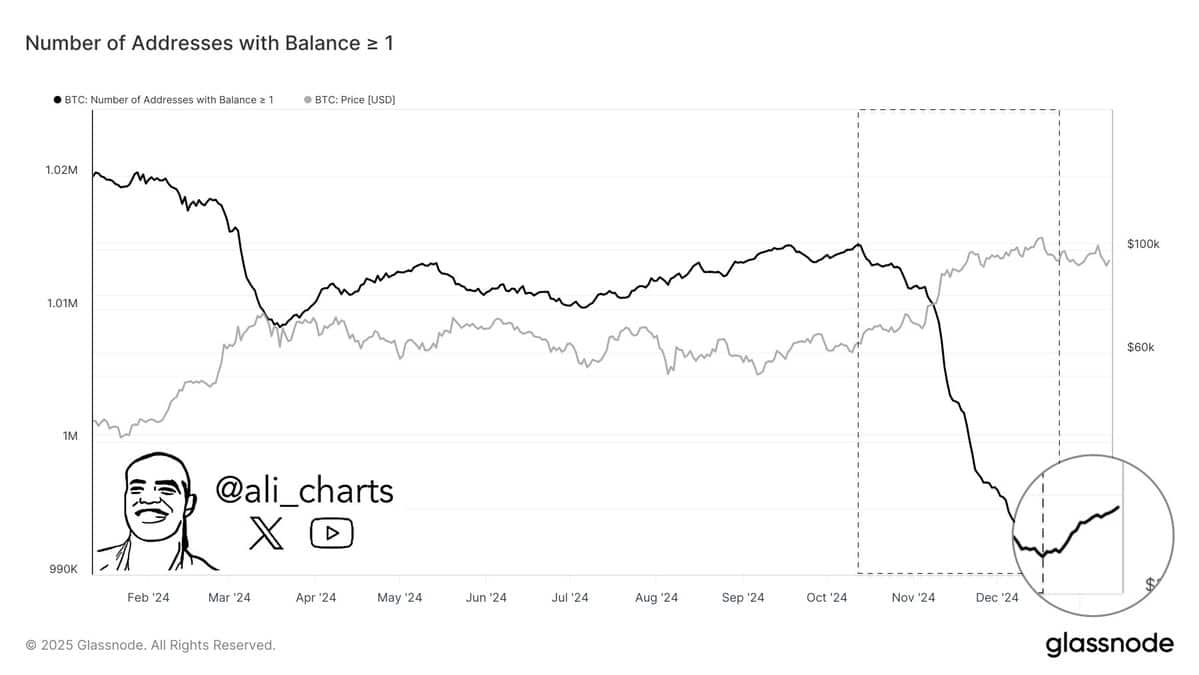

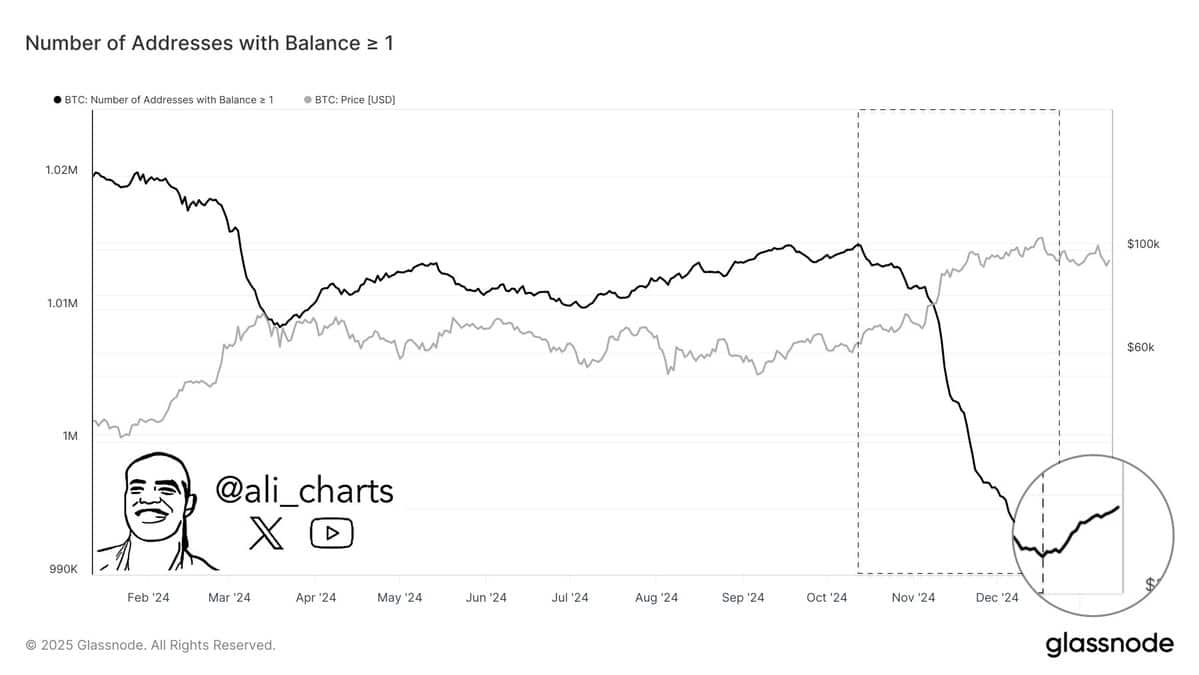

After monitoring the variety of addresses with a steadiness of at the least 1 BTC, Glassnode discovered that Bitcoin acquisitions have skyrocketed this 12 months.

In keeping with the info, there was a major improve within the variety of addresses holding greater than 1 BTC. This marks a notable shift, particularly after a prolonged distribution part that started in October throughout which many BTC holders offered.

Supply: Glassnode

Such accumulation usually signifies a renewed sense of confidence available in the market. When traders change from promoting to holding, it means they count on lasting worth and are more likely to maintain the asset – probably triggering a rally.

AMBCrypto additionally noticed different market exercise, indicating rising bullish sentiment amongst merchants. This might point out a potential improve within the worth of BTC within the brief time period.

Liquidity improve and changes of BTC traders

In keeping with Whale alertUSD Coin (USDC), the second-largest stablecoin issuer within the crypto market, added 250 million USDC to its coffers within the final 24 hours.

Such coin exercise usually alerts rising demand for stablecoins as merchants put together to amass extra crypto belongings. Traditionally, BTC has usually benefited from some of these will increase in coin exercise. If the development continues, the worth of BTC might regularly rise within the coming buying and selling classes, fueled by elevated curiosity in takeovers.

Along with the elevated liquidity, there was a notable shift amongst prime BTC traders who collectively maintain 2,535 BTC (value over $239 million).

These traders moved their holdings from a cryptocurrency alternate, Kraken, to a non-public pockets, signaling rising confidence in BTC. Primarily as a result of they selected to retailer their belongings exterior of exchanges for added safety.

The switch, from Kraken to an unknown pockets, came about in three transactions: 620 BTC, 888 BTC and 1,027 BTC.

Derivatives merchants are unconvinced by BTC’s rally

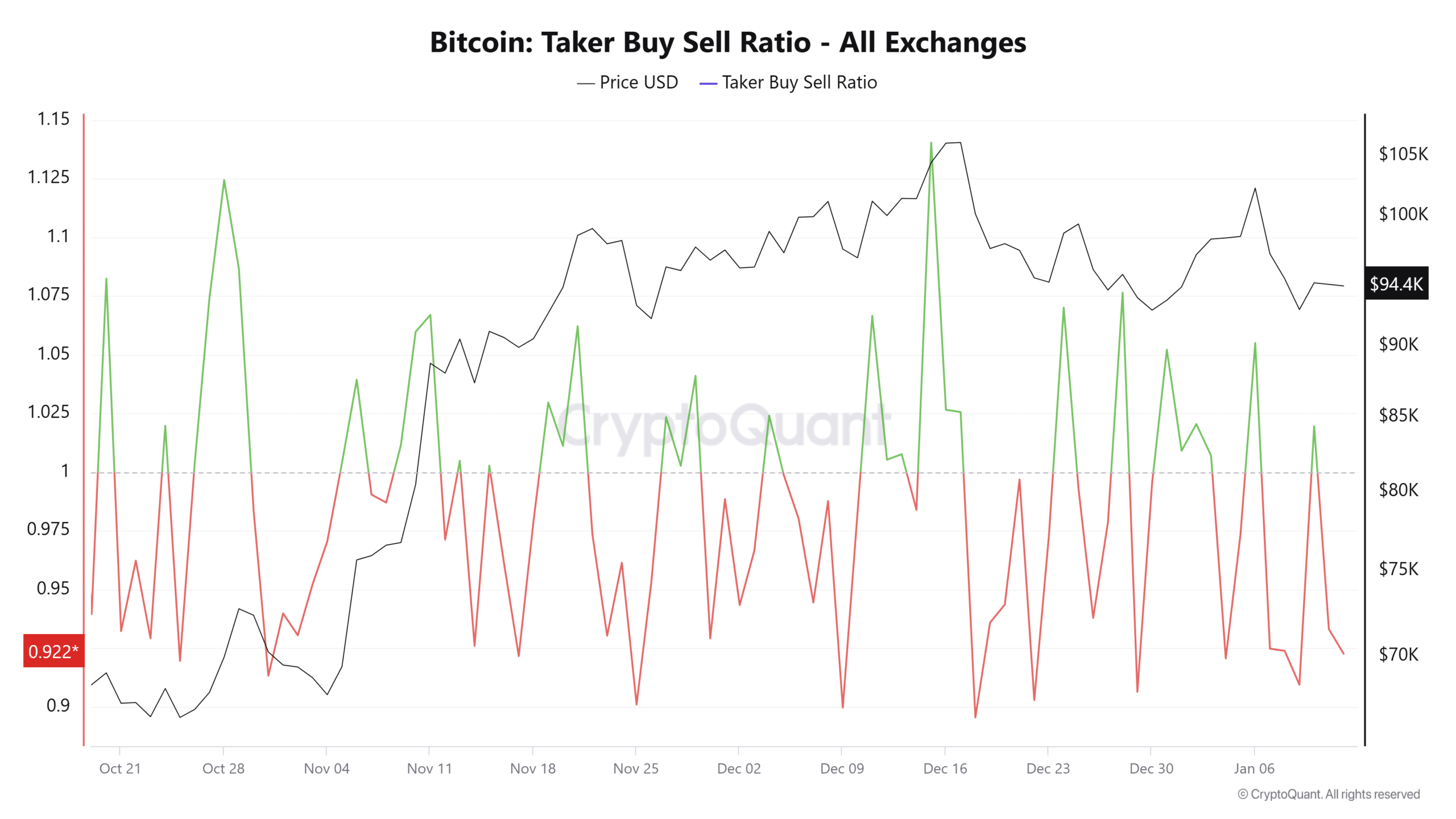

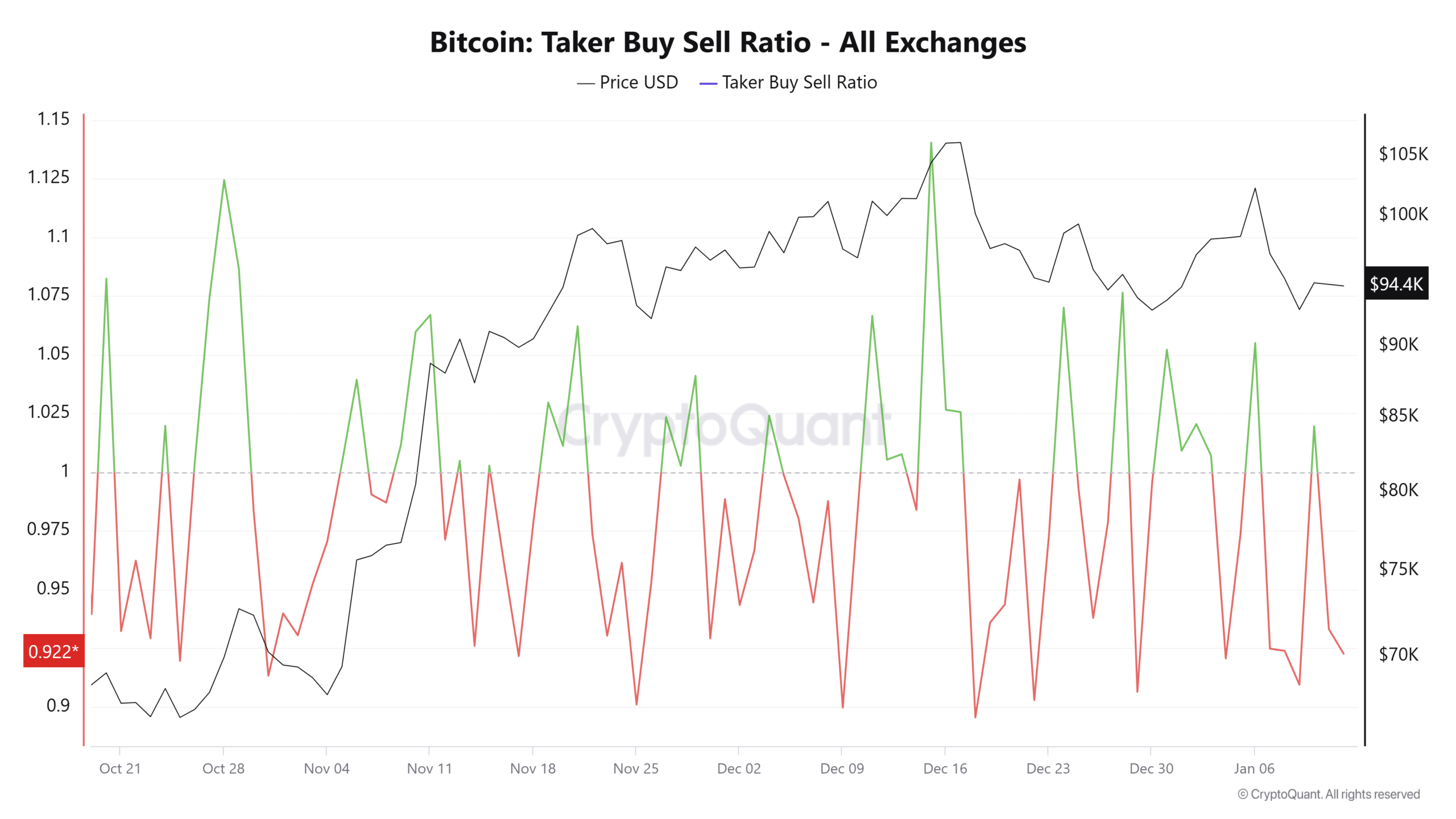

In keeping with the Taker Purchase Promote Ratio on CryptoQuant, which measures the ratio of shopping for to promoting within the derivatives market, sellers at the moment dominate the market.

On the time of writing, this ratio had fallen under 1, with a worth of 0.922. This indicated that gross sales exercise outweighed purchases. If this metric continues to say no, Bitcoin’s continued worth appreciation could possibly be delayed.

Supply: Cryptoquant

Nonetheless, for the reason that hole with the impartial zone is lower than 0.1, an influx of further capital into the market and a bigger outflow of BTC from the exchanges might positively affect sentiment amongst derivatives merchants. This might proceed the asset’s rally on the charts.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now