Analysis

Will BTC Price Dip Below $90K This Week?

Credit : coinpedia.org

The value of Bitcoin has fallen in latest days as a result of it has not attracted sufficient consumers round $ 98,000. In consequence, sellers have consolidated the worth round $ 95,000. Nonetheless, the just lately launched Sizzling Shopper Value Index (CPI) report might change issues, as a result of many analysts suppose that the upper than anticipated inflation can fall this week the worth from Bitcoin to $ 90k.

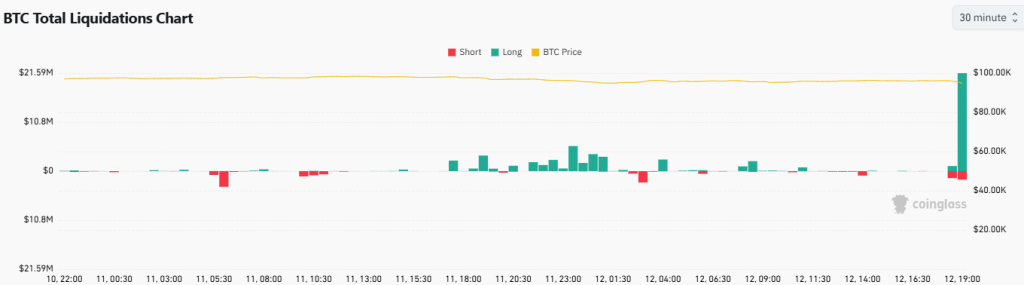

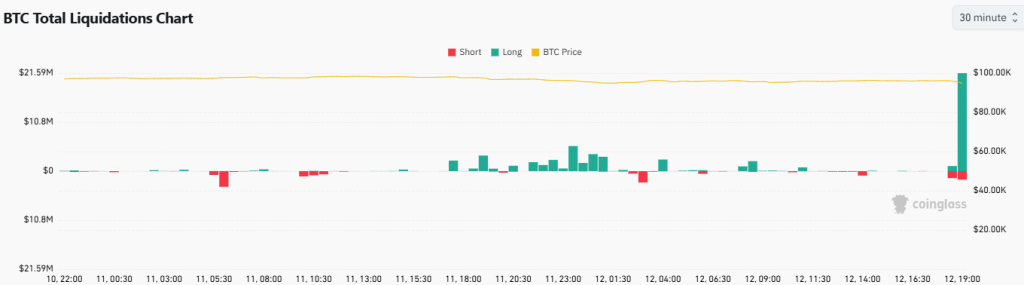

Greater than anticipated CPI report prompts lengthy liquidations

Bitcoin Value rose to $ 96k for the CPI report, as a result of the market anticipated a softer inflation knowledge for January. Nonetheless, the Shopper Value index elevated by 3% in comparison with final yr, in order that the pace was collected in comparison with the share of two.9% of December and exceeding the predictions of economists.

Additionally learn: US CPI knowledge launched: what’s the impression on the crypto market?

The CPI of January normally reveals appreciable value adjustments that firms implement firstly of the yr. That’s the reason in the present day’s report is a vital indicator of how nicely the Federal Reserve does in his efforts to regulate inflation.

The index rose by 0.5% in comparison with final month, which is barely quicker than the rise of 0.4% in December and better than the 0.3% improve economists predicted.

After the latest CPI report, the worth of Bitcoin took a pointy decline. Inside just some minutes it fell from a spotlight of $ 96,000 to round $ 94,000. In accordance with Coinglass, there have been nearly $ 25 million in whole Bitcoin liquidations, with consumers shortly closed $ 22 million in lengthy positions.

If the CPI is increased than anticipated, because of this inflation doesn’t lower as hoped. This usually ensures that the Federal Reserve retains and even will increase rates of interest to handle inflation.

Excessive rates of interest normally make the greenback stronger and treasury bonds extra enticing as a result of they provide a better effectivity. This will result in traders desire these safer investments above extra risky, akin to cryptocurrencies. In consequence, the demand for cryptocurrencies akin to Bitcoin can fall, resulting in decrease costs.

Analysts now predict that this improve in inflation can decelerate the latest restoration within the cryptomarket that began after the crash on 3 February. It’s anticipated that the Bitcoin prize might fall this weekend to check the extent of $ 90,000, which can fall the possibility that it’s going to attain $ 100,000 quickly.

What’s the subsequent step for BTC value?

The value of Bitcoin couldn’t stay secure as a result of it went by way of a pointy sale available in the market after CPI Information. Sellers led a downward development when BTC fell to $ 94k below numerous Fibonacci ranges. Bitcoin at the moment prices $ 95,304, with 2.1% within the final 24 hours.

The BTC/USDT pair experiences resistance across the stage of $ 96k, as a result of sellers actively defend that stage. If it may keep above this level, this may help consumers to push the worth as much as $ 98,000 and presumably to $ 100k.

Alternatively, if Bitcoin continues to behave below the EMA20 development line on the 1-hour graph, it may be confronted with a substantial downward strain, presumably pushing the worth under $ 94,000 and to a retest of the $ 91k stage.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024