Altcoin

Will Donald Trump’s victory be bullish for Bitcoin ETF inflows again?

Credit : ambcrypto.com

- Bitcoin ETFs noticed file inflows amid the broader market’s restoration, signaling optimism amongst traders

- Political shifts are driving the inflow of digital property, with Republicans seen as pro-crypto

Amid a broader market restoration, Bitcoin [BTC] ETFs have been gaining reputation these days with vital inflows – an indication of a constructive market pattern.

Bitcoin ETF replace

Based on Farside InvestorsBitcoin ETFs recorded collective inflows of $371 million on October 15.

Main the pack was BlackRock’s IBIT with $288.8 million, adopted by Constancy’s FBTC with $35 million. Moreover, Ark 21Shares’ ARK ETF reported figures of $14.7 million, whereas Grayscale’s GBTC lastly noticed inflows of $13.4 million.

Whereas some ETFs had no inflows, none reported outflows. This may be interpreted as reinforcing the rising curiosity in Bitcoin-based funding automobiles.

Only a day in the past, Bitcoin ETFs recorded their highest single-day web inflows since June – a mixed worth of $555.9 million.

Main this momentum was FBTC, which reported inflows of $239.3 million – the most important since June 4. As well as, GBTC additionally noticed renewed curiosity with figures of $37.8 million – the very best degree since Could and the primary constructive influx in October.

This coincided with Bitcoin trading at $67,823.08 on the charts, after rising 3.56% in 24 hours and gaining 9.44% over seven days. As anticipated, this has fueled hypothesis that the crypto could also be gearing up for a brand new all-time excessive.

CoinShares Hyperlinks This to Elections – However Why?

The most recent model of CoinShares is attention-grabbing report additionally highlighted a notable improve in digital asset inflows, totaling $407 million. A shift attributed to rising investor curiosity, coupled with a possible Republican victory.

This current surge in capital is an indication of elevated curiosity in crypto, one pushed by expectations {that a} Republican Celebration-led administration may result in favorable regulatory shifts for the sector.

The report famous:

“Digital asset funding merchandise noticed inflows of $407 million, as investor selections are possible extra influenced by the upcoming US elections than by the outlook for financial coverage.”

The corporate supported its evaluation by mentioning that the current inflows are carefully aligned with political developments, relatively than financial indicators.

Notably, stronger-than-expected financial knowledge had minimal impact on halting the sooner outflows.

Based on CoinShares, this improve in inflows was adopted by the current US vice presidential debate. Following this, polling momentum shifted to Republicans, who have been seen as extra supportive of digital asset initiatives.

Managers weigh in…

ETF Retailer president Nate Geraci supported this angle, emphasizing that the outcomes of the US election may have a serious influence on the way forward for the digital asset business.

He mentioned,

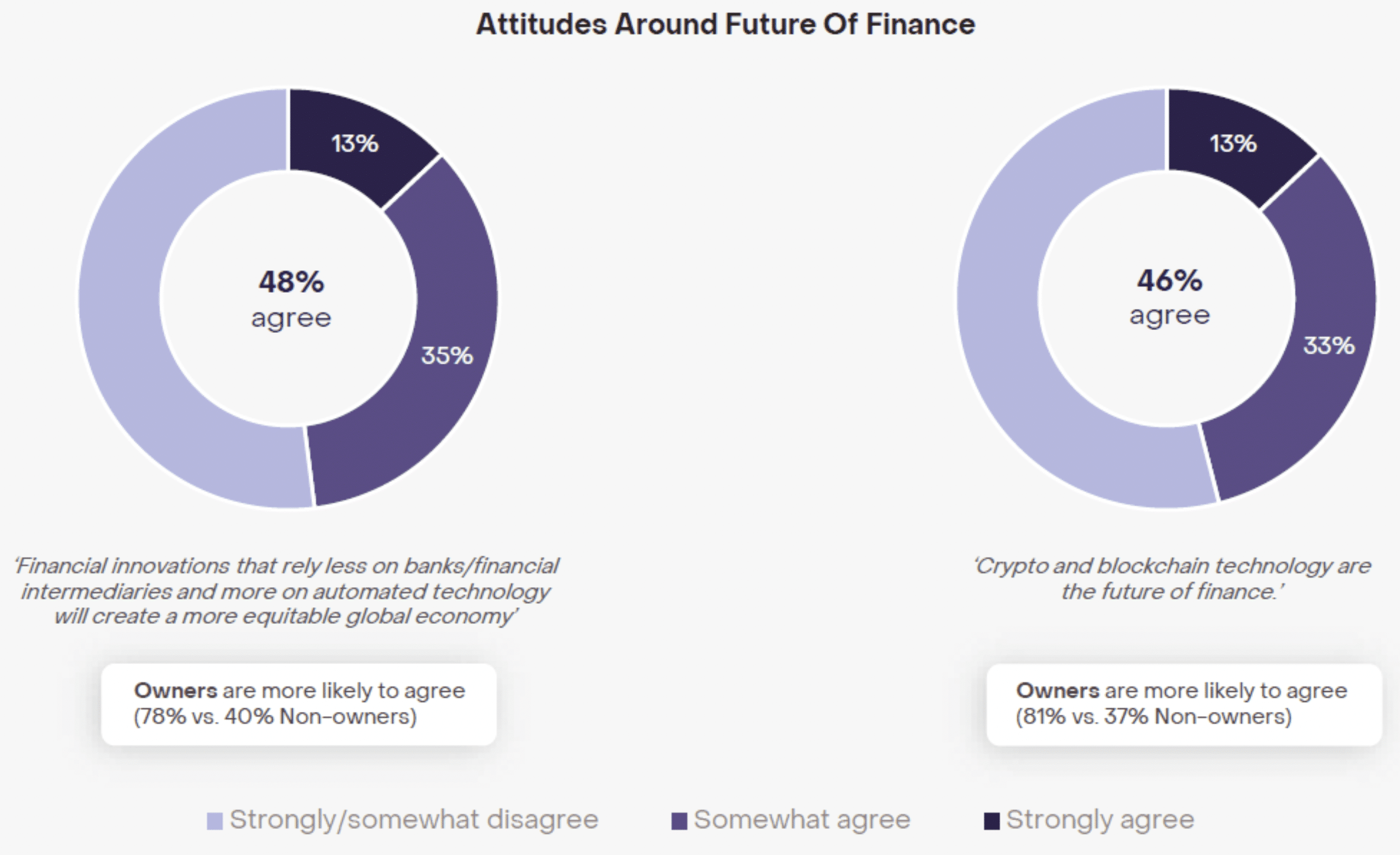

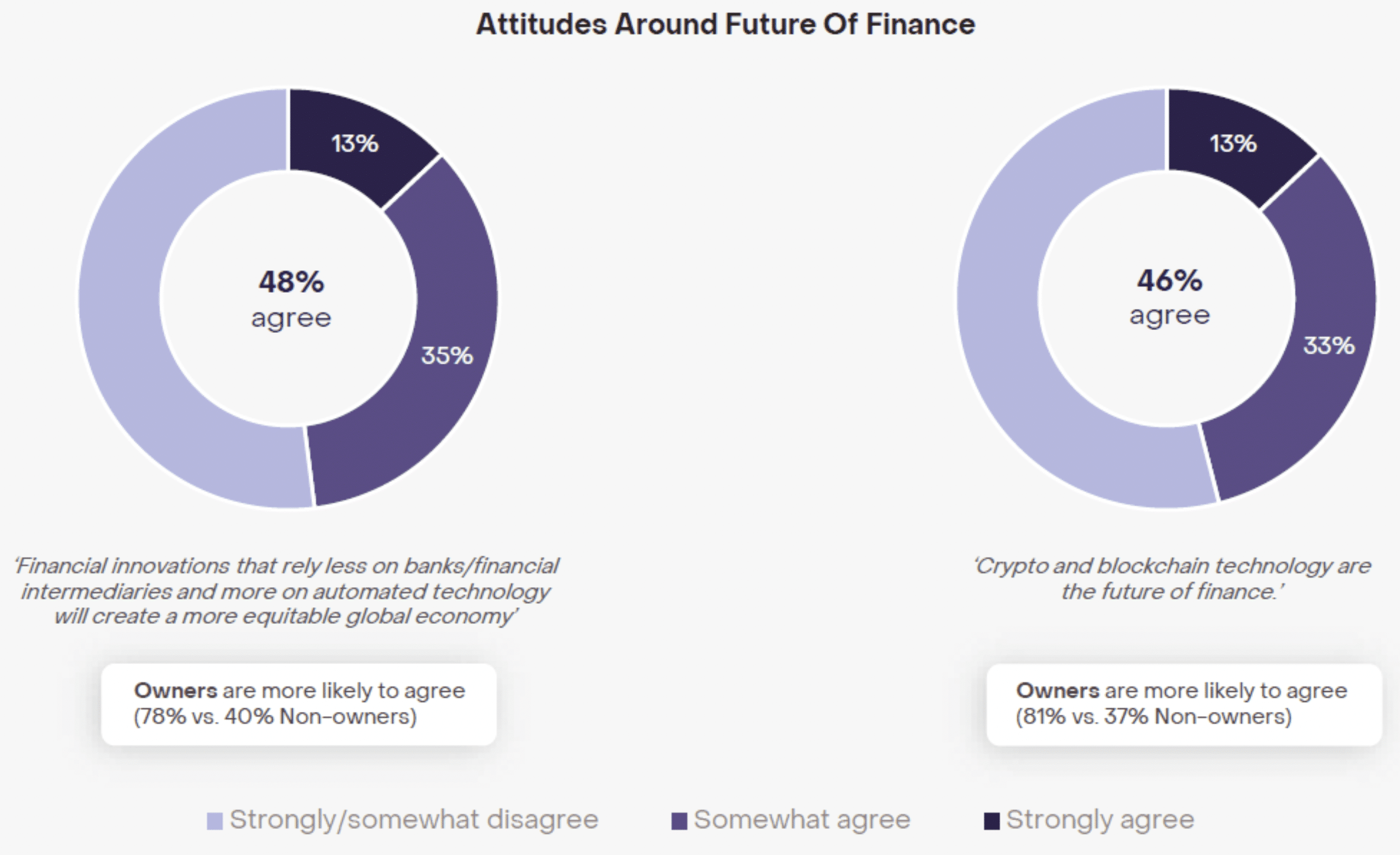

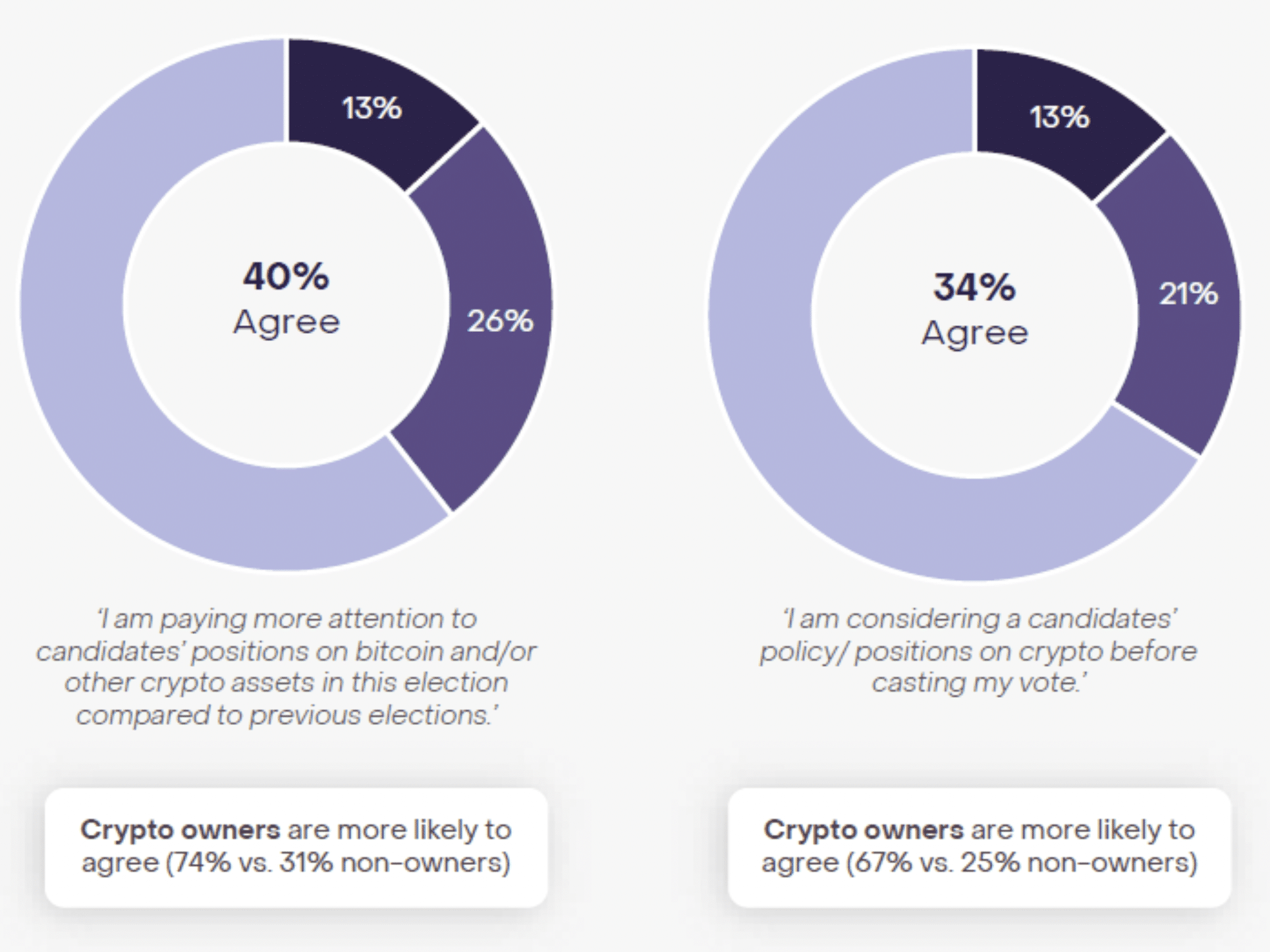

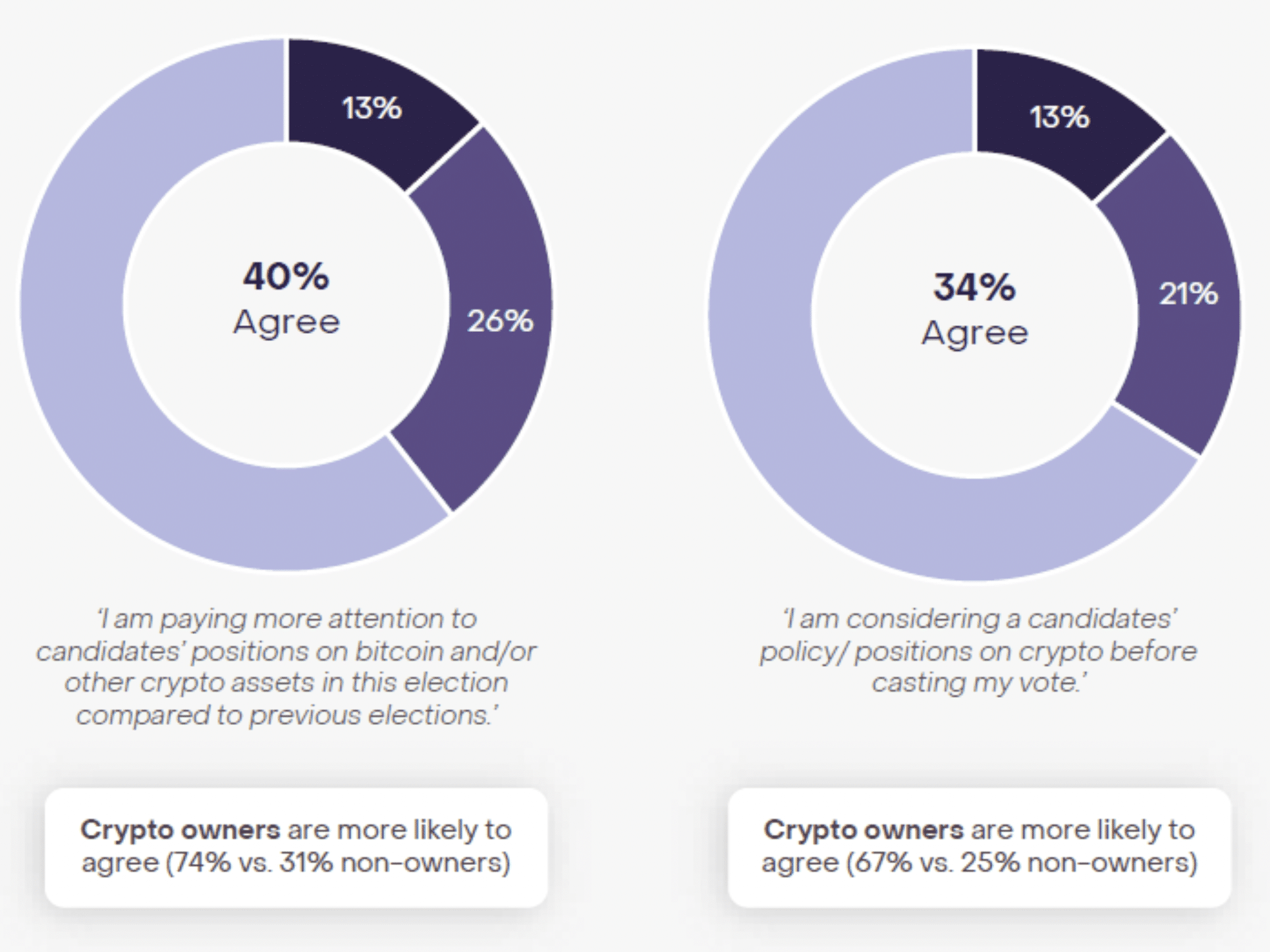

“46% agree that crypto and blockchain are the way forward for the monetary world. 34% mentioned they thought of candidates’ crypto holdings earlier than voting.”

Supply: Nate Geraci/X

Geraci added,

“It is changing into a mainstream downside.”

Supply: Nate Geraci/X

Geraci highlighted insights from a current ballot for this Grayscalea examine into the interplay between cryptocurrency and the upcoming elections.

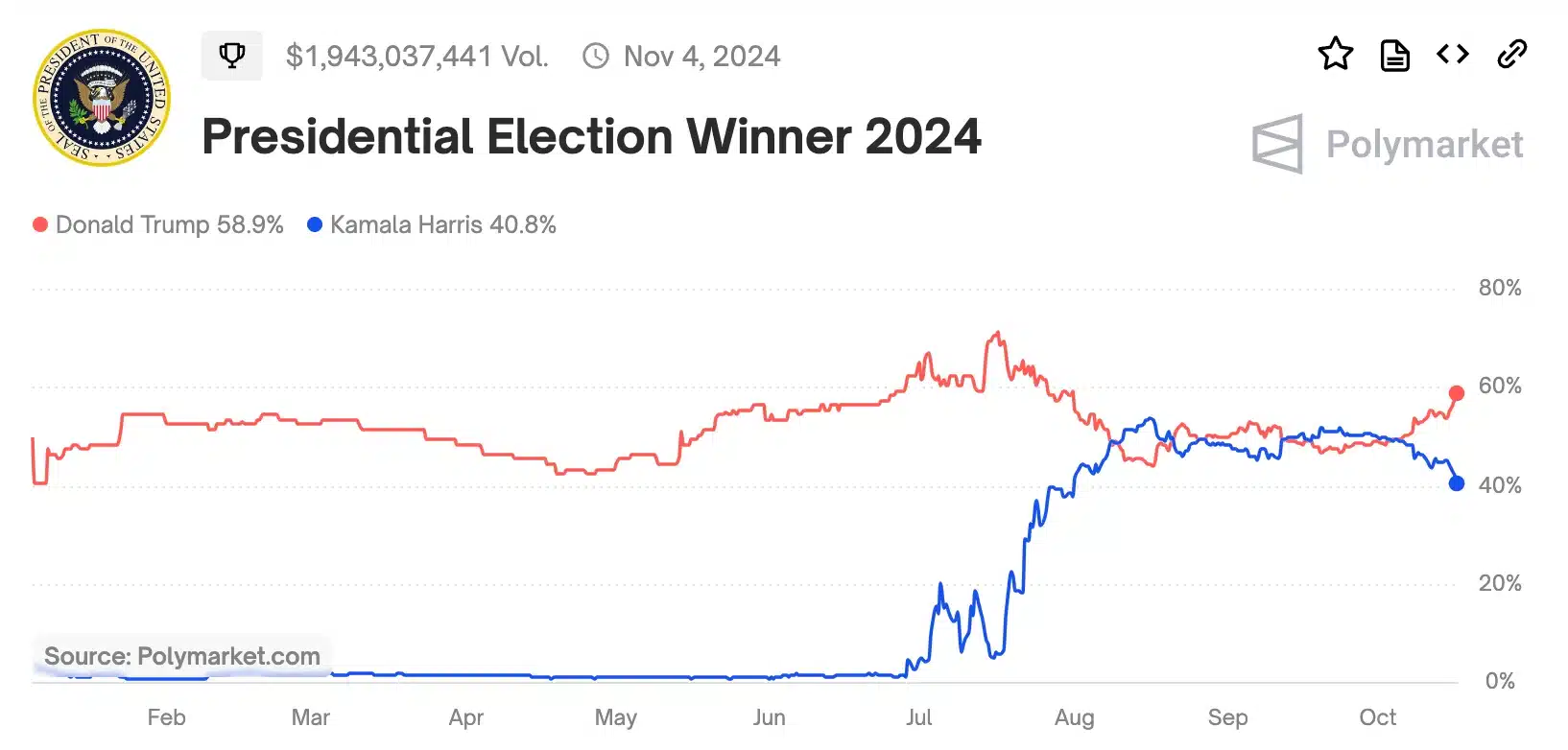

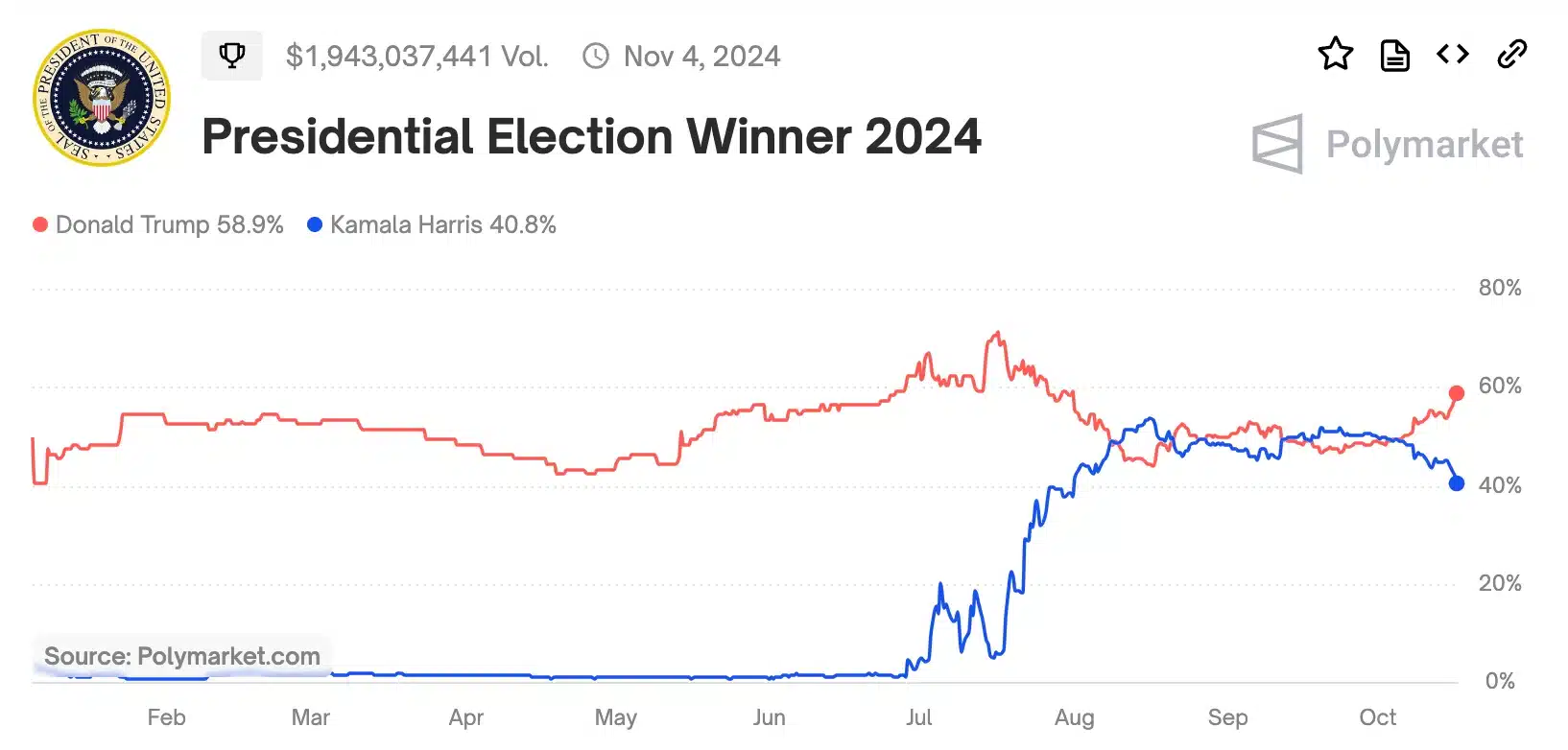

With Trump gaining reputation because the Republican candidate on Polymarket, the most recent stretch guarantees to deliver essential developments for the sector.

Supply: Polymarkt

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024