Analysis

Will ETH Price Decline Further?

Credit : coinpedia.org

Up to now hours, the value of Ethereum has had a tough time attracting the acquisition demand. Because of this, it seems that information on the chains to promote extra. As gross sales stress grows and a very powerful value ranges are misplaced, there’s a greater threat of huge liquidations. This will result in a higher lower within the value of Ethereum.

Ethereum is confronted with a threat of $ 6 billion

Within the final 24 hours, the value of Ethereum has fallen sharply because the gross sales stress elevated after it had misplaced a very powerful assist ranges. In keeping with information from Coinglass, greater than $ 117 million had been liquidated by Ethereum transactions. Of those, consumers misplaced round $ 72.24 million, whereas sellers needed to shut round $ 44.7 million briefly positions.

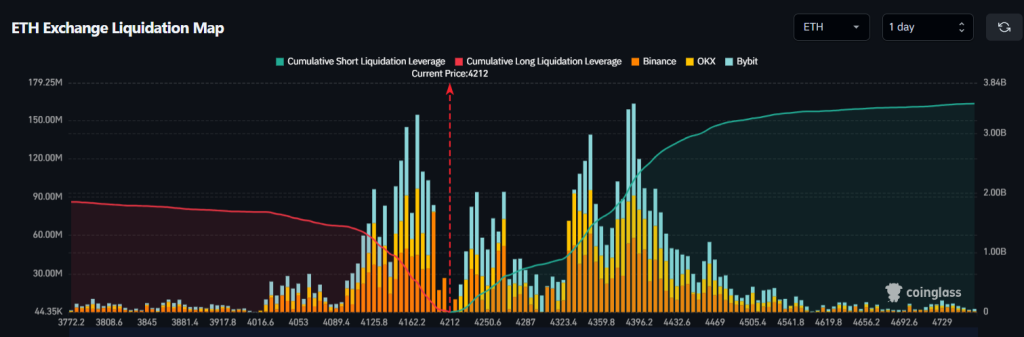

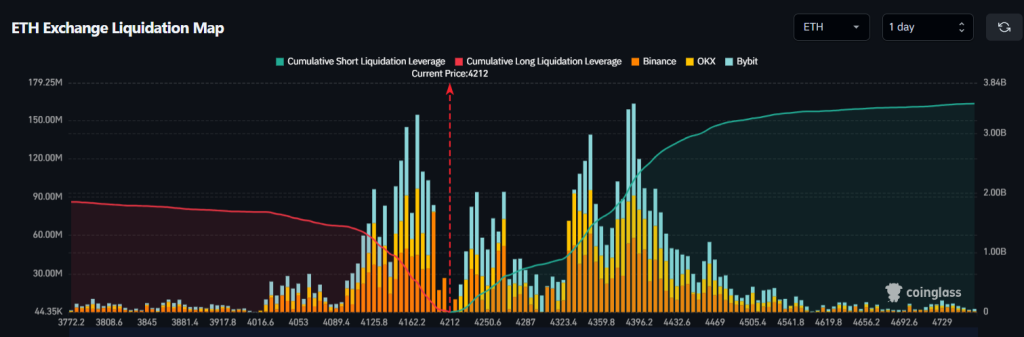

Not too long ago, Ethereum has issue breaking above sure resistance ranges, which has added extra downward stress. Coinglass additionally reviews that round $ 6 billion in lengthy (purchase) positions will be endangered if Ethereum drops to $ 4,200.

A warmth hood from liquidation factors reveals a big cluster of transactions that may be compelled to shut if costs proceed to fall. This will result in much more gross sales, as a result of merchants are crying to go away their positions.

At current, extra merchants wager that Ethereum will fall than up. That’s the reason market makers can attempt to push costs greater, presumably as much as $ 4,500, to activate cease loss or to liquidate quick positions. At current, the lengthy/quick ratio of Ethereum is 0.8447, which implies that about 54% of the merchants expects the value to fall rapidly.

Additionally learn: Ripple CTO says that micro technique “won’t work out effectively” if Bitcoin value drops

On the identical time, the demand for ETH is powerful from firms which have giant portions of it of their treasury. The most important, Bitmine, introduced yesterday that it has elevated its ETH pursuits by $ 1.7 billion previously week, bringing the full to $ 6.6 billion.

That implies that they’ve added greater than 373,000 ETH cash, making their inventory grew from 1.15 million to 1.52 million. This type of giant -scale shopping for creates a robust upward stress on the value, which is a optimistic signal for Ethereum.

What’s the subsequent step for ETH value?

ETH continued to fall after falling underneath a very powerful assist degree at $ 4,400. This in all probability implies that merchants take a revenue within the quick time period. From writing, ETH value acts at $ 4,205 and greater than 2percenthas fallen over the previous 24 hours.

The following essential degree to view is $ 4,143. If ETH is bouncing strongly from this degree, this will likely imply that consumers intervene and attempt to flip it into a brand new assist zone. In that case, the ETH/USDT pair can rise once more and presumably attain $ 4,777. If it breaks greater than $ 4,777, chances are high that it might climb to $ 5,000.

Nevertheless, if ETH falls beneath $ 4,143 and stays there, this may point out a deeper withdrawal. The worth can then fall to round $ 3,800, and presumably even to the 50-day advancing common at $ 3,556.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024