Altcoin

Will Ethereum Reach $3.6K in Q1? – ETH/BTC ratio suggests…

Credit : ambcrypto.com

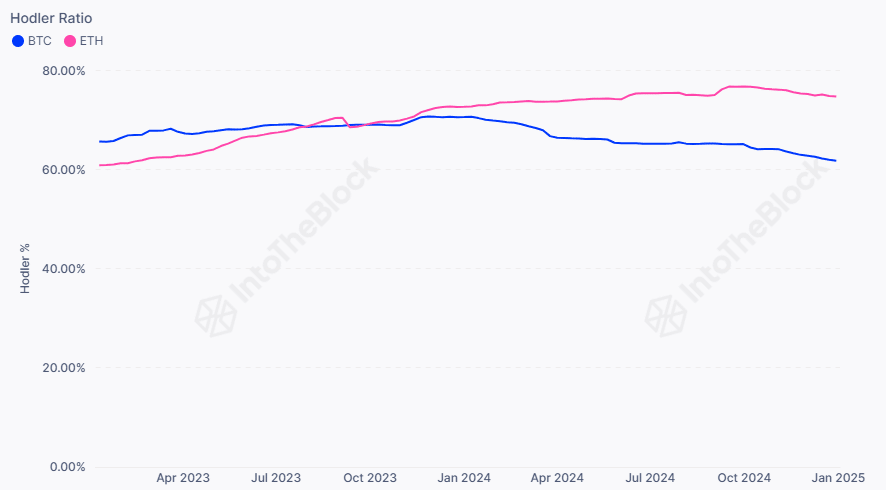

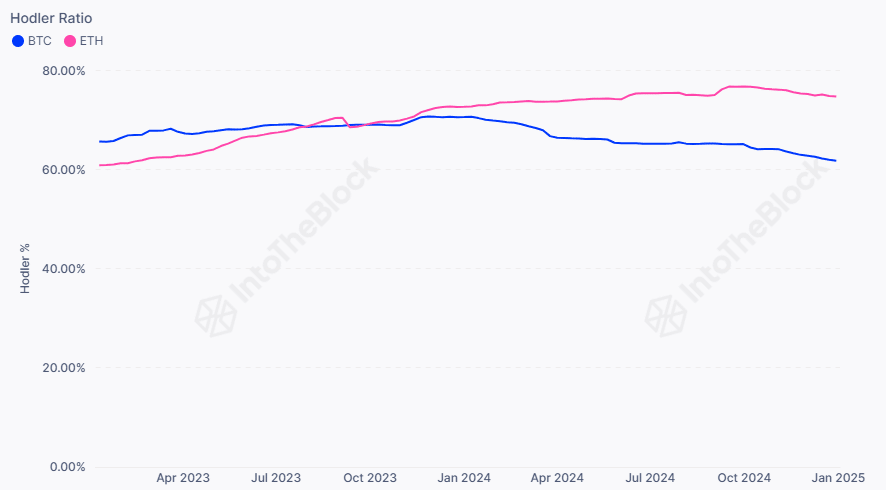

- Lengthy-term ETH holders had been extra bullish than their BTC friends.

- ETH/BTC was at an important level, however a powerful restoration had but to happen.

Ethereums [ETH] long-term holders (LTH) have proven extra bullish beliefs than their Bitcoin [BTC] counterparts.

Analytics agency IntoTheBock confirmed that the market shift started in early 2024 and intensified in 2025 because the ETH LTH cohort expanded possession and dominance to almost 75%.

Quite the opposite, the BTC LTH cohort has ruthlessly liquidated their property, dropping their dominance under 60%. The corporate declared,

“Presently, 74.7% of Ethereum addresses are long-term holders, which is considerably higher than Bitcoin. This development will seemingly proceed till Ethereum approaches its all-time excessive and holders begin taking earnings.”

Supply: IntoTheBlock

Will ETH acquire floor within the first quarter?

The replace is no surprise as ETH’s value efficiency has lagged behind BTC’s since early 2024. BTC surpassed its earlier cycle excessive and reached the excessive of $108,000, making virtually each holder worthwhile.

ETH has by no means achieved such a feat. So, most ETH bulls could also be holding it in anticipation of a future rally to make a revenue or break even on their investments.

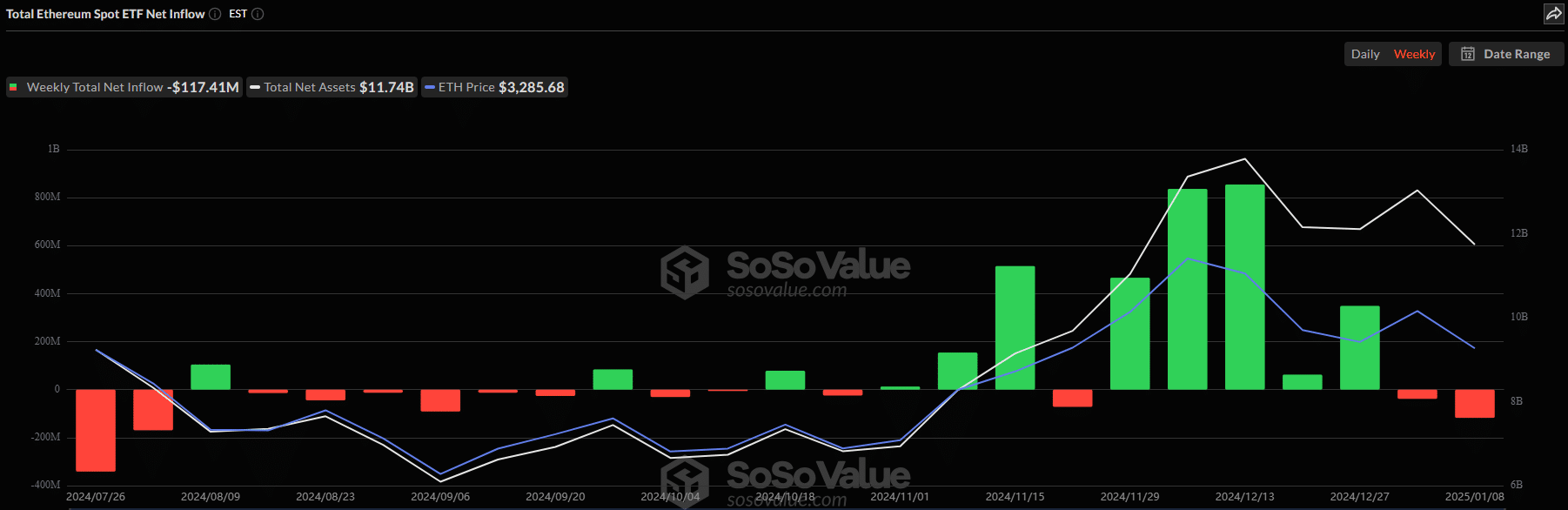

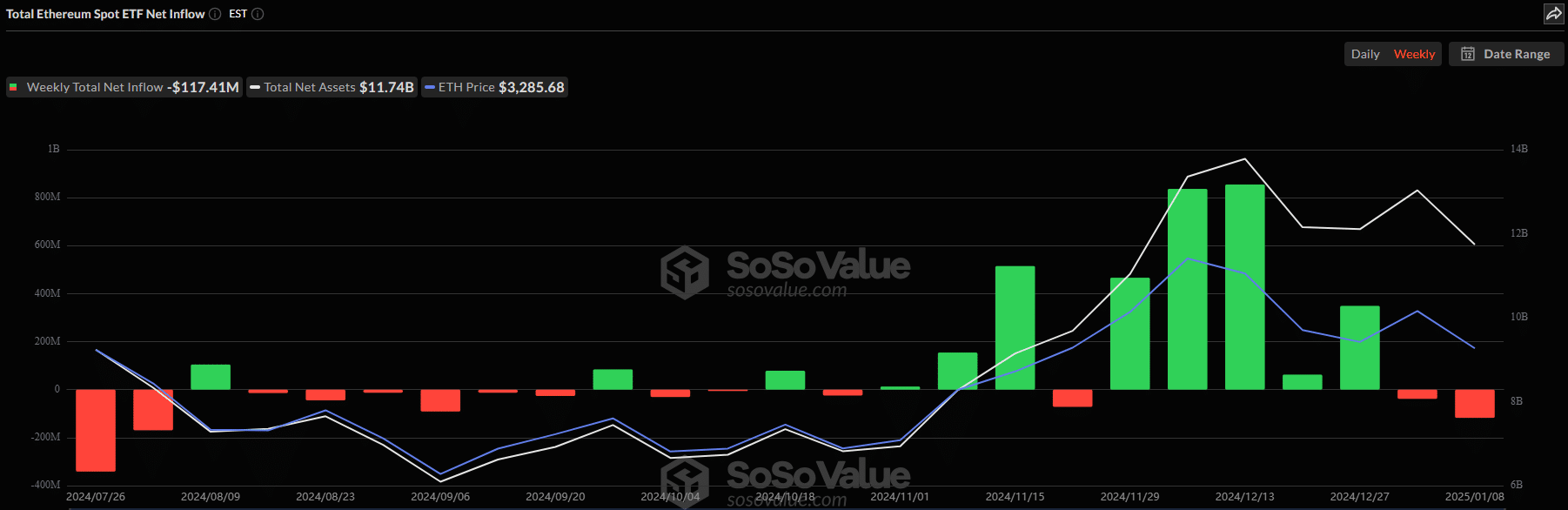

Institutional demand for ETH and BTC was considerably distorted within the new 12 months. Based on information from Soso Worth, ETH ETFs are on observe to finish their second week of outflows. This contrasts with demand in November, when merchandise recorded 5 consecutive weeks of inflows.

Supply: SoSo worth

BTC, then again, noticed internet inflows over the previous two weeks. If this institutional demand development continues, BTC might outperform ETH on the worth charts.

Nevertheless, one other indicator, the ETH/BTC ratio, confirmed a possible pivot for ETH. This indicator tracks the relative value efficiency of ETH versus BTC. It fell to a four-year low of 0.30, underscoring ETH’s underperformance over that interval.

Nonetheless, it shaped a double backside sample, indicating a possible restoration and a possible market shift in favor of ETH.

Supply: ETH/BTC ratio, TradingView

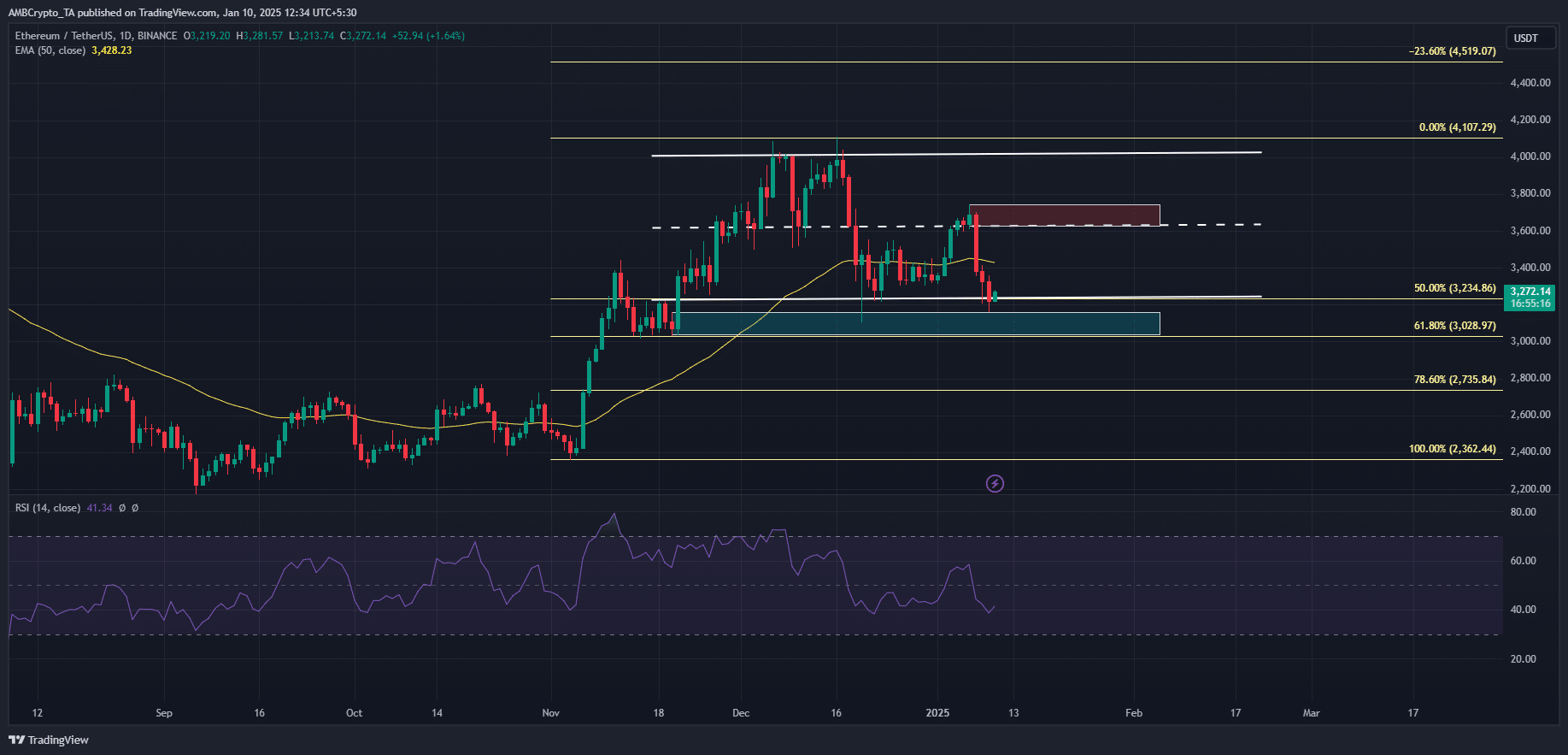

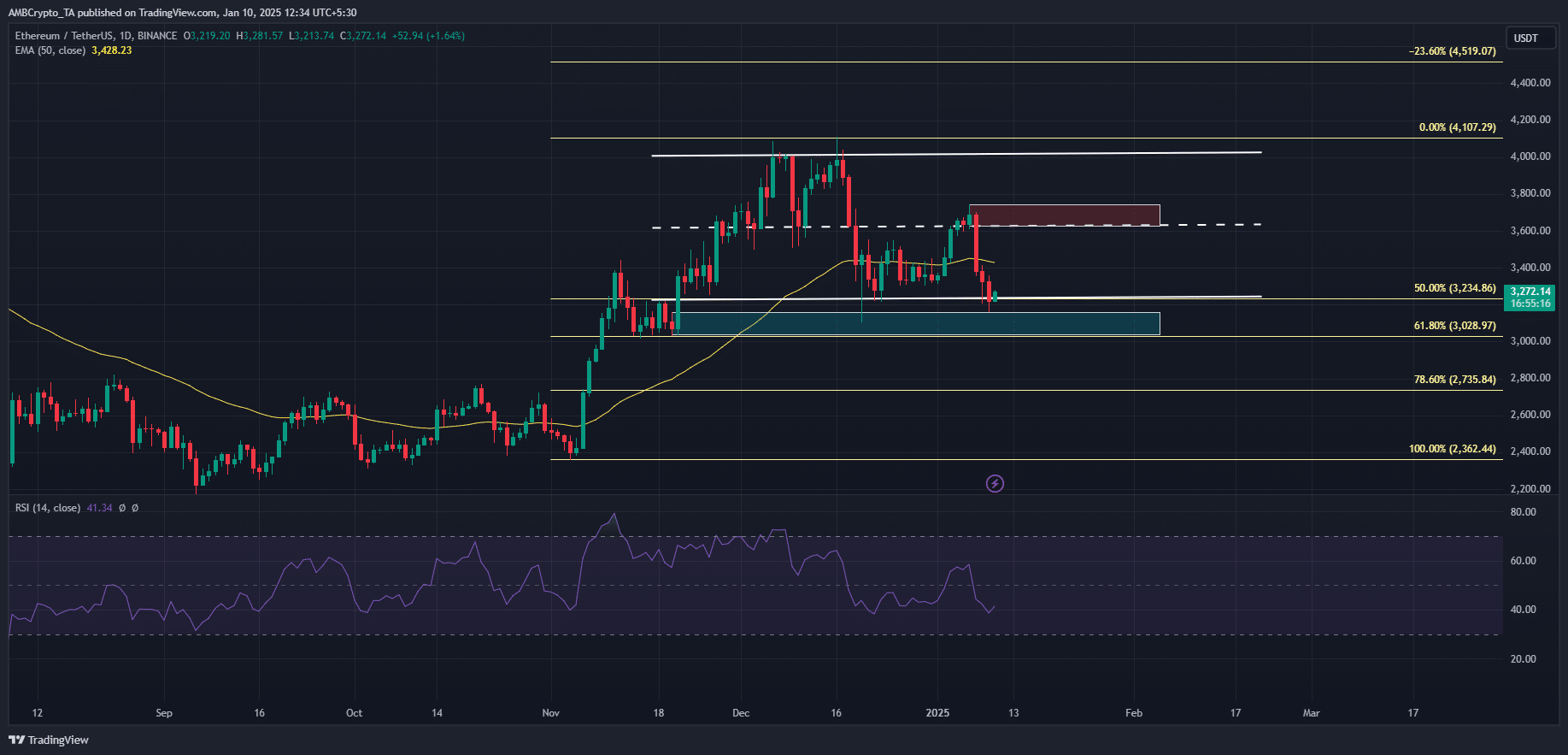

That mentioned, the current market crash has dragged ETH to its December lows above $3K. ETH might try to get well from the $3K-$3.3K help zone, with an instantaneous goal of $3.6K. This was the identical prospect shared by some ETH merchants on X (previously Twitter).

Learn Ethereum’s [ETH] Worth forecast 2025–2026

Nevertheless, ETH’s seemingly restoration could possibly be additional strengthened if it had been to reclaim the 50-day EMA.

Supply: TradingView

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now