Ethereum

Will Ethereum’s struggles continue? Risk-taking hits lowest levels since 2024

Credit : ambcrypto.com

- Ethereum’s dangerous urge for food is falling, which signifies warning available on the market and a slower progress.

- The Bybit -Hack appears to have had a comparatively delicate impression, overshadowed by broader market shifts.

Ethereum’s [ETH] Resilience is examined as latest occasions, together with the rumors Bybit Hack, Shift Market sentiment.

Surprisingly, the sale had much less impression after the potential infringement of safety than the three February marketplace for the market, which stays extra influential regardless of unclear causes.

Underneath these brief -term fluctuations, there’s a deeper concern: the starvation of Ethereum has steadily decreased since March 2024.

Though diminished dangers can cut back liquidations and promote accumulation, it additionally signifies a sluggish market. With ETH that floats round the important thing ranges, the query is whether or not it may well keep its place whether or not lengthy -term uncertainty might be confronted.

The Bybit Hack: A small occasion on the bigger picture?

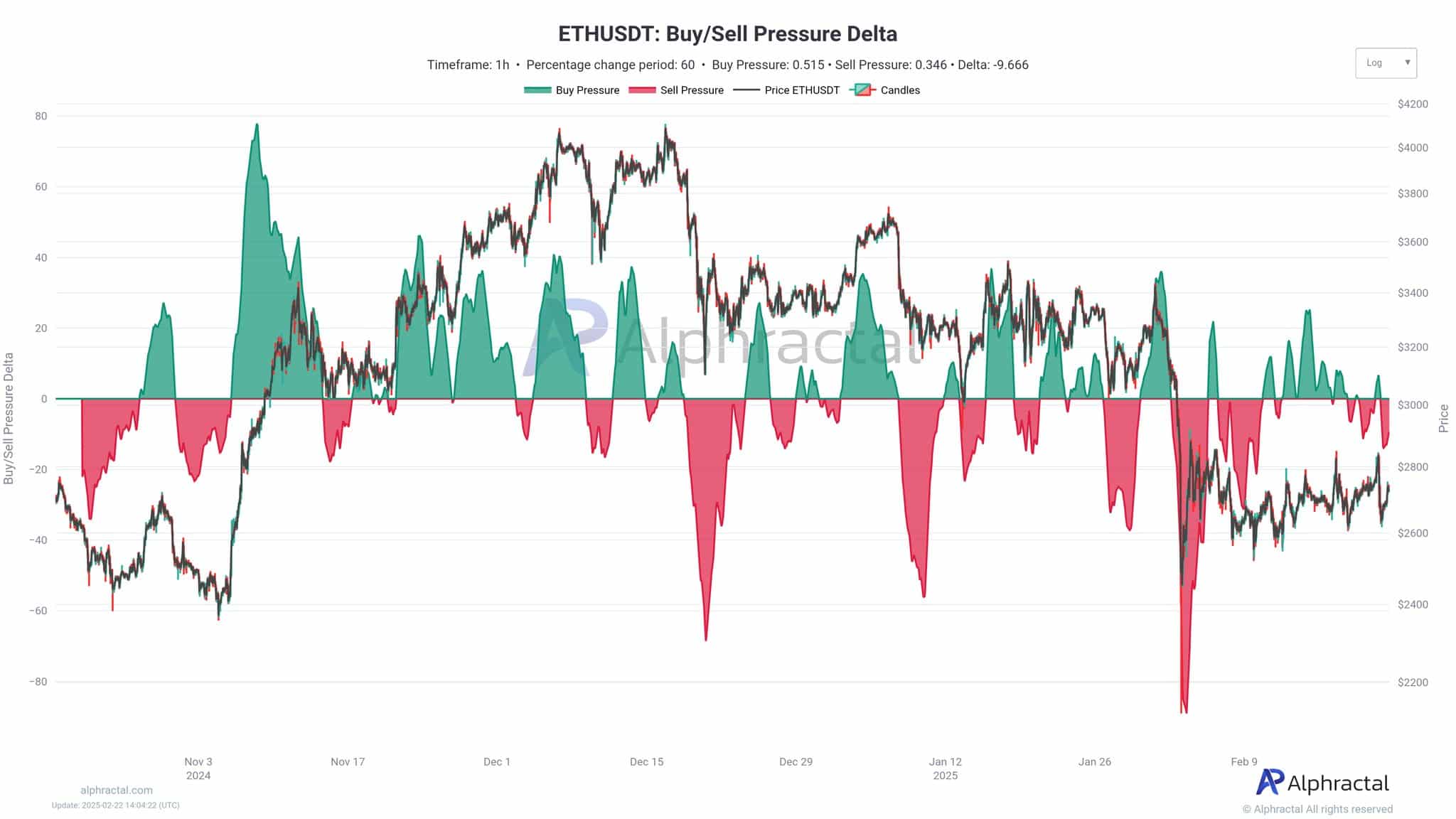

Regardless of the priority concerning the potential Bybit-Hack, information means that the sharpest drops of ETH in latest months had been linked to wider risk-off actions, no remoted occasions.

Supply: Alfractaal

There was a outstanding worth lower on the finish of January and the start of February, nicely earlier than the information concerning the hack appeared.

The sale on 3 February, which was extra severe than the impression of the hack, is a sign of deeper liquidity issues and shifting sentiment.

By falling the danger since March 2024, Ethereum is confronted with diminished participation of leverage merchants. Though this may result in fewer liquidations, the sluggish restoration of ETH signifies the continual market insecurity.

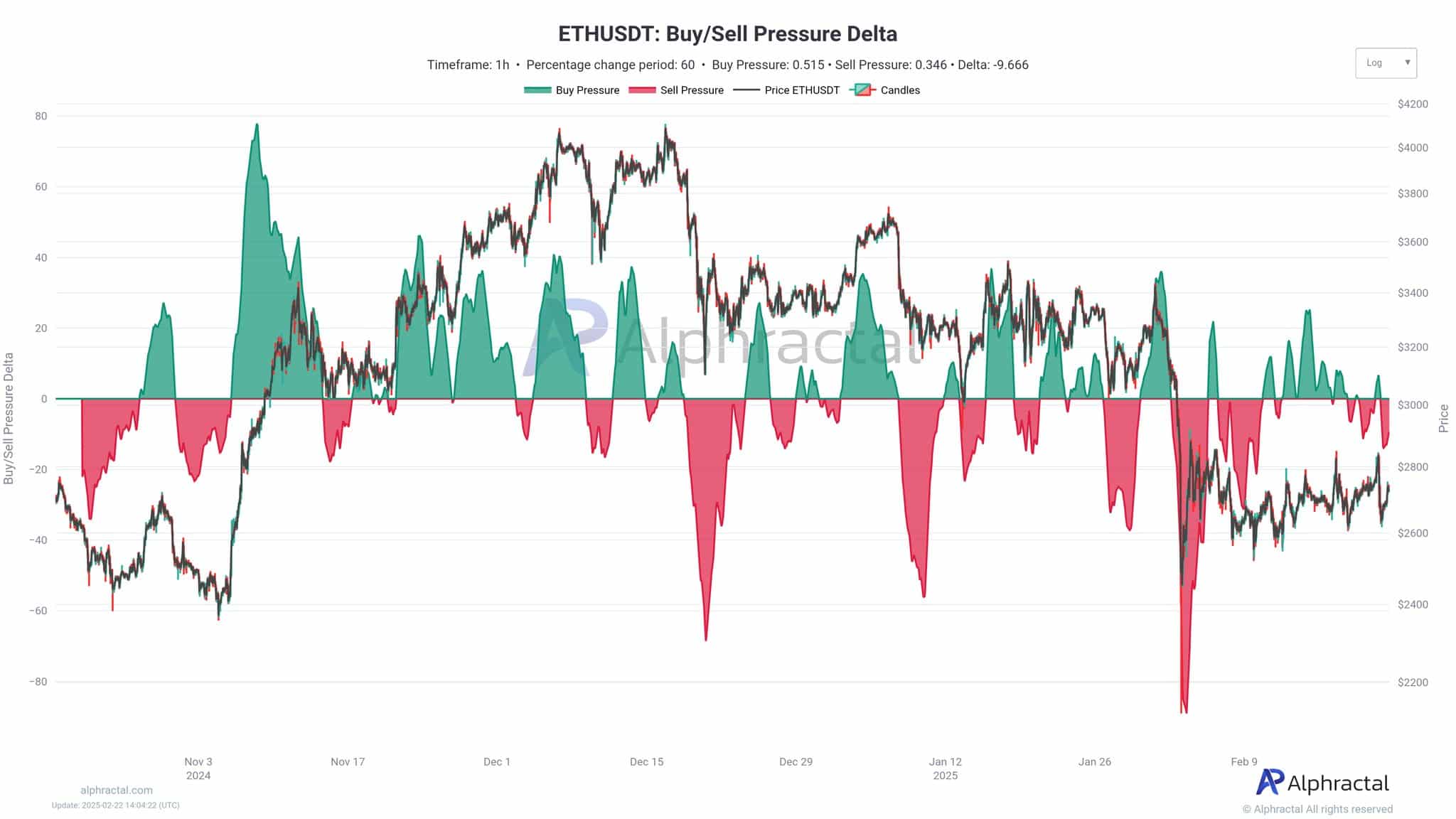

Ethereum: Is the falling danger a purpose for concern?

Ethereum’s danger -etlust has fallen steadily since March 2024, which displays a wider shift in sentiment. The NRM -Grafiek Reveals a transparent downward pattern traders turn out to be dangerous.

Traditionally, the urge for food led speculative streets with a better danger, however the present market feels extra cautious.

Supply: Alfractaal

Regulatory uncertainty and diminished leverage participation have contributed to this pattern.

Though decrease danger trodies cut back volatility and create a extra secure atmosphere, in addition they dampen the potential for explosive worth actions.

Except danger -a little lust, Ethereum can proceed to behave in a extra managed and fewer speculative method.

The Threat Geese paradox

Because the dangerous urge for food from Ethereum decreases, the market introduces a part of diminished volatility and fewer liquidations.

This stability can encourage lengthy -term accumulation, however may also result in stagnation, as a result of worth valuation delays with no speculative momentum.

Supply: Alfractaal

Traditionally, decrease Sharpe relationships coincided with lateral motion and require persistence from traders.

If the risk-corrected effectivity of Ethereum stays built-in, the market might get an intensive accumulation part as a substitute of an imminent outbreak.

Ethereum: The battle for supply and supply

The worth of Ethereum is more and more influenced by institutional influx, retail sentiment and authorized developments.

Blackrock’s latest funding alerts of $ 3.6 billion institutional belief, presumably stabilizing costs and stimulating acceptance.

Within the meantime, the retail sentiment stays distributed, with some accumulation on dips and others cautiously as a consequence of market uncertainty.

The potential approval of Ethereum strike ETFs in 2025 can repeat retail curiosity, whereas bettering the readability of the authorized within the US can cut back the uncertainty of traders.

Finally, the way forward for Ethereum will rely upon the balancing of institutional assist with persistent participation of the retail commerce and a positive regulatory state

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024