Analysis

Will Injective’s Multi-year Support Ignite a Massive 2025 Rally?

Credit : coinpedia.org

With the INJ value forecast for 2025 attracting new consideration, Injective is now buying and selling within the important multi-year help zone of $6 to $7, a area that has repeatedly produced sturdy reversals in its historical past. With bullish fundamentals, ETF anticipation and a significant community improve on the horizon, Injective seems positioned for one in all its most vital recoveries but.

INJ on multi-year help: a historic entry level for main rallies

With INJ value hovering round $7.81 as we speak, Injective is at a help vary that has persistently acted as a long-term reversal zone. The earlier interactions with the $6-$7 space have produced sharp multi-week rallies, and merchants now anticipate an analogous response because the broader market stabilizes.

The technical construction additionally reinforces this imaginative and prescient. The INJ The value chart exhibits a value decline on the decrease finish of a long-term vary, in keeping with a falling wedge that has been energetic since August 2024. Whereas traditionally, each touchpoint on this trendline has led to rallies, creating optimism {that a} breakout in the direction of $21 earlier than year-end stays possible.

Basic power: injective lead improvement and networking exercise

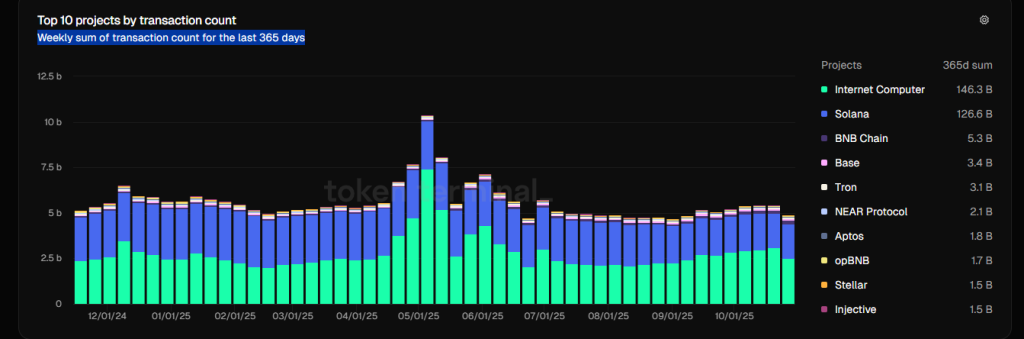

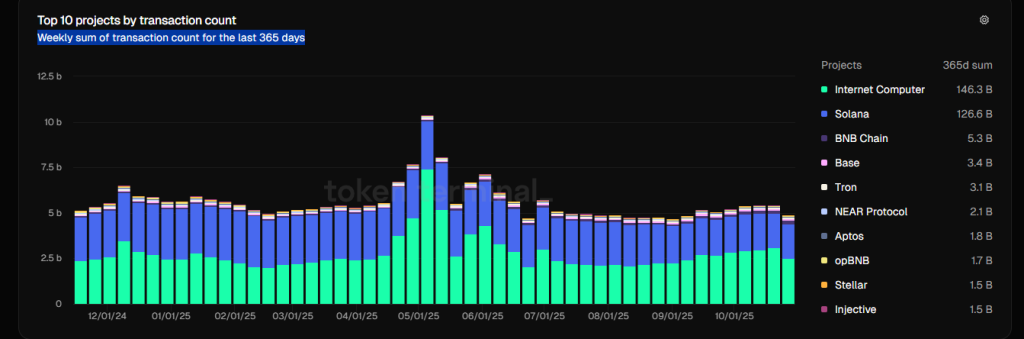

Along with value motion, Injective’s fundamentals proceed to strengthen. It’s at the moment at 1 in weekly code commits for all blockchainsdemonstrating improvement actions of the best stage. With greater than 1.5 billion transactions processed, Injective additionally ranks tenth worldwide in tTotal number of transactions based on annual data.

This stage of progress signifies rising community adoption and rising developer confidence within the ecosystem. Rising exercise typically precedes aggressive value motion, reinforcing the constructive outlook for the INJ value for 2025.

ETF Hypothesis and Mainnet Improve Drive Bullish Momentum

Institutional curiosity can also be strongly evident. In October, 21Shares has filed an S-1 filing with the SEC to launch the first-ever INJ ETF. As soon as the US authorities resumes full regulatory exercise, this utility shall be reviewed and the probabilities for approval seem promising.

ETF approval would unlock new liquidity channels, considerably increasing market entry for injective crypto. This mirrors how ETF inflows boosted Bitcoin and Ethereum earlier this 12 months.

In the meantime, Injective is making ready to launch its Altria Mainnet Improve (IIP 583) inside the subsequent 5 days. This improve is seen as a significant step ahead and has bolstered neighborhood expectations that the momentum is shifting decisively bullish.

Technical indicators level to accumulation earlier than growth

Whereas the long-term indicators look constructive, some technical devices are nonetheless exhibiting combined indicators. The RSI close to 37.50 signifies that the market is cooling additional and will enter a deeper undervalued zone round 30. MACD and AO stay subdued, indicating that consolidation continues to be underway.

Nevertheless, the Chaikin movement of 0.14 exhibits rising constructive inflows, indicating that accumulation is already taking place beneath the floor. As soon as momentum turns bullish, INJ value USD has the potential to re-enter $21, broaden to $44 and presumably retest $52 ATH in 2026.

As these catalysts align, the INJ value forecast for 2025 continues to strengthen, making Injective one of the adopted recoveries available on the market.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to offer well timed updates on every thing crypto and blockchain, from startups to trade majors.

Funding disclaimer:

All opinions and insights shared signify the creator’s personal views on present market situations. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts duty in your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our web site. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now