Ethereum

Will Interest Rate Decision Revive Buying Demand?

Credit : coinpedia.org

Final week Bitcoin (BTC) skilled appreciable volatility. Conflicting market alerts brought on Beerarish strain, in order that merchants don’t set a transparent directional pattern. Because of this, giant altcoins equivalent to Ethereum and XRP fell beneath essential value factors. Nevertheless, after hints of American CPI and PPI information that will chill out inflation, the market collected, making it a stage for a doubtlessly bullish week forward.

Curiosity resolution can breathe new life into Crypto

Within the midst of a lower of two% final week, Bitcoin continues to run significantly downward dangers because of a number of Bearish macro -economic strain.

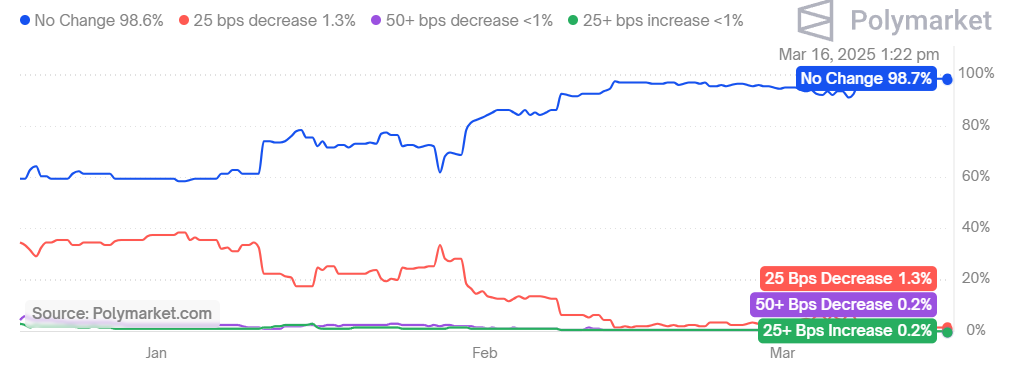

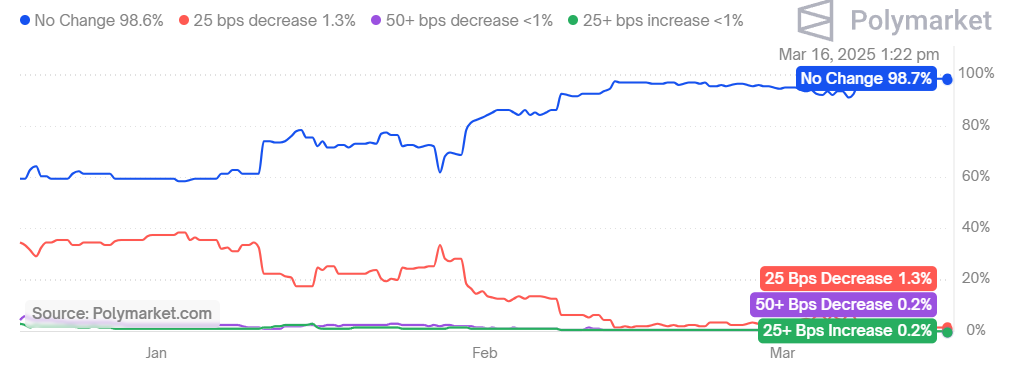

On a greater word, analysts within the crypto prediction markets, equivalent to polymarket, are optimistic a few doable break in Federal Reserve Fee Tales subsequent week. Furthermore, there’s a rising hope that geopolitical tensions between Russia and Ukraine can relieve.

Gogelaars on polymarket costs in a likelihood of 99% that the Fed Pauseing Fee-Verhoogs in March, with the prospect {that a} ceasefire of Russia-Ukraine reaches almost 80%. If these developments happen, a rise in urge for food of the danger can result in elevated investments in Bitcoin and different cryptocurrencies, which can comply with upward impulse.

Bitcoin -Worth forecast

Bitcoin bulls attempt a restoration, though they most likely expertise appreciable resistance between the EMA20 pattern line and the $ 86.7k. The BTC value is at present $ 84.262, after the final 24 hours elevated by 0.09%.

If the worth stays above the 20-day EMA, this might counsel that the current dip beneath $ 84k was only a hose lure. Underneath such circumstances, the BTC/USDT pair can climb to the crucial degree of $ 86.7k and probably a picture of $ 93,000.

Then again, if the worth falls sharply from this resistance zone, this may counsel that bears have the higher hand. This could improve the prospect of a fall within the essential degree of help at $ 79,974.

Ethereum Worth forecast

Ether has confronted with rising volatility across the falling resistance line, which means that rising domination amongst patrons and sellers. ETH value is consolidated beneath the essential $ 2K marking. From writing, ETH value acts at $ 1,923 and greater than 0.2percenthas risen over the previous 24 hours.

The relative energy index (RSI) is beginning to present early indicators of a optimistic divergence. If the worth infringes the EMA50 pattern line, the ETH/USDT pair might rise to the degradation degree of $ 2,109. Bears can intensify their gross sales efforts at this degree; Nevertheless, if the bulls reach retaining their momentum, the couple can proceed to the 50-day SMA at $ 2,530.

These optimistic prospects would turn out to be invalid if the worth will not be at $ 2,109 after which falls beneath $ 1,772. Such a motion would point out a bearish dominance.

XRP -Worth forecast

XRP bounced from the help degree of $ 2 and broke above the EMA20 pattern line on the 1-hour graph. Bears attempt to cease the restoration at this EMA, however proceed to purchase strain from Bulls suggests a possible outbreak above it.

If profitable, the XRP/USDT pair might climb to $ 2.65. Thrilling this degree can set the stage for a rally to $ 2.97.

Conversely, a pointy fall within the present degree would point out that the sentiment bearish stays. In such a case, the couple can overview the crucial help of $ 2.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024