The Chainlink worth prediction for 2025 has turn out to be a focal point because the token consolidates inside a decent vary between $16.5 and $18.5. Regardless of a quiet October, the broader technical setup and strengthening fundamentals recommend LINK might be making ready for a significant bullish reversal heading into November.

LINK is buying and selling in a decent vary however is making ready for a turnaround in November

On the time of writing, the Chainlink worth is at the moment close to $17.95, reflecting a modest each day improve of 0.30% and a market cap of $12.17 billion. The Chain link The worth chart (LINK) exhibits continued sideways motion, but analysts level towards a rising wedge sample that has been lively since late 2023.

This wedge construction has repeatedly decided the asset’s trajectory, with a current rejection close to the mid-band in September resulting in profit-taking and a gradual pullback. The present setup signifies that LINK worth might get away of the symmetrical triangle and retest the assist zone of $13.50–$14.50, according to the decrease boundary of the wedge. Traditionally, such areas have led to robust upswings in Chainlink market cycles.

Chainlink Value Prediction November 2025 Outlook: Accumulation earlier than an upswing

If the Chainlink worth forecast for 2025 is appropriate, subsequent November might be a turning level. Analysts count on that after LINK hits the important thing assist space, it might provoke a restoration part with a goal of $27.86, the excessive of the yr based mostly on the Coinbase chart, earlier than doubtlessly rising in the direction of $46 within the first half of 2026.

The sample implies a interval of accumulation till the tip of October, adopted by rising demand over the past two months of the yr. That is in keeping with the everyday market rotation noticed when long-term holders start to build up during times of low volatility.

Ecosystem energy: partnerships and growth of reserves

Whereas the Chainlink worth in USD has moved sideways, the ecosystem continues to achieve momentum. In October Chainlink partnered with S&P World to convey its Stablecoin Stability Assessments (SSAs) on-chain through Knowledge Hyperlink, marking some of the necessary collaborations of the month.

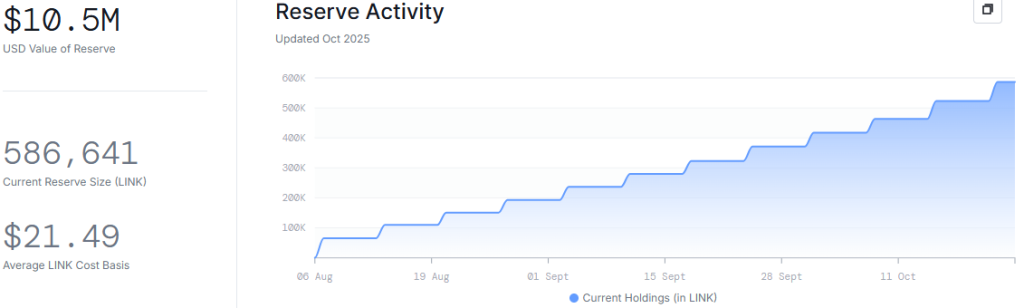

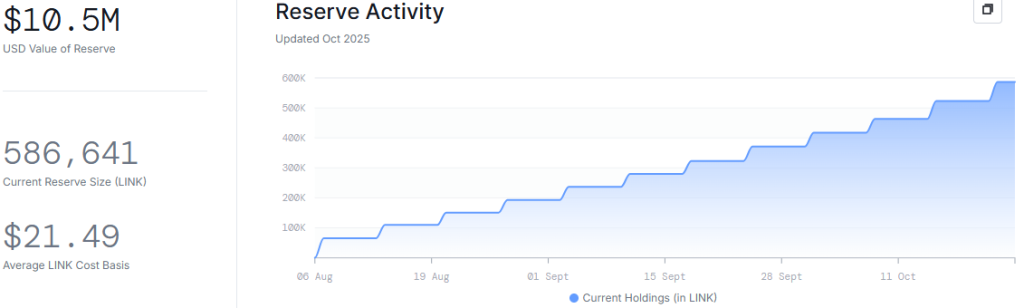

Furthermore, the Chainlink Reserve, a rising strategic pool funded via protocol revenues, has extensive particularly since August. Latest information exhibits that there are a complete of 586,641 LINKs value roughly $10.5 million, underscoring rising confidence within the protocol’s monetary basis and sustainability.

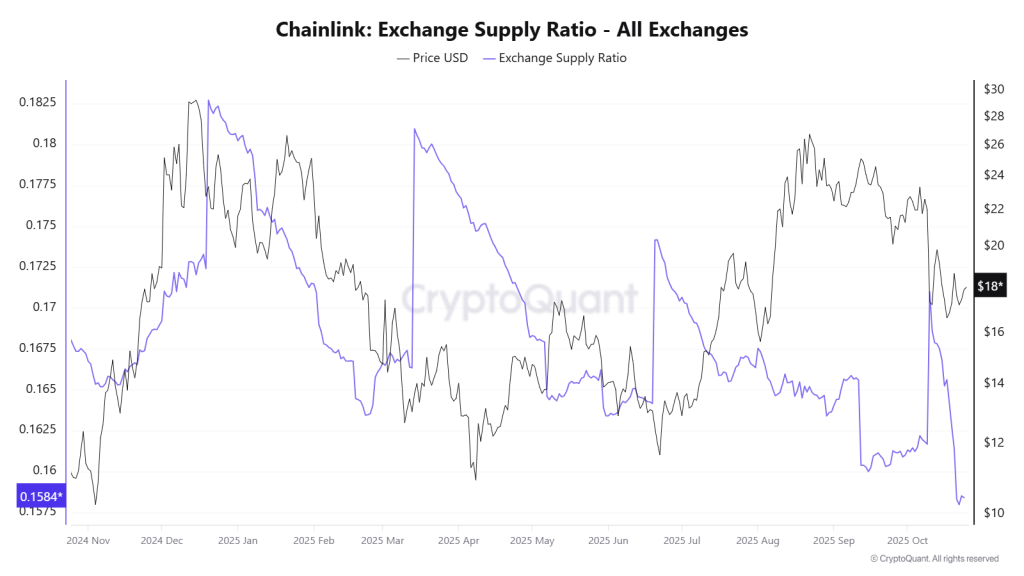

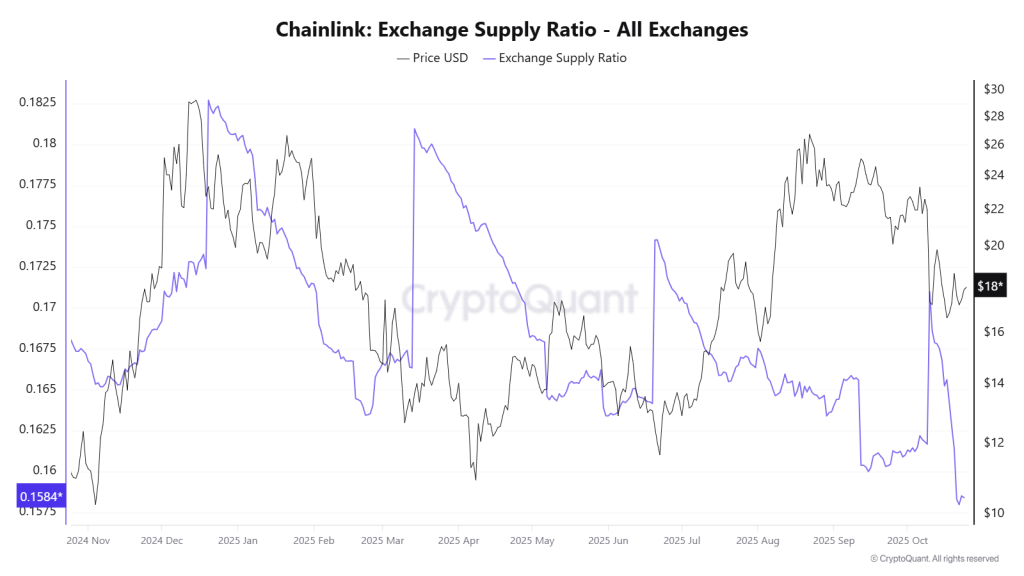

Provide metrics point out a bullish structural shift

On a series indicators additionally assist the bullish Chainlink worth forecast for 2025. The Change Provide Ratio has steadily declined, indicating that long-term holders are eradicating their tokens from exchanges. This development reduces potential promoting stress and will increase the probability of a provide shock, the place decreased availability causes costs to rise.

If this metric continues to say no, Chainlink might expertise accelerated upside momentum as soon as demand reemerges, particularly as ecosystem progress and strategic reserves assist its long-term prospects.