Ethereum

Will markets soar or crash?

Credit : ambcrypto.com

- Practically $3 billion in BTC and ETH choices are expiring as merchants brace for top volatility and main worth motion.

- Market makers are repositioning amid a lull in vacation buying and selling as $98K BTC and $3,700 ETH ranges dominate consideration.

Bitcoin [BTC] And Ethereum [ETH] choices contracts value $3 billion have been set to run out on December 13. These expirations usually result in elevated market exercise, with merchants conserving an in depth eye on potential worth actions.

On the time of writing, Bitcoin was priced $100,073whereas Ethereum was buying and selling on $3,881.12in keeping with information from Coingecko.

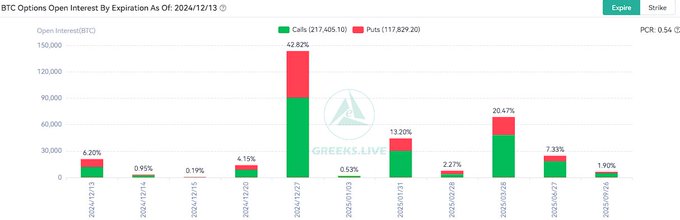

Bitcoin choices value $2.1 billion are nearing expiration

Bitcoin has $2.1 billion value of choices contracts expiring. The put-call ratio is 0.83, which signifies that there are extra calls (bullish bets) than places (bearish bets).

The utmost ache level – the worth level at which most choices will expire nugatory – is $98,000.

Supply:

With Bitcoin’s market cap at $1.98 trillion and a circulating provide of 20 million cash, merchants are maintaining a tally of its subsequent steps.

The 24-hour buying and selling quantity for BTC has reached $94.48 billion, indicating elevated exercise because the expiration date approaches.

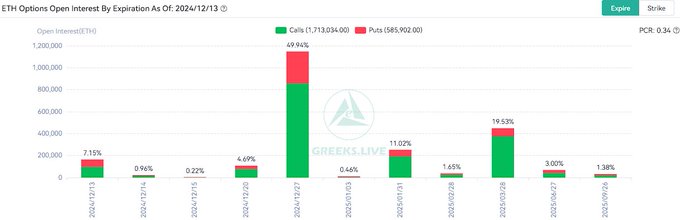

Ethereum choices see $640 million expiration

Ethereum has $640 million value of choices expiring, with a put-call ratio of 0.68, displaying even stronger bullish sentiment than Bitcoin. The utmost ache level for ETH is $3,700, an important stage that merchants are carefully watching.

Supply:

Ethereum’s buying and selling quantity over the previous 24 hours is $44.47 billion, with a market cap of $467.65 billion and a circulating provide of 120 million ETH.

Though ETH has seen a slight worth decline of 0.63% over the previous 24 hours, its week-on-week efficiency stays flat, reflecting a wait-and-see perspective amongst merchants.

Market makers are repositioning as liquidity diminishes

In keeping with Greeks.livemarket makers are shifting their positions throughout this era of expirations, which coincides with lowered buying and selling volumes through the vacation season.

Analysts have famous rising implied volatility (IV), indicating markets are getting ready for sharper worth actions. “Decrease liquidity through the holidays usually will increase market volatility,” Greeks.dwell analysts mentioned.

In addition they highlighted the rising correlation between crypto costs and the US inventory markets, suggesting that inventory worth actions may affect cryptocurrency actions.

Financial information provides further complexity

The expiration of those choices comes after per week of financial developments within the US in November inflation rose to 2.7%, with a core CPI of 0.3%, pointing to persistent inflation issues.

Learn Bitcoin’s [BTC] Worth forecast 2024-25

Whereas a price reduce by the Federal Reserve is predicted, issues stay about whether or not inflation will gradual the easing.

These components, mixed with billions in crypto choices expiring, may result in elevated market exercise.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT11 months ago

NFT11 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Videos4 months ago

Videos4 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September