Bitcoin

Will the Crypto Market Crash Again? Here’s What the Data Says

Credit : coinpedia.org

After a quick restoration on September 10, 2024, the general crypto market seems to be present process one other huge decline. Following the discharge of the US Client Worth Index (CPI) and the opening bell of the US market, main cryptocurrencies together with Bitcoin (BTC), Ethereum (ETH), Solana (SOL) and others have fallen considerably.

Crypto Market Enormous Current Drop

In keeping with the Coinmarketcap, BTC, ETH, SOL, and DOGE have skilled worth drops of 1.95%, 1.85%, 2.10%, and a pair of.35% respectively previously few hours.

This worth drop means that traders and crypto lovers usually are not proud of the most recent CPI report. Though the CPI has fallen to 2.5%, considerably decrease than the earlier month’s 3.0%, this indicators that inflation is cooling.

The potential motive for Bitcoin’s worth drop

Nevertheless, the potential motive behind the market sell-off is the notable Bitcoin dump by short-term holders and miners.

A outstanding crypto analyst posted a message on X (previously Twitter) stating that Bitcoin short-term holders took benefit of the latest worth surge on September 10 and bought virtually 14,816 BTC price $850 million. In one other submit, the analyst famous that Bitcoin miners additionally bought a big 30,000 BTC price $1.71 billion previously 72 hours.

Bitcoin technical evaluation and upcoming ranges

In keeping with the professional technical evaluation, BTC appears bearish because it lately broke yesterday’s low and fell under the USD 56,000 degree. Moreover, the 200 Exponential Shifting Common (EMA), a technical indicator typically utilized by merchants to detect long-term developments, exhibits that Bitcoin is in a downtrend.

Primarily based on historic worth momentum, if BTC closes a day by day candle under the $56,000 degree, there’s a excessive likelihood that it might drop to $54,000 or decrease if the bearish development continues.

Bearish statistics within the chain

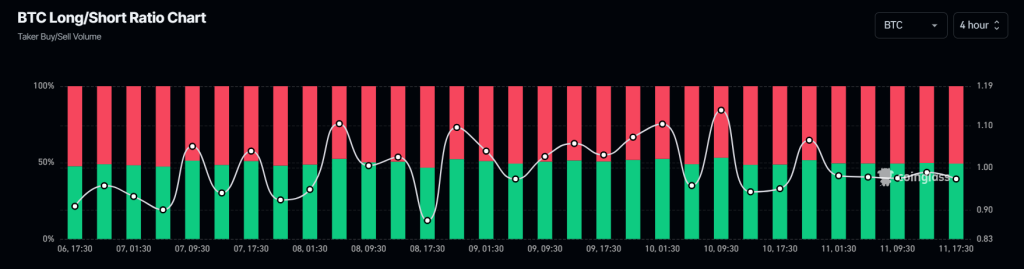

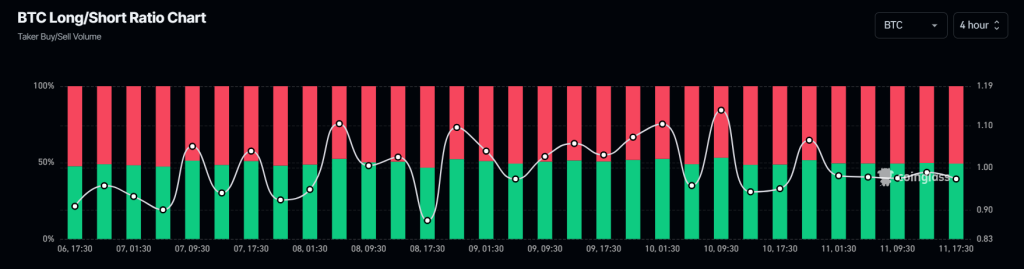

Nevertheless, this bearish outlook is additional supported by on-chain metrics. Coinglass’s BTC Lengthy/Brief ratio at present stands at 0.881 (the worth under 1 signifies bearish market sentiment). Moreover, BTC future open curiosity has additionally fallen by 1.5% and continues to say no.

In the meantime, 53.14% of prime Bitcoin merchants maintain brief positions, whereas 46.86% maintain lengthy positions, highlighting that bears are at present dominating property and have the potential to create extra promoting strain.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024