Ethereum

Will the Fed’s Rate Cut Spark a Rebound Post Crypto Market Crash?

Credit : coinpedia.org

The crypto market crash that began on October 10 has develop into probably the most devastating sell-offs within the historical past of digital property. The occasion, which was triggered by a wave of pressured liquidations totaling practically $19 billion, worn out hundreds of over-leveraged positions out there.

In response to Whole crypto liquidation chart knowledge, the vast majority of losses got here from lengthy merchants, indicating widespread panic and sharp risk-off sentiment. Your entire week was full of liquidations, with quantities of practically $23 billion collectively worn out between October 10 and 17.

Within the aftermath, Bitcoin (BTC) fell under the essential help degree, reaching $103,600, whereas Ethereum (ETH) fell to $3,700 and XRP fell to $2.20. The magnitude of the crash additionally unfold to the derivatives and ETF markets, the place Bitcoin ETFs recorded outflows of greater than $500 million, whereas Binance noticed consumer withdrawals of round $185 million in a single day.

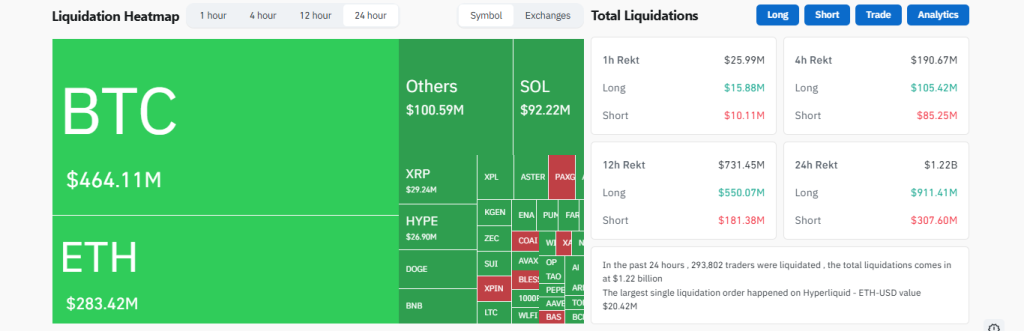

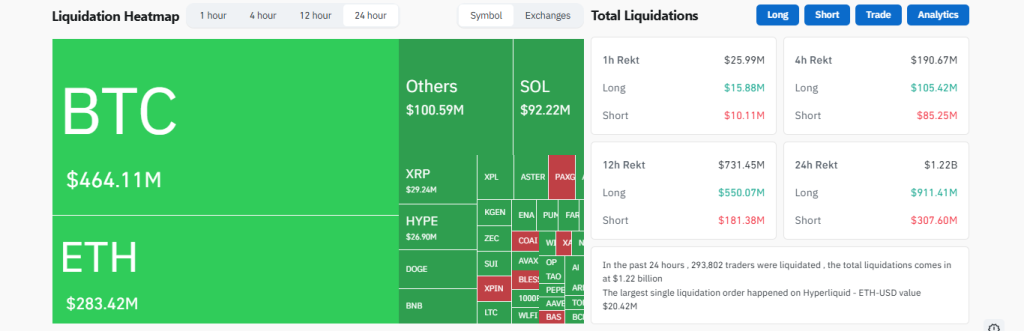

October 17 Liquidation provides $1.21 billion extra to the tally

The ache didn’t cease on the primary dive on October tenth. The crypto market crash in October 2025 lasted a full week, and immediately’s crypto market liquidations present that market circumstances have deteriorated as volatility stays extreme.

The most recent file on October 17 noticed one other $1.21 billion in positions liquidated, marking probably the most unstable classes because the preliminary collapse. Greater than 294,000 merchants have been worn out inside 24 hours, underscoring how fragile sentiment nonetheless is.

In the identical method, more digging It notes that there have been initially bullish makes an attempt to get better, however between October 14 and 17, the liquidation sample shifted once more in favor of the bears. Because of this, short-term restoration makes an attempt within the crypto sector failed, with longs as soon as once more dominating the wipeouts.

About $700 million was cleared on the 14th; on the fifteenth: $450 million extra; on the sixteenth, roughly $730 million disappeared. On the seventeenth, bearish dominance totally returned, exhibiting that the market has but to stabilize. The most important single liquidation passed off immediately, October 17, on Hyperliquid, the place an ETH-USD place price $20.42 million was forcibly closed.

Why did the crypto market crash immediately?

A number of causes for the crypto market crash got here collectively to create this storm. First, world commerce tensions escalated following President Trump’s renewed 100% tariff threats in opposition to China, resulting in a pointy sell-off in world markets.

Second, the continuing US authorities shutdown has heightened investor fears, whereas outflows from Bitcoin ETFs point out institutional danger aversion.

The result’s a broad risk-free surroundings, the place merchants want money and secure property over cryptocurrency publicity. That is why the gold worth (XAU/USD) is skyrocketing and reached an ATH of $4380 immediately. What made the state of affairs worse was that extreme leverage and successive margin calls amplified volatility, making a domino impact on the inventory markets.

Key technical ranges and what comes subsequent

From a technical standpoint, information of the crypto market crash was the primary subject that scared weak fingers and noticed the market dump, and this occasion nonetheless factors to extra potential downsides if the present help within the prime blue-chip cryptos fails.

Bitcoin now faces its subsequent psychological check at $100,000, with a attainable extension to $95,000 if bearish stress will increase. For Ethereum, the 200-day EMA of close to $3,550 acts as a essential line of protection, whereas XRP The worth chart exhibits that the $2.00 degree is seen because the quick security web.

Trying forward, merchants are primarily trying on the Federal Reserve assembly on October 29, the place the CME FedWatch tool provides a 97% probability of an rate of interest minimize of 0.25%. Such a transfer may inject much-needed liquidity into the market and probably set off a near-term restoration. Till then, the market stays tense as merchants brace for extra volatility.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial tips primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our overview coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to offer well timed updates on every thing crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the writer’s personal views on present market circumstances. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability to your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our website. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024