Analysis

Will the New PYTH Network Reserve Trigger a Chainlink-Style 80% Price Rally?

Credit : coinpedia.org

The newest announcement surrounding the brand new PYTH Community Reserve has shed some gentle on the crashing PYTH Community worth, because the undertaking now claims to be shifting to a sustainable, revenue-backed worth mannequin. With PYTH Community worth hovering round $0.064 right now, the market is now weighing whether or not this structurally strengthened mechanism can catalyze renewed upside momentum, much like the earlier Chainlink reserve-driven 80% rally in August this yr.

PYTH Reserve introduces a brand new worth constructing engine

The launch of the PYTH Community Reserve marks a considerable shift in how community worth is strengthened. Primarily based on the data from

Basically, this construction goals to transform all actual buyer income into long-term worth assist for the PYTH Community crypto, which is certainly a big profit for PYTH holders.

Importantly, the reserve will purchase round a 3rd of presidency bonds every month, in line with the info. A barely completely different reserve was introduced by Chainlink in August. Possibly the vibe right here is completely different concerning the mannequin, however the concept is to get an analogous therapy because the LINK Prize.

Throughout that interval, Chainlink worth rose practically 80% inside 19 days, making a notable benchmark for market observers to evaluate how PYTH Community worth charts would possibly reply to this growth.

Income streams that feed the reserve

They knowledgeable the viewers that the PYTH Community Reserve is supported by 4 main ecosystem income streams. Pyth Professional, which surpassed $1 million in annualized income in its first month, and Pyth Core, which generated recurring on-chain income throughout greater than 100 chains.

Likewise, they’ve Entropy, which can also be gaining reputation in gaming, prediction markets, and even L1 integrations. And Specific Relay is designed solely for the aim of offering low-latency block area and aggressive execution.

PYTH mentioned these merchandise collectively kind the financial engine of the community. This aligns adoption with authorities bond development and, in the end, potential buying energy on the open market.

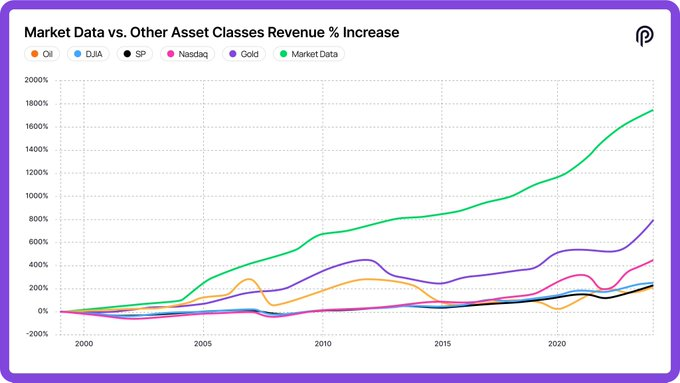

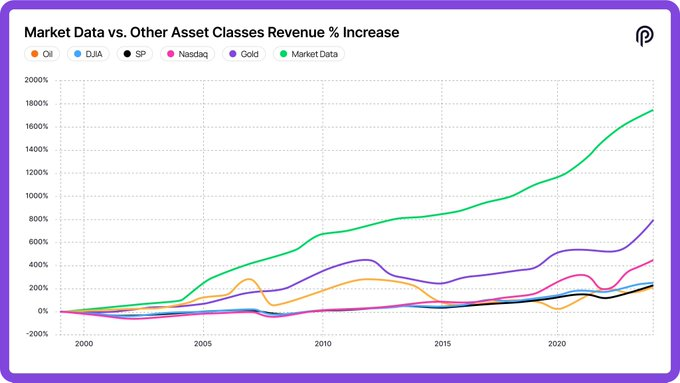

Market alternatives assist long-term enlargement

Their publish additionally included details about their institutional query, which stays a central storyline for any deep-dive investor.

They introduced that establishments spend over $50 billion yearly on market information, and the PYTH Community believes that capturing even 1% of that market would generate roughly $500 million in ARR, and they’re fairly assured that they will considerably increase the PYTH Community reserve.

Moreover, the adoption of Pyth Professional by main monetary establishments and lively DeFi protocols positions PYTH as one of many quickest rising information providers in latest cycles.

- Additionally learn:

- Whale Hundreds $612 Million in BTC, ETH, and SOL Longs – Is a Wider Crypto Market Rally Coming?

- ,

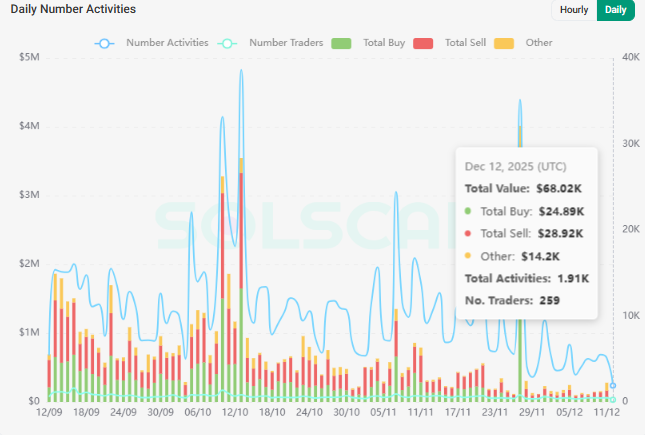

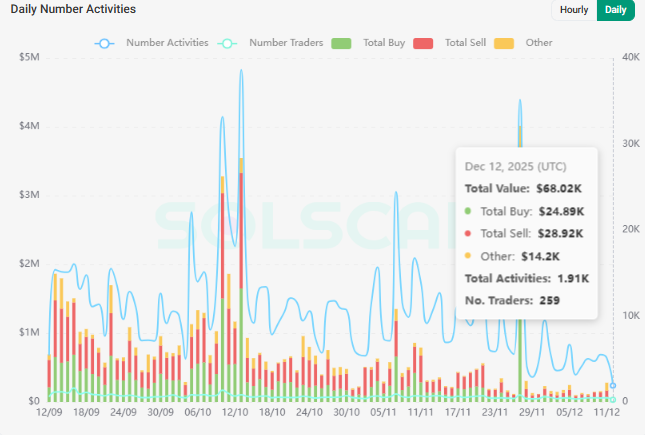

Declines in DeFi exercise add weight to the catalyst

Though the story is comparatively robust, for now the onchain exercise tells a special story, which appears to be in a troubled scenario. Knowledge from visualizing Solscan shows that DeFi exercise has steadily declined since mid-September. Every day exercise values have fallen from about $2 million to about $68,000, with lively merchants dropping from about 1,170 to simply 259 on December 12.

This deterioration underlines why the PYTH reserve could also be properly timed, because the ecosystem seems to wish a catalyst able to reinvigorating participation.

Whereas the early pleasure resembles the run-up to the Chainlink reserve rally, the query stays whether or not PYTH Community worth USD will reply in variety relying on investor reception and continued demand.

Watching the $0.064 zone because the reserve is activated

With PYTH Community’s worth at the moment buying and selling round $0.064, an 80% rally much like Chainlink’s might theoretically push the inventory to $0.12 by the tip of the yr.

Moreover, the PYTH Community’s worth forecast means that if momentum continues by means of early 2026, some analysts predict the goal will shift to a worth close to $0.22. For now, the market will deal with how the PYTH Community Reserve will impression provide dynamics and sentiment within the coming weeks.

Incessantly requested questions

The PYTH Community Reserve is a price assist mechanism that makes use of ecosystem income to repurchase PYTH tokens on a month-to-month foundation, amplifying its long-term worth.

Sure, even 1% of the $50 billion annual market information spend might generate an ARR of ~$500 million, which might drive adoption of PYTH and authorities bond-backed buybacks.

If the reserve is lively, PYTH might transfer from $0.064 to $0.12 within the close to time period, and presumably $0.22 if momentum continues in early 2026.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our professional panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our assessment coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to supply well timed updates on every part crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared symbolize the creator’s personal views on present market situations. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts duty on your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays fully impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now