Altcoin

Will the new yields of Aave be sufficient to withdraw new buyers for an outbreak?

Credit : ambcrypto.com

- With Aave’s new income choices, it could possibly compete with widespread fintech options reminiscent of Sensible and Revolut

- The market has responded positively since growth, whereby the acquisition exercise has emerged over the previous 24 hours

Aave [AAVE] Maybe engaging for traders available on the market in the intervening time after a month of main sale has fallen the value of the Altcoin by 19.42%. In response to this constructive sentiment, the crypto rapidly climbed by 3.57percentafterwards? Nonetheless, that isn’t all, as on the time of the press, there have been extra indications that the rally may proceed.

Throughout this part of the market, merchants purchased a substantial quantity from Aave. Whereas the ecosystem worth is structured throughout this era, it has continued to climb.

Aave -Protocol performs higher than Fintech Options

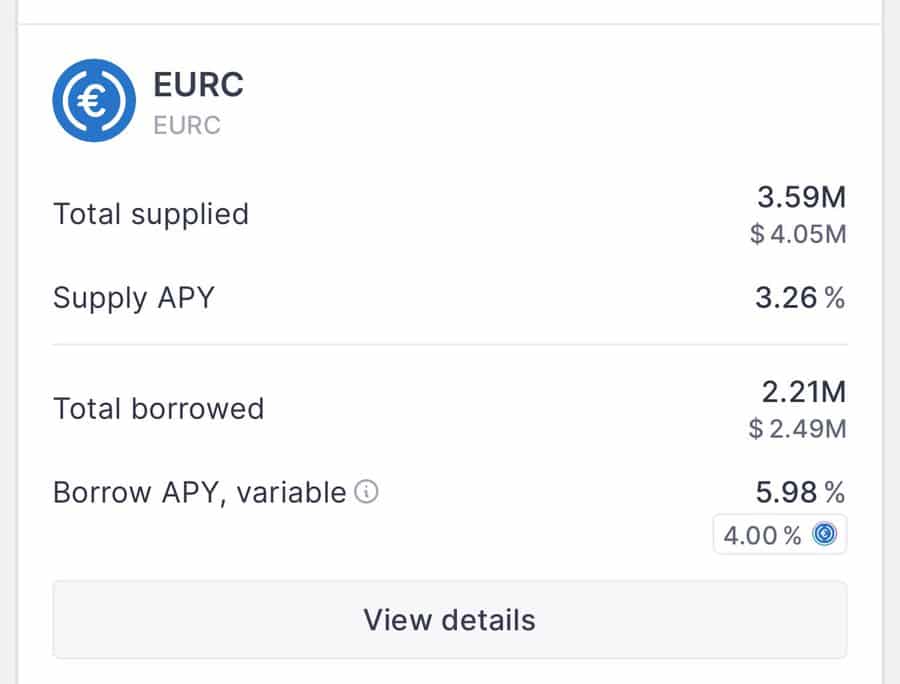

Based on a latest message from founder Stani Kulechov, now a offer Extra return on its EUR -Munt than widespread Fintech Options Sensible and Revolut, which provide decrease rates of interest.

Supply: Aave

Lenders on Aave now earn as much as 3.28% APY – larger than Sensible’s 2.24% and Revolut’s 2.59% (Extremely Plan).

Naturally, these elevated returns Aave as a profitable magnet for yield-hungry customers who’re on the lookout for a greater capital effectivity.

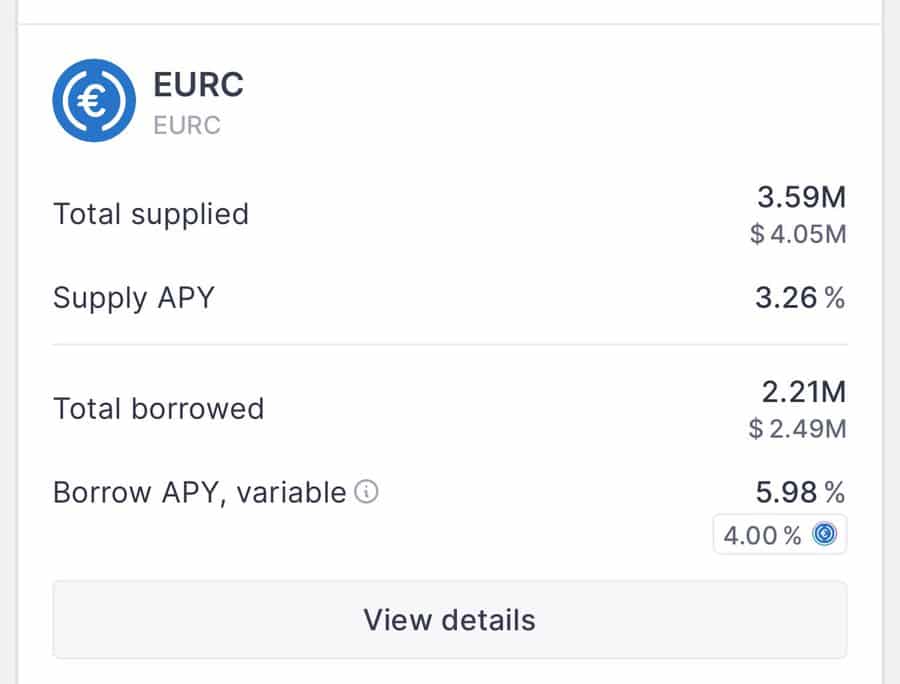

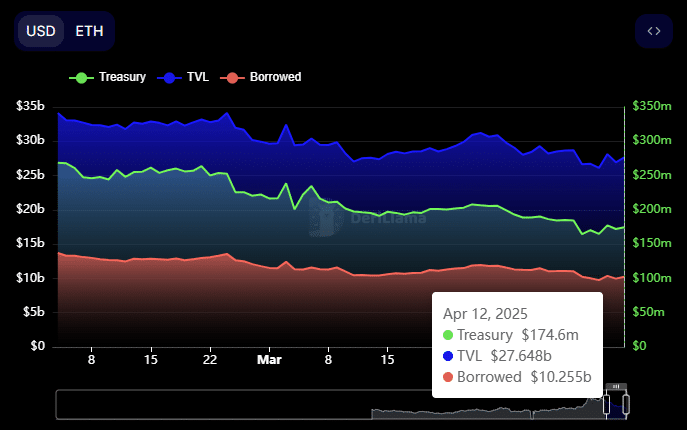

As well as, Defillama information revealed a rise in exercise on the protocol, with liquidity influx that marks a visual enhance. Borrowing on Aave climbed to $ 10,255 billion – indicative of the rising consumer involvement throughout the board.

Within the meantime, the TVL from the protocol rose to $ 27,648 billion, indicating extra deposits and stronger religion in Aave’s ecosystem.

Supply: Defillama

This prompt that there’s a pattern of rising curiosity amongst contributors out there. Upon growth, it could possibly affect the worth of Aave on the graphs – the native token of the platform.

How did the market react to an Aave?

Consumers available on the market have continued to gather an Aave after information in regards to the growth and engaging yields.

In truth, information from IntotheLock emphasised a exceptional enhance in Aave’s quantity at commerce festivals for lengthy -term possession. On the time of writing, round $ 1 million was bought from Aave from the market.

Supply: Intotheblock

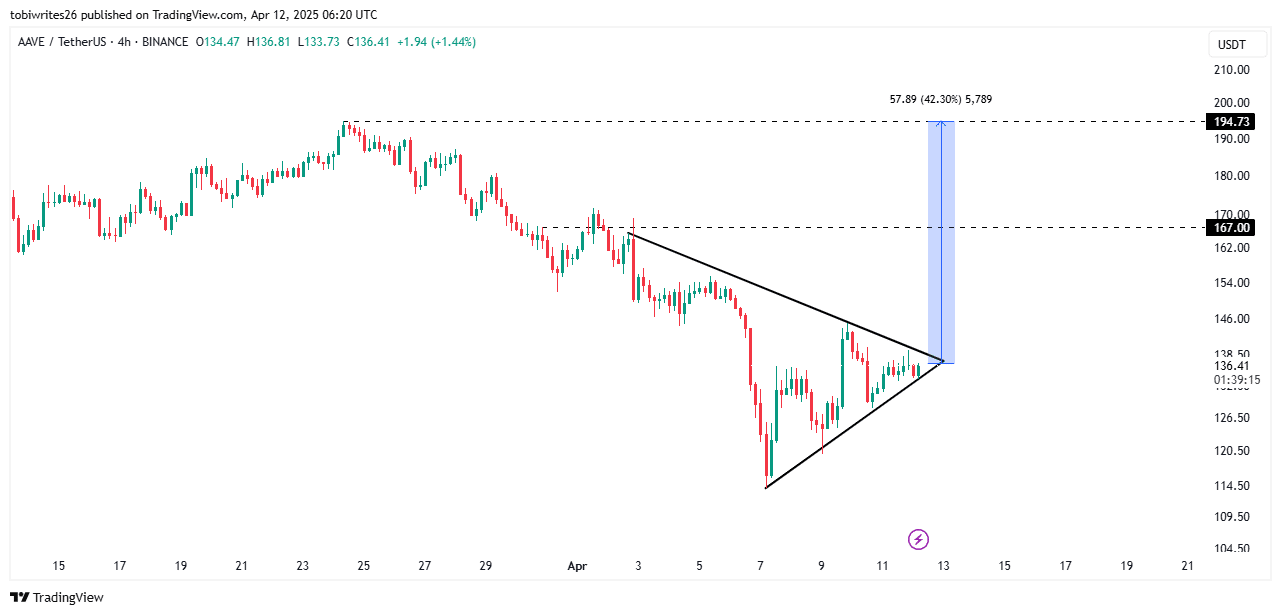

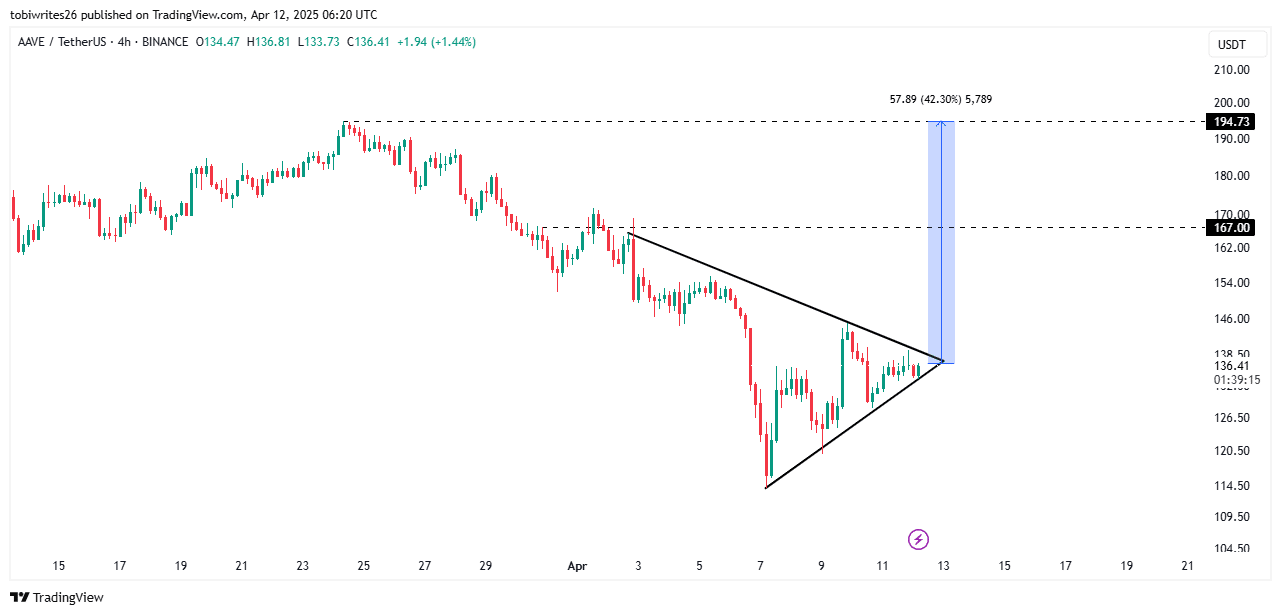

This rising curiosity, if it continues, may result in an enormous rally of 42%, the place the Altcoin climbs to $ 194. This might be the case as a result of it’s actively traded inside a symmetrical triangular sample that is named a bullish sample.

This sample consists of converging assist and resistance traces. A violation of the resistance line would sign the beginning of a Rally for Aave, with a brief -term goal of $ 167 and a protracted -term goal of $ 194.

Supply: TradingView

Such a rally may also rely upon the energy of the market momentum. If it stays excessive, the infringement is extra seemingly.

Quite the opposite, Aave can proceed to consolidate inside this sample, the place accumulation continues to happen.

The adoption stays excessive

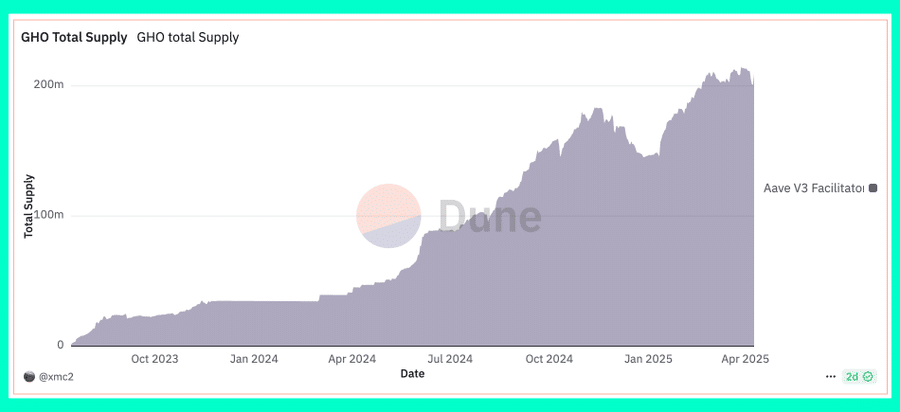

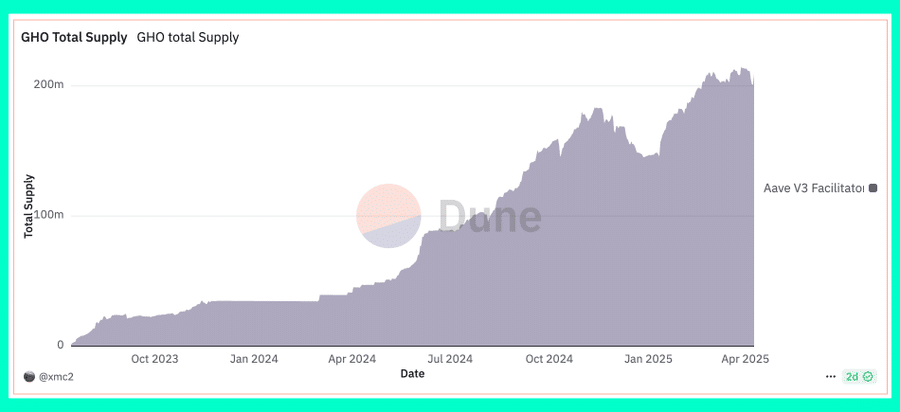

There was a rising adoption of the indigenous stablecoin of Aave, GHO, with the identical huge development of 442% alone previously 12 months.

Such a rise in Stablecoin’s vary implies the sustainable usefulness of the Stablecoin and, by extension, the Aave protocol. If the full provide arises, this could imply the rising demand. This might most probably be mirrored within the worth of Aave that climbs larger within the charts.

Supply: Dune Analytics

Lastly, the market sentiment has remained bullish these days. Aave has a better probability of attaining its goal of $ 167 if this pattern is maintained.

-

Meme Coin6 months ago

Meme Coin6 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain12 months ago

Blockchain12 months agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos12 months ago

Videos12 months agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana3 months ago

Solana3 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024