Policy & Regulation

Will The Plans of SEC and CFTC to Modernize Financial Markets Succeed?

Credit : cryptonews.net

The US Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) have a joint explanation On September 5, 2025, steps coordinated to modernize American monetary markets. Within the press launch, the companies confirmed that they’re evaluating the coverage to introduce 24/7 commerce cycles, to control everlasting futures and to increase supervision at crypto and derivatives markets.

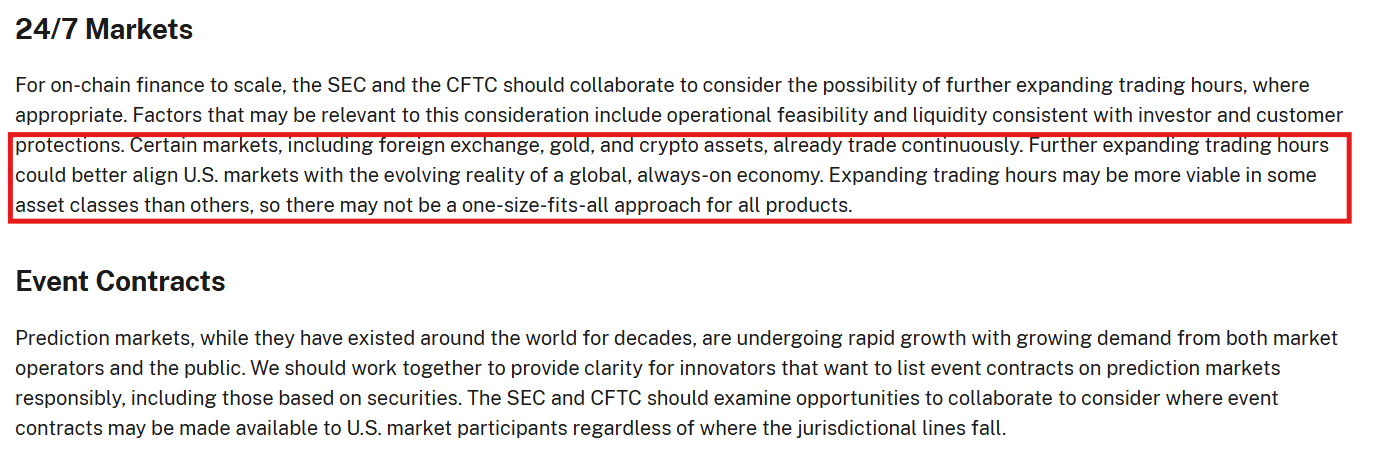

Push to steady market entry

American markets have been working below mounted weekday hours for greater than a century. Since 1985, the New York Inventory Alternate and Nasdaq have adopted a normal schedule that’s closed on nights and weekends. The joint rationalization questioned whether or not that framework stays appropriate in a monetary system that’s more and more being shaped by crypto, international trade and uncooked supplies, all of that are repeatedly appearing over areas of regulation.

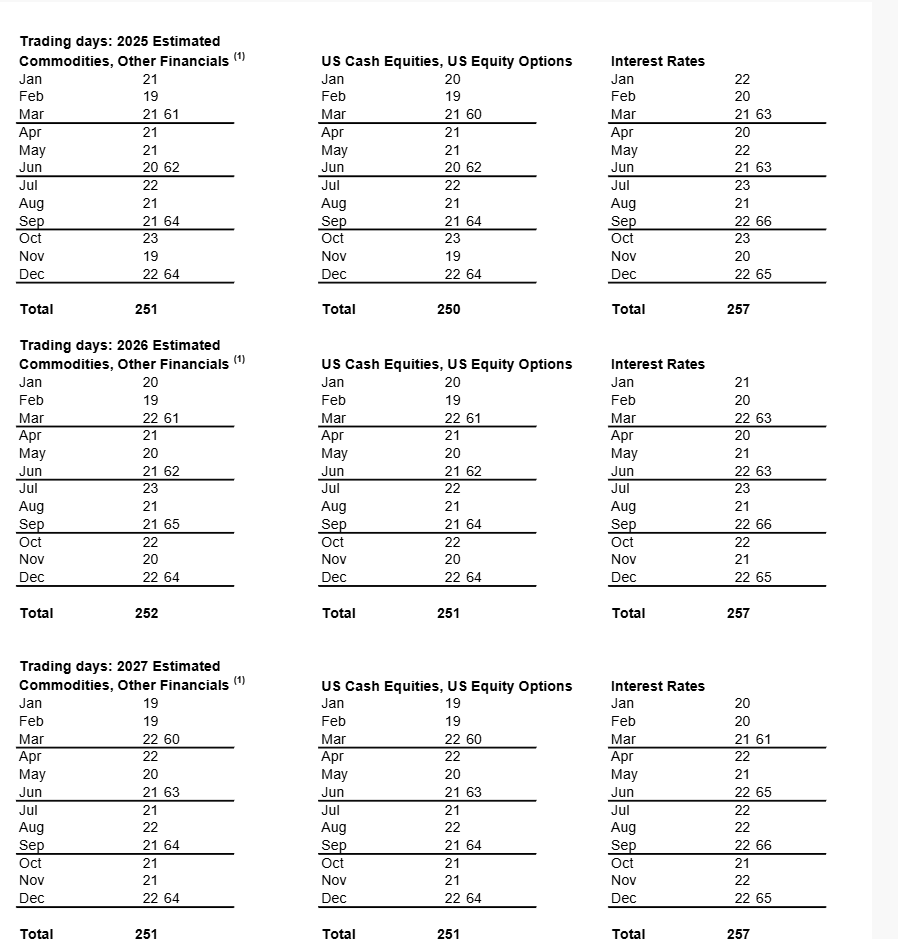

Supply: New York Stock Exchange (Trade Days)

“Additional growth of buying and selling hours can higher tailor the American markets to the creating actuality of a worldwide, all the time to financial system,” stated the assertion.

Each companies emphasised that though prolonged hours might speed up the capital velocity, additionally they deliver additional dangers. In a single day positions will be uncovered to world contributors in several time zones, creating vulnerability for merchants who can’t continually comply with the markets. Officers famous that growth “in some energy lessons will be extra viable than others”, which exclude a common strategy.

Supply: Sec/cftc press release

The shift to steady commerce could be an necessary break with the previous American follow. It will additionally require important upgrades of the infrastructure of the clearing, the settlement and threat administration to course of transactions across the clock.

Regulatory deal with cryptoderivaten

The SEC and CFTC confirmed that perpetual futures contracts are being investigated. These merchandise, which miss an expiry date, dominate offshore crypto exchanges and are good for essentially the most spinoff quantity. Bringing below the American jurisdiction may give home buyers entry to stricter lever checks and improved threat frameworks.

The companies additionally acknowledged the necessity for authorized readability about occasion contracts, a kind of spinoff centrally in prediction markets. Occasion contracts, linked to particular outcomes corresponding to elections or financial knowledge releases, have risen worldwide, however stay inconsistently regulated in the USA. By establishing clear guidelines, supervisors wish to accommodate innovation whereas retaining buyers.

Officers stated that everlasting contracts and prediction markets could be mentioned on a public spherical desk deliberate for September 29. The assembly is anticipated to draw contributors in trade, teachers and market operators.

Coordination with the crypto -framework of Trump -administration

The joint proposals comply with the coverage route of the federal government of President Donald Trump. In July the administration revealed an inter -agency report wherein suggestions have been set out for a uniform digital financial system framework. That report knowledgeable the SEC and CFTC of coordinating crypto markets, allocating the CFTC authority on spot buying and selling and the SEC jurisdiction on tokenized securities.

In August, the CFTC extensively The Pathway (Ftile Bourt of Trad of Trad (FBOT), which open regulated channels for offshore -exchanges to serve American prospects. The FBOT register, which has been in drive because the Nineteen Nineties, permits international exchanges to request the replace for a part of the Opmatents for a width lessons for a broadere of broadere of broadcast lessons to be a width class. In current buildings whereas sustaining supervision.

The July report additionally ordered to construct quantum -proof structure to guard cryptographic protocols. Regulators warned that the progress in Kwantum Computing might finally endanger the coding requirements that shield financial institution, financing and protection programs. The Activity Pressure of the Crypto Property is taking a look at a proposal to quantum -proof digital property earlier than such dangers happen.

Motion to uniform supervision

Atkins and Pham describe the present initiatives as “a brand new begin” for his or her companies. Each supervisors emphasised that markets for results and non-security converge, which requires stricter coordination and up to date guidelines. By increasing buying and selling hours, assuaging restrictions on derivatives and providing innovation -exemptions for Defi protocols, the companies are goal of decreasing holes between American and international markets.

Civil servants additionally outlined the idea of ‘tremendous apps’. These platforms can supply commerce on securities, spot crypto, lever Futures and occasion contracts below one regulatory framework. Atkins argued that such programs would eradicate the necessity for a number of licenses and state-per-state necessities. Throughout a speech in July to the America First Coverage Institute, he described Tremendous apps as an ‘necessary precedence’, which Crypto talked about as a justification for his or her creation.

Individuals within the trade welcomed the dialogue. Crypto corporations stated that entry to perpetual contracts and built-in platforms can cut back belief in offshore festivals. Conventional monetary representatives expressed warning and emphasised that infrastructure, liquidity and mechanisms for investor safety would require upgrades earlier than steady commerce on a scale might launch.

Dangers and criticism

Whereas the companies introduced the proposals as steps in modernization, critics warned of doable penalties. Some coverage analysts argued that creating super-apps mixture of results, crypto and derivatives can enhance the systemic threat. Others stated that steady commerce might drawback smaller buyers who’re unable to examine markets for all hours.

Fischer, a former SEC officer, acknowledged that reforms that enable perpetuals, prediction markets and built-in platforms “Crypto -ineem corporations will give a lead over traditions on all markets.” She added that such reforms can take years to implement, however described them as ‘extraordinarily harmful’ with out ample assure. Critics additionally issued concern about volatility in in a single day markets and challenges in guaranteeing an orderly association in time zones.

The SEC and CFTC confirmed that discussions will proceed on the spherical desk of September 29. Individuals are anticipated to evaluate proposals for steady commerce, occasion contracts, perpetual futures and innovation adjustment for Defi. The outcomes of the assembly can type the premise for formal rules processes later this yr.

Conclusion

The joint announcement marks a uncommon illustration of alignment between the SEC and CFTC. For years, variations about jurisdiction have been delayed by the progress of the rules, particularly in crypto markets. The brand new framework, shaped by Witte Huis and cooperation between our bodies, signifies Washington’s intention of adapting American funds to digital realities.

If applied, 24/7 commerce could be a very powerful transformation within the American market construction, as a result of digital commerce emerged within the Nineteen Eighties. Perpetual Futures and Occasion contracts will be merchandise which have lengthy been restricted to offshore exchanges below home supervision. Tremendous apps can, if realized, merge separate capabilities in a uniform market.

Nevertheless, the reforms are confronted with authorized, technical and operational obstacles. Market managers should overhaul programs to deal with a relentless settlement. Regulators should design safety towards volatility, manipulation and cyber dangers. Traders, each institutional and retail, should adapt to a market with out closing bell.

The Roundtable of September 29 begins to type how these challenges are being tackled. As world funds go to continuous operation, American supervisors appear to be decided to make sure that the American markets stay aggressive in a digital, all the time on financial system.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now