Analysis

Will UNI Crypto Hit $22 Before Year-End?

Credit : coinpedia.org

As market volatility subsides, consideration shifts to Uniswap’s 2025 worth forecast, which seems to be more and more enticing. The UNI crypto has been exhibiting a long-term rising, widening wedge sample since 2022, and with current whale exercise rising, November may very well be an important month for a breakout on the Uniswap worth chart.

UNI pricing construction is gearing up for an enormous transfer

Uniswap worth is hovering close to $6.54 right this moment, stabilizing after retesting the decrease certain of its multi-year rising broader wedge sample. Since 2022, this formation has decided the value habits of the UNI/USD, inflicting cyclical rallies and pullbacks inside well-defined development traces.

Between Might and August 2025, UNI’s worth evaluation confirmed a rally from $4.60 to $12, delivering a pointy 150% achieve earlier than heavy resistance emerged. Nonetheless, the rejection round $12 was adopted by a chronic consolidation, which pushed costs again to the decrease wedge assist zone in early October.

With costs as soon as once more testing this essential degree, technical indicators level to a brand new potential upside section. If the bullish momentum continues, the Uniswap worth forecast for November 2025 may see worth targets close to $12 and $14. A break above $14 may push UNI in direction of $22 by the tip of the yr.

Within the occasion of slower demand, the identical transfer may lengthen into the primary quarter of 2026, according to the higher fringe of the wedge.

- Additionally learn:

- Pump.enjoyable worth reaches $0.005098, merchants search for affirmation above $0.0051

- ,

Whale exercise signifies accumulation section

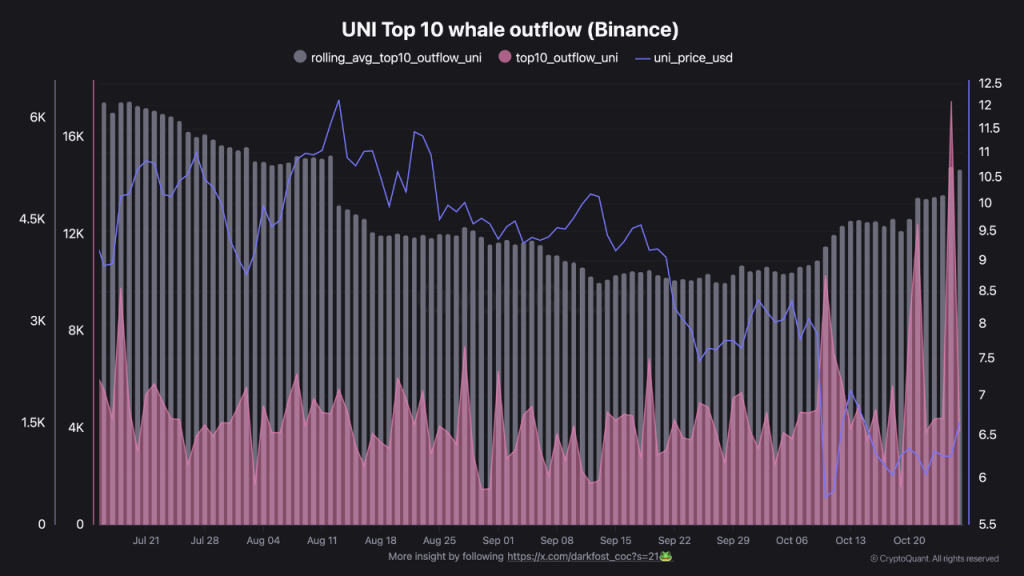

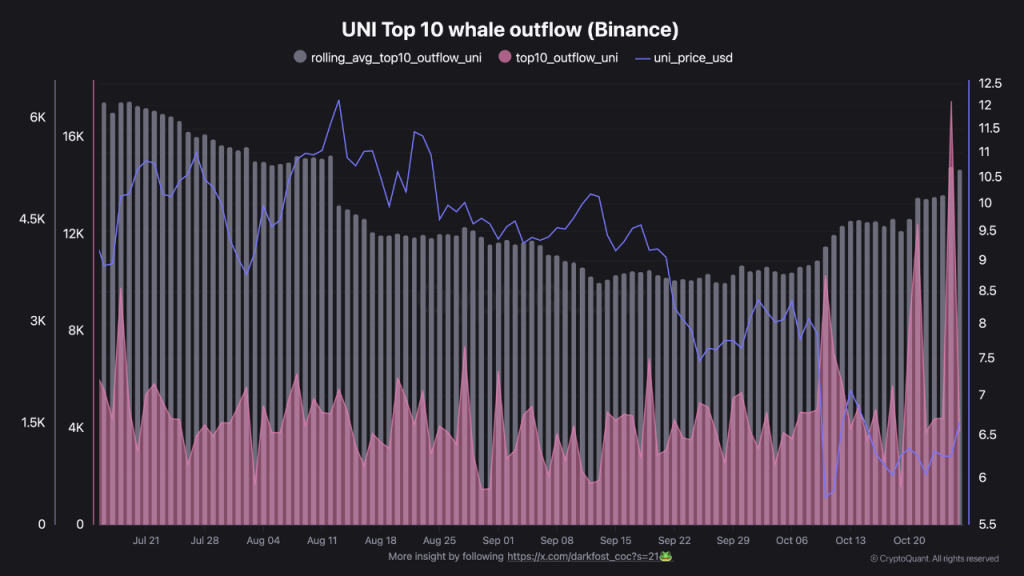

Along with technical features, these are additionally indicators on the chain echo renewed curiosity from main buyers. Binance knowledge reveals a noticeable enhance in UNI crypto outflows, particularly from the highest 10 largest trades attributed to whale wallets. This exercise reached a each day peak of 17,400 UNI and a quarterly excessive of 5,250 UNI month-to-month outflows, indicating accumulation by influential holders.

Traditionally, such large-scale withdrawals from exchanges like Binance point out preparation for long-term holdings or repositioning in DeFi ecosystems, which frequently precede important worth actions. The timing of this whale exercise, which coincides with a retest of the value ground, provides power to the bullish Uniswap 2025 worth forecast story.

Market confidence is returning as whales develop into energetic once more

Whales usually function with strategic precision, getting into solely when technical and behavioral indicators align. Their renewed presence in UNI reinforces the market’s rising perception that these property have regained whale curiosity and are about to backside out after months of correction, following a short rally in July, which was then adopted by a correction. Uniswap’s worth evaluation now reveals a transparent shift from reactionary promoting to proactive accumulation.

If demand accelerates in November, the token may retest its mid-year highs, confirming the bullish construction that has endured for greater than two years. A confirmed breakout wouldn’t solely restore market confidence but in addition reestablish UNI as among the best performing DeFi property within the coming cycle.

As the ultimate quarter of the yr unfolds, the technical construction, whale habits and cyclical market restoration are all aligning, offering a powerful basis for Uniswap’s 2025 worth predictions.

Steadily requested questions

UNI may rise from $6.54 to $12-$14 in November if it breaks wedge resistance fueled by whale shopping for in opposition to assist, probably reaching $22 by yr finish.

UNI’s potential upside is linked to a restoration from a key assist degree and elevated accumulation by giant buyers, indicating rising confidence in its long-term worth.

Technical evaluation signifies that UNI is testing a essential assist zone. A profitable seize may result in important income, however all crypto investments include inherent dangers.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers primarily based on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We attempt to offer well timed updates on all the things crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared signify the creator’s personal views on present market situations. Please do your personal analysis earlier than making any funding selections. Neither the author nor the publication accepts duty on your monetary selections.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks could seem on our web site. Adverts are clearly marked and our editorial content material stays utterly impartial from our promoting companions.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024