Ethereum

World Liberty Finance’s $9.89M ETH swap: Trouble for Ethereum?

Credit : ambcrypto.com

- World Liberty Finance and Grayscale, two main establishments, have transferred a good portion of their ETH holdings to exchanges, indicating the opportunity of a sell-off.

- Investor exercise in ETH has come to a standstill, with the funding premium turning unfavourable as demand falls.

Ethereum [ETH] has underperformed in latest weeks and is down 18.31% over the previous month. The bearish development continued over the previous 24 hours, with a slight lack of 0.53%.

Current market tendencies recommend that Ethereum’s decline might intensify within the coming days, particularly after the inauguration of the brand new US President, Donald Trump.

Investor actions should not in favor of ETH

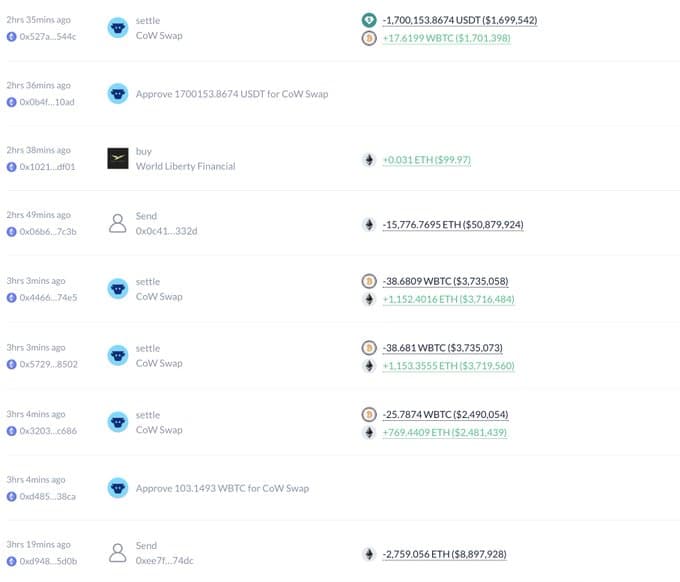

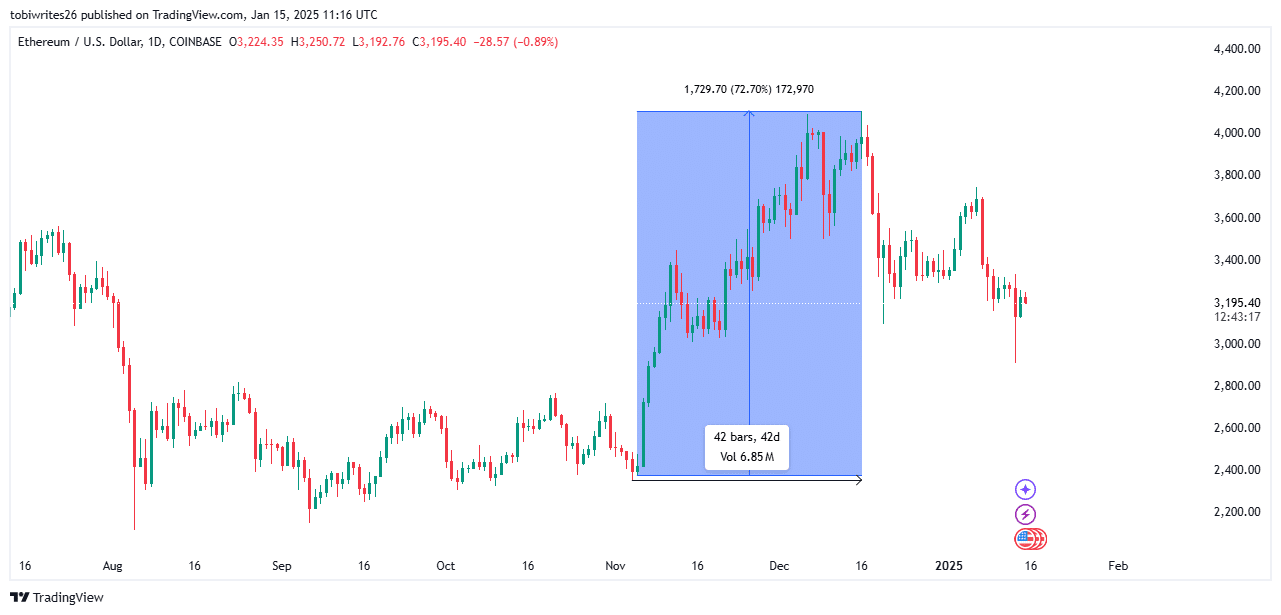

In a latest transfer, World Liberty Finance, related to newly elected President Donald Trump, has elevated its ETH holdings by buying extra tokens after which promoting them.

On this transaction, World Liberty exchanged 103 WBTC, value $9.89 million on the time of the change, for 3,075 ETH.

After finishing the commerce, they added 15,461 ETH to their holdings, bringing their whole to 18,536 ETH, which was then deposited into the cryptocurrency change Coinbase Prime.

Supply: DeBank

When property transfer from personal portfolios to exchanges, it often alerts an impending sell-off. Nevertheless, on this case, the sale might not occur instantly.

World Liberty Finance could also be holding the property in anticipation of a worth enhance following the upcoming inauguration of President-elect Trump, as we’ve got seen previously.

The potential for a major Ethereum rally with Trump taking workplace may mirror the worth enhance following his 2024 presidential victory.

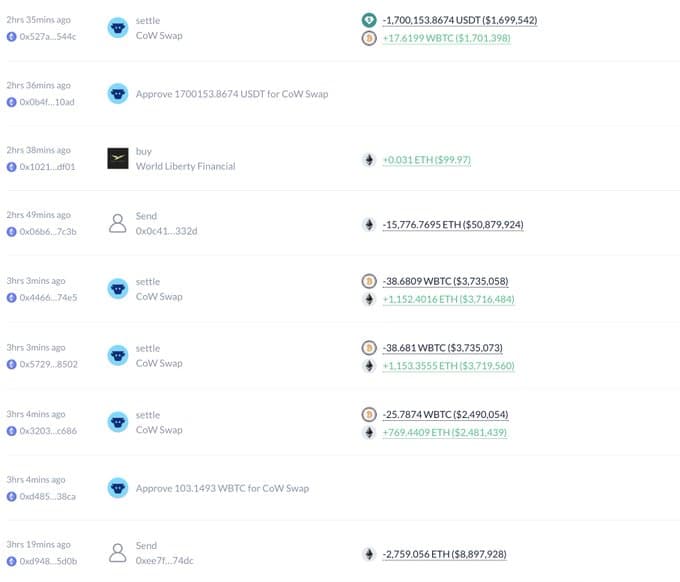

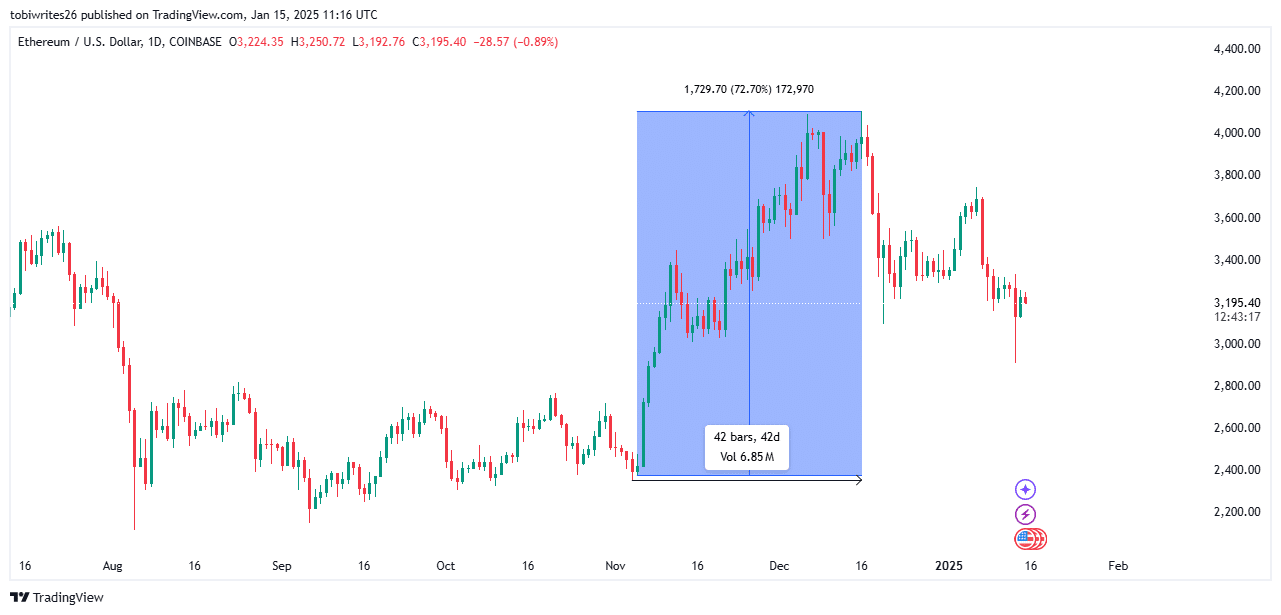

On November 5, 2024, ETH rose 72.70%, from a low of $2,379.30 to a excessive of $4,109.00 on December 16, 2024 – simply 42 days later.

Supply: TradingView

If historical past repeats itself, World Liberty Finance may aggressively promote its ETH on Coinbase Prime after the anticipated worth enhance, probably inflicting the worth of ETH to fall.

Extra information from Intel exhibits that institutional investor Grayscale, identified for its giant ETH holdings, has adopted the same sample and moved its property to Coinbase Prime.

In accordance with the info, three transactions moved a complete of 16,941 ETH to Coinbase Prime, valued at $54.27 million on the time, indicating a bearish perspective in direction of the asset.

Supply:

Demand is beginning to lower

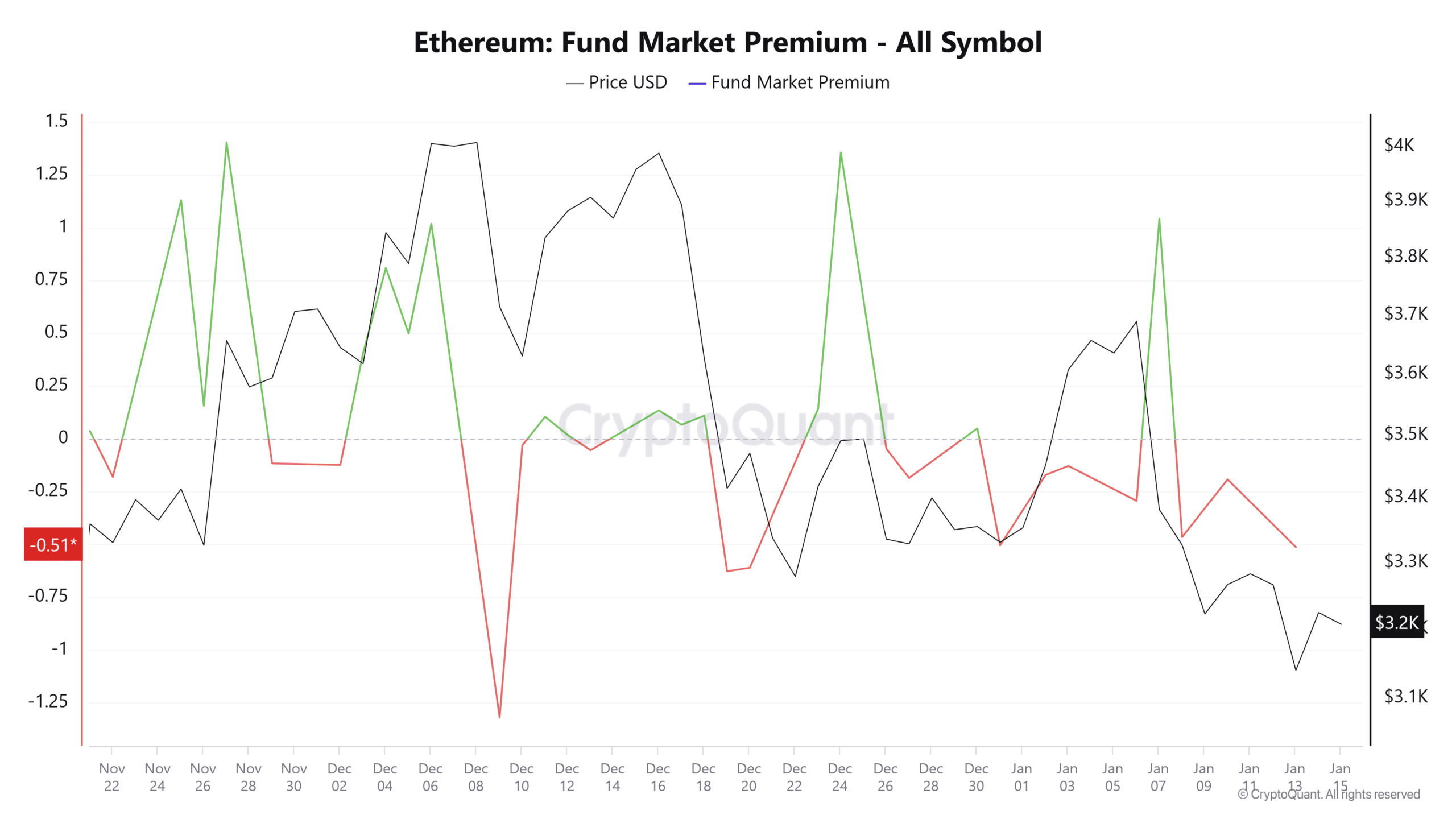

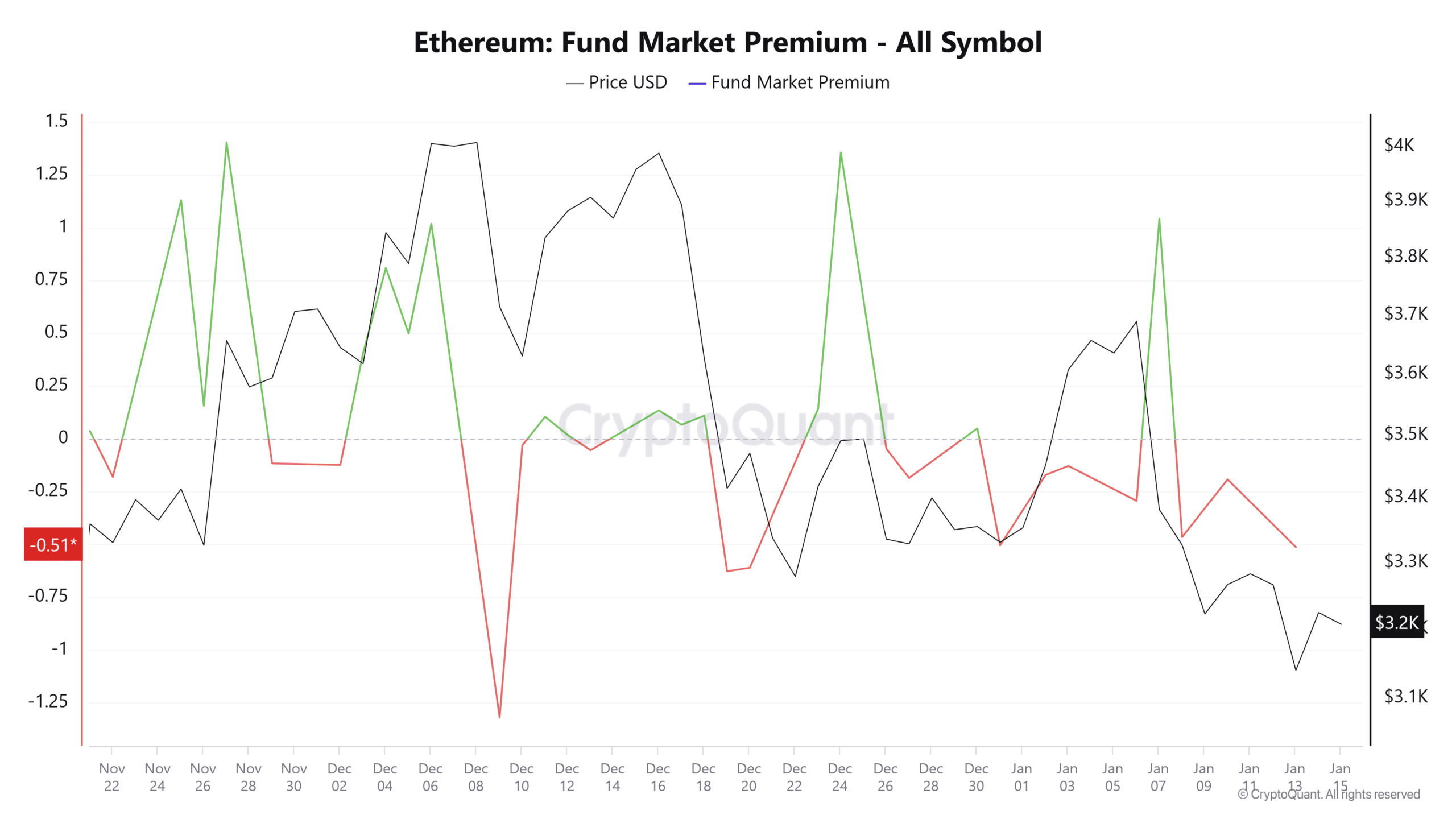

In accordance with CryptoQuant’s premium index, which measures institutional demand for an asset, ETH’s fund premium has fallen considerably. It’s now buying and selling at unfavourable 0.515 and transferring additional away from its impartial zone.

A drop under the impartial zone (zero) signifies that institutional traders are much less prepared to pay a premium for ETH, indicating a decline in demand and a steadily bearish outlook.

Supply: CryptoQuant

On the identical time, spot merchants are displaying indicators of uncertainty. These merchants now desire to maintain their property on exchanges, the place they will simply promote, relatively than in personal portfolios for long-term funding.

Learn Ethereum’s [ETH] Value forecast 2025-26

This habits is mirrored within the change’s web circulation, which on the time of writing shifted from a each day web circulation of unfavourable 39,270 ETH in early January to only 6,093 ETH.

This sentiment means that each institutional and retail traders are shedding curiosity, with some steadily promoting their positions. Nevertheless, the overall sentiment stays that ETH remains to be thought-about a bullish asset.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024