Altcoin

XLM Outperforms Bitcoin in November: Will the Rally Hold Despite Caution?

Credit : ambcrypto.com

- The XLM valuation towards Bitcoin has proven a big improve because the starting of November.

- XLM as soon as once more rose above the Parabolic SAR, indicating continued bullishness.

Stellar lumens [XLM] has proven a big improve in its valuation towards Bitcoin since early November. XLM’s outperformance towards Bitcoin marked a constructive shift in market sentiment.

This uptrend mirrored a resurgence in investor curiosity, as Stellar Lumens navigated away from earlier lows to problem new resistance ranges.

Current buying and selling exercise pushed XLM’s valuation to ranges not seen in months, sparking discussions in regards to the potential to maintain these features. The chart confirmed a breakout of the sequence of decrease highs and decrease lows – a bullish indicator within the technical market knowledge.

Supply: IntoTheCryptoverse

The important thing query remained: Can Stellar Lumens proceed its rise to extra strong valuation benchmarks versus Bitcoin?

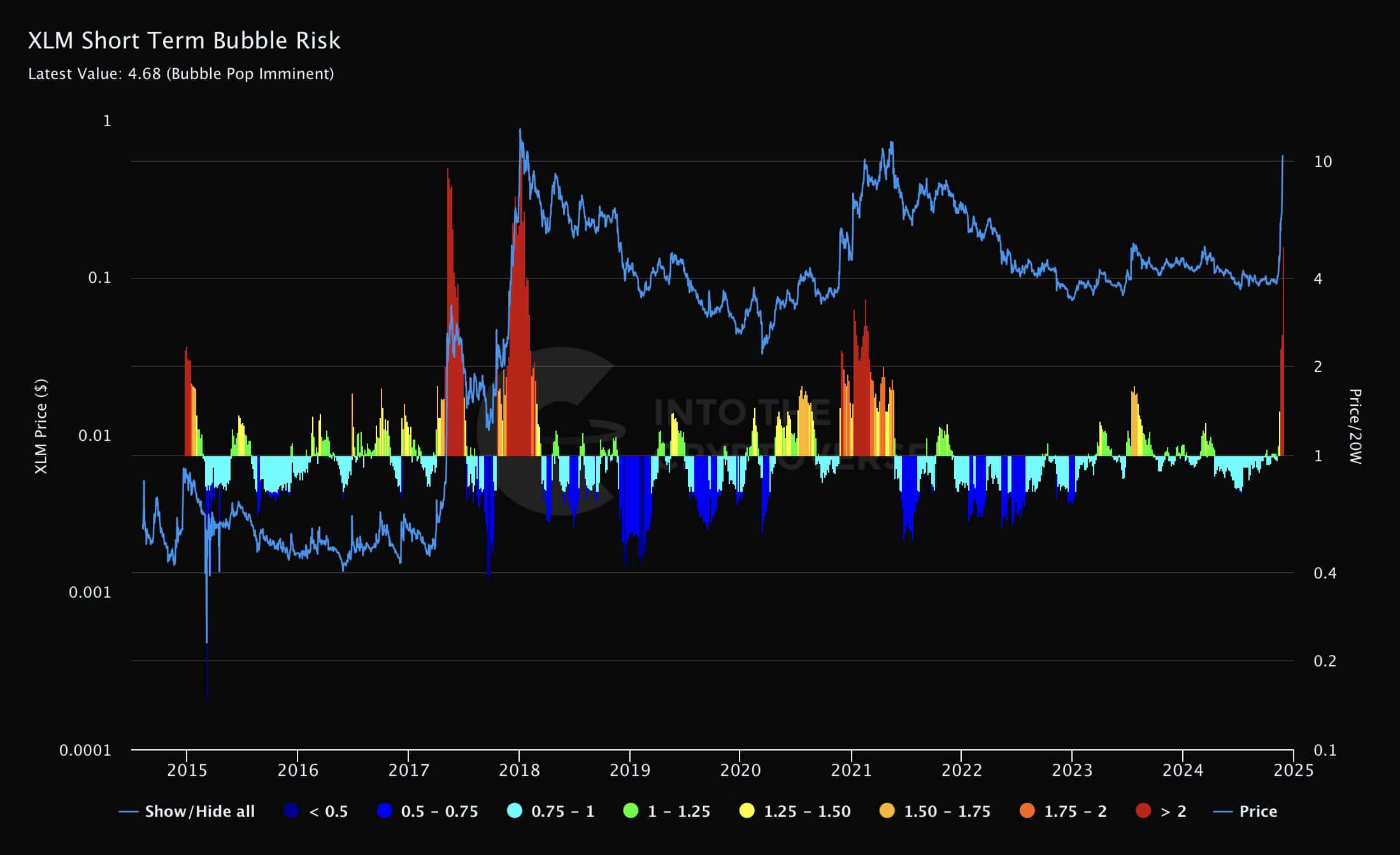

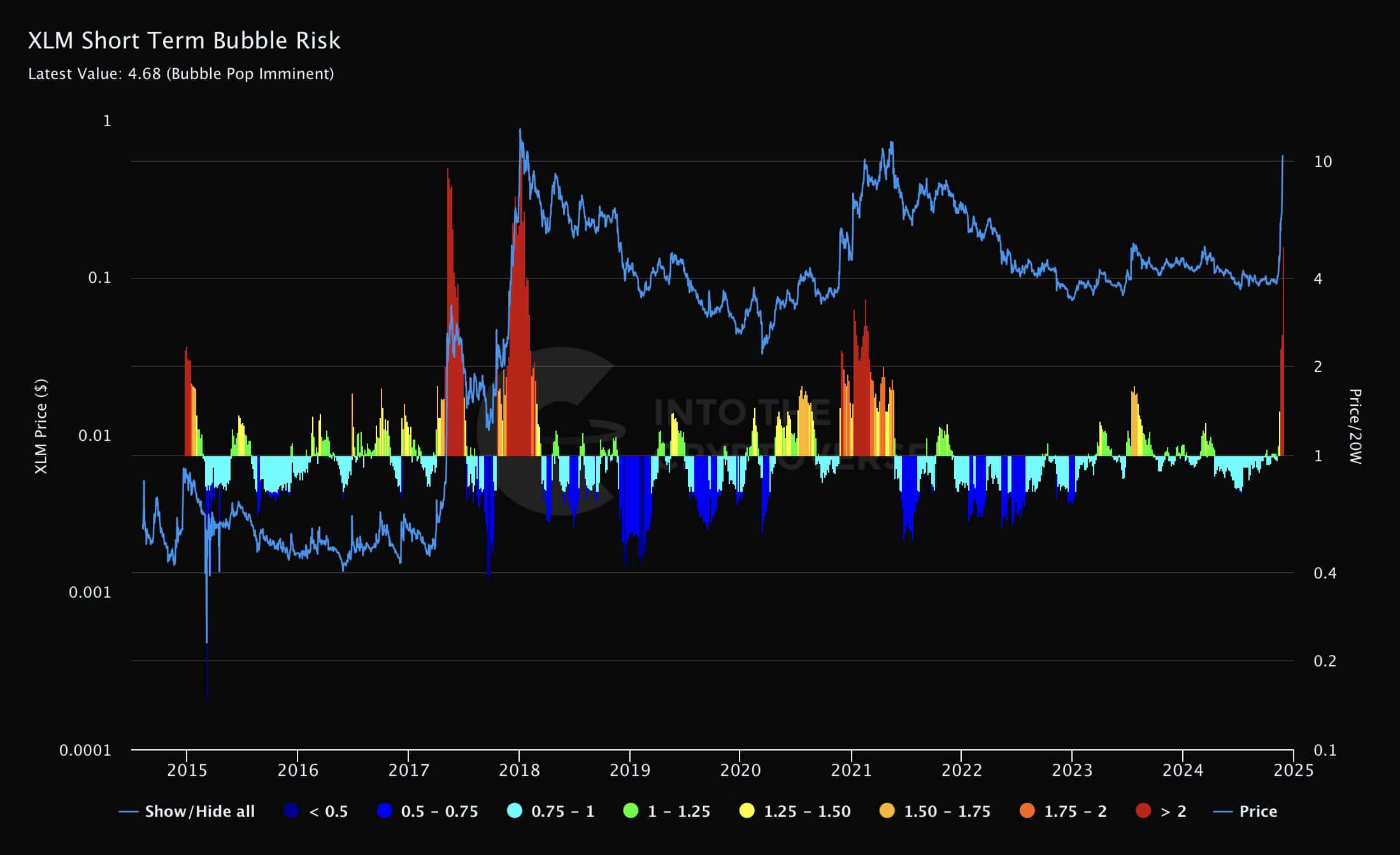

XLM faces a doable bubble burst

Regardless of Stellar Lumens outperforming Bitcoin when it comes to valuation, the short-term bubble threat indicator spiked to 4.68, indicating {that a} bubble might be imminent.

This excessive threat score warned buyers that whereas Stellar Lumens was searching for some assist across the $0.5 degree, coming into lengthy positions may nonetheless be precarious except this worth degree is firmly anchored as a flooring for future progress.

Supply: IntoTheCryptoverse

As Stellar Lumens worth motion unfolds, merchants ought to preserve an in depth eye on the $0.5 assist zone as a confirmed stabilization right here may open the door for a extra sustainable uptrend.

The chart evaluation highlights vital threat factors that might considerably affect XLM’s worth trajectory within the close to time period.

Value prediction and recording of ATH

XLM confirmed volatility, in step with the month-to-month alerts from the Parabolic SAR. XLM as soon as once more rose above the Parabolic SAR, indicating continued bullish upside.

Traditionally, each time XLM exceeded this threshold, it typically peaked, adopted by a decline. Nonetheless, the short-term bubble threat indicator spiked on the similar time, warning of a doable retracement.

The sample indicated that it will be clever to attend for Stellar Lumens to return beneath the Parabolic SAR or stabilize earlier than anticipating additional rallies.

Supply: buying and selling view

This cyclical conduct instructed the significance of strategic entries and exits within the unstable crypto market, particularly when key indicators sign a shift.

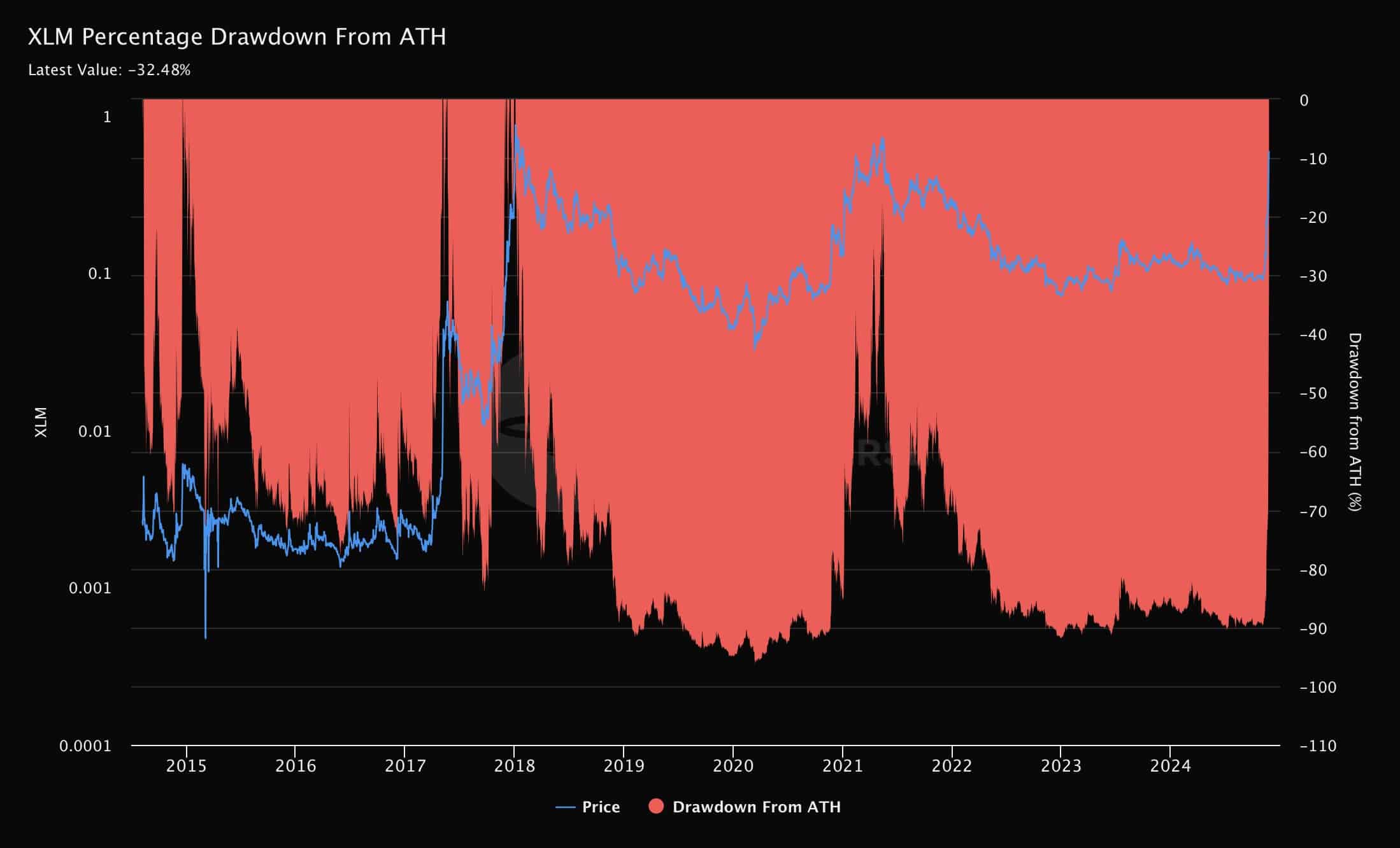

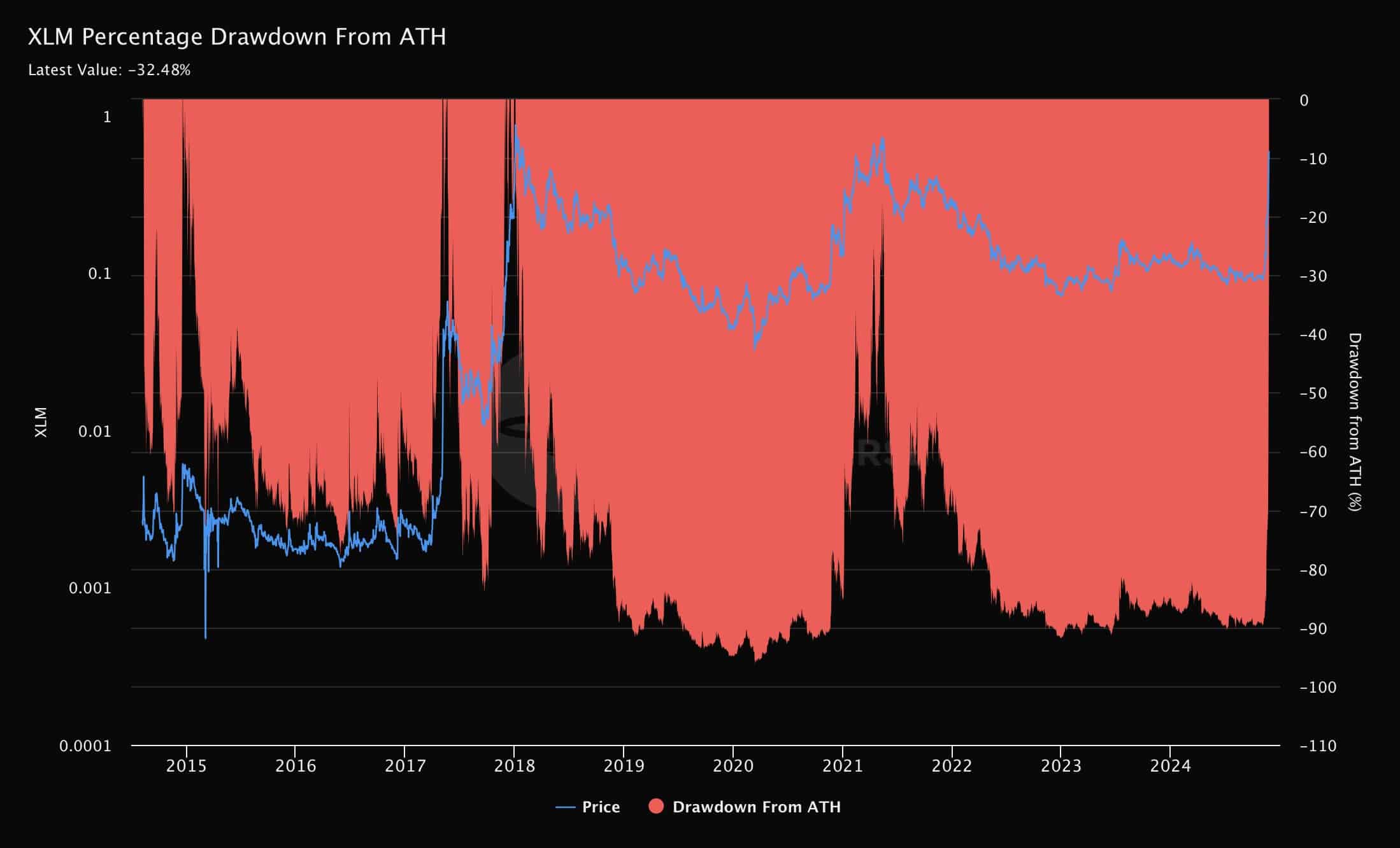

Moreover, XLM’s efficiency diminished ATH absorption to simply 32.48%. This was vital given the historic volatility in XLM costs, which have seen vital ups and downs over time.

The chart mirrored durations of sharp will increase within the worth of XLM, adopted by equally speedy declines, that are usually related to broader market tendencies.

Supply: IntoTheCryptoverse

Learn Stellar’s [XLM] Value forecast 2024–2025

The present drawdown price discount indicated a constructive restoration development, indicating that XLM is regaining worth from its lows extra successfully than previously.

This restoration might be a sign of rising investor confidence and a stabilizing market place for XLM.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024