Policy & Regulation

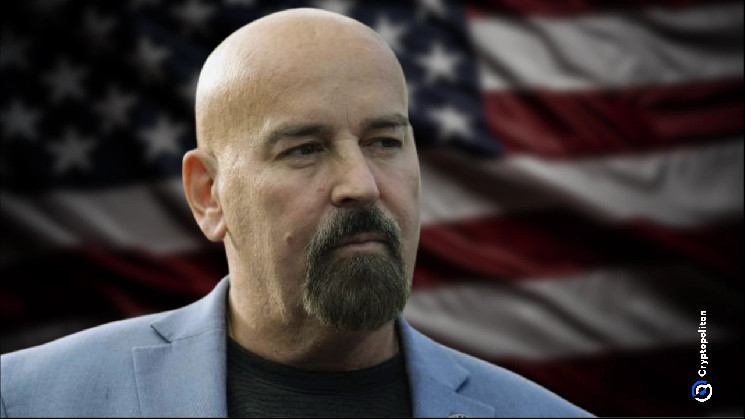

XRP lawyer John Deaton criticizes old SEC for favoring real crypto criminals SBF and Do Kwon

Credit : cryptonews.net

XRP lawyer John Deaton has accused the US Securities and Change Fee (SEC) of focusing professional cryptomabins, whereas performing precise fraudsters equivalent to Sam Bankman-Fried (SBF) and at present does KWON in a submit on X.

“The SEC missed precise fraud in crypto as a result of it had a bureaucratic hack in Gary Gender Hyper Hyper centered on implementing a political agenda set by his grasp Senator Elizabeth Warren. Let’s not neglect that Genler has met De Bernie Madoff from Crypto – SBF – a number of occasions, “Deaton wrote.

“SBF met Rep. Maxine Waters, former CFTC chairman Rostin Benham, and was allowed to testify earlier than the congress. Why did he get a lot unimaginable entry? Easy! He paid for it. “

In response to testimony from SBF’s personal course of, he led $ 10 million to the Biden administration and $ 70 million to Democrats in the course of the Mid -Phrases of 2022 to achieve entry to supervisors.

The SEC lasted years to go after Kwon, regardless of clear indicators of fraudulent actions in Terra’s actions. When the SEC lastly interviewed him at a crypto convention, it was made public with public spot and indignation, whereby Gensler’s face was even processed in memes on the physique of Darth Vader.

Amanda Fischer, Employees Chef on the SEC, defended Kwon’s dealing with by the desk and admitted that the sec might have been extra aggressive, however the authorized maneuvers of Kwon was blamed for suspending the motion. “The SEC ought to have continued him about many issues, not only one,” Fischer mentioned. “But it surely’s onerous to do when the suspect disputes the legality of the summons and the invention has been launched for years.”

She then criticized the crypto group and requested why many gathered into the protection of Kwon as a substitute of insisting on stricter enforcement. “What introspection do you may have in regards to the trade that gathered on the protection of Kwon?” she requested.

Federal Courts tear SEC’s enforcement technique aside

The aggressive motion of the SEC in opposition to Crypto firms led to a number of authorized defeats. Judges have accused the SEC to behave illegally in his enforcement strategy.

Deaton pointed to a ruling the place a federal decide mentioned that SEC legal professionals “had missed a loyal loyalty to the legislation.” A Courtroom of Enchantment later found that the sec ‘random and fickle’ had acted, whereas a 3rd court docket went thus far to punish the SEC as a result of he was mendacity in opposition to the court docket.

One of the controversial sec actions amongst Gensler was the lawsuit in opposition to Coinbase. The SEC had accepted Coinbase’s IPO in 2021 and mentioned it was within the curiosity of the viewers. Lower than two years later, the company circled and complained Coinbase and claimed that her complete enterprise mannequin was unlawful.

However now the SEC reportedly drops the lawsuit in opposition to Coinbase. Coinbase CEO Brian Armstrong confirmed on X {that a} deal has been reached with the SEC workers to reject the case, though it was not formally introduced by the workplace itself.

Brian known as the choice an enormous victory and thanked crypto voters for serving to select pro-Crypto politicians. “The crypto voter is actual and appeared within the hundreds of thousands,” he wrote.

The SEC initially accused Coinbase of exploiting an unlawful change, dealer and clearing company whereas providing not registered results. The lawsuit was a part of a broader efficiency that promised Trump to show throughout his marketing campaign.

Trump’s new sec notes the previous playbook of crypto enforcement

The SEC follows a brand new strategy underneath Trump’s authorities. The company has simply introduced the institution of the Cyber and Rising Applied sciences Unit (CETU) to interchange the crypto property and cyber unit.

CETU, led by Laura d’Allaird, consists of 30 fraud specialists and legal professionals centered on cyber crime and monetary misconduct. Performing SEC chairman Mark Uyeda mentioned that CETU’s objective is to guard traders and on the identical time develop crypto -innovation, and added: “This new unit would be the work of the Crypto Job Pressure led by Commissioner Hester Peirce complement. “

The CETU will give precedence to fraud circumstances that should do with AI, the blockchain and social media. It additionally goes after hackers who steal insider data on social media, or faux commerce web sites and takeovers of the retail dealer accounts.

The Trump marketing campaign was explicitly centered on the aggressive alignment of the SEC in opposition to Crypto. Throughout his rallies, he repeatedly promised to dismiss Gary Gensler on ‘day one’ of his presidency. Gensler resigned earlier than Trump might.

-

Meme Coin8 months ago

Meme Coin8 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT10 months ago

NFT10 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Solana5 months ago

Solana5 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Videos3 months ago

Videos3 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now