Analysis

XRP Price Builds Momentum as Macro Catalysts and ETF Hopes Spark Accumulation

Credit : coinpedia.org

The broader crypto market seems to be approaching a serious turning level and the XRP value is correct in the midst of it. With liquidity anticipated to rise and macro catalysts aligned, XRP’s consolidation section may quickly give option to a decisive breakout, which might set the tone for a brand new bullish cycle.

Liquidity locks and macro dominoes are aligning

As the worldwide economic system braces for a sequence of… synchronized macro shiftLately, dangerous belongings resembling crypto have obtained renewed consideration. The tip of quantitative tightening (QT), the prospect of fee cuts and a $1.5 trillion liquidity injection are laying the groundwork for what could possibly be a historic rally.

Mixed with easing tensions between the US and China and robust earnings at S&P, the present setup paints a “risk-on” setting. This good storm of liquidity, storyline and capital rotation makes digital belongings like Bitcoin, Ethereum and particularly XRP stand out among the many blue-chip cryptocurrencies.

XRP value enters a symmetrical triangle: accumulation earlier than growth

Presently, the XRP value is hovering round $2.62, with a market cap of $157 billion and $4.49 billion in 24-hour buying and selling quantity. On the XRP value chart, the token converges inside a symmetrical triangle sample.

This value compression signifies an prolonged accumulation section. Good cash seems to be quietly positioning itself forward of what could possibly be a serious shift as soon as volatility will increase. The resilience of the XRP value at this time highlights rising investor confidence regardless of persistent macro uncertainties.

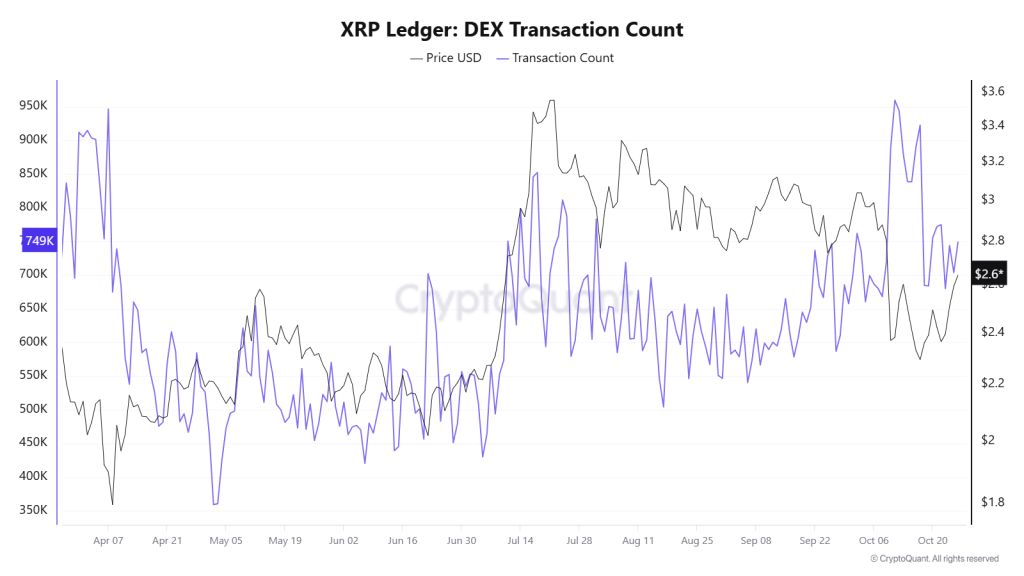

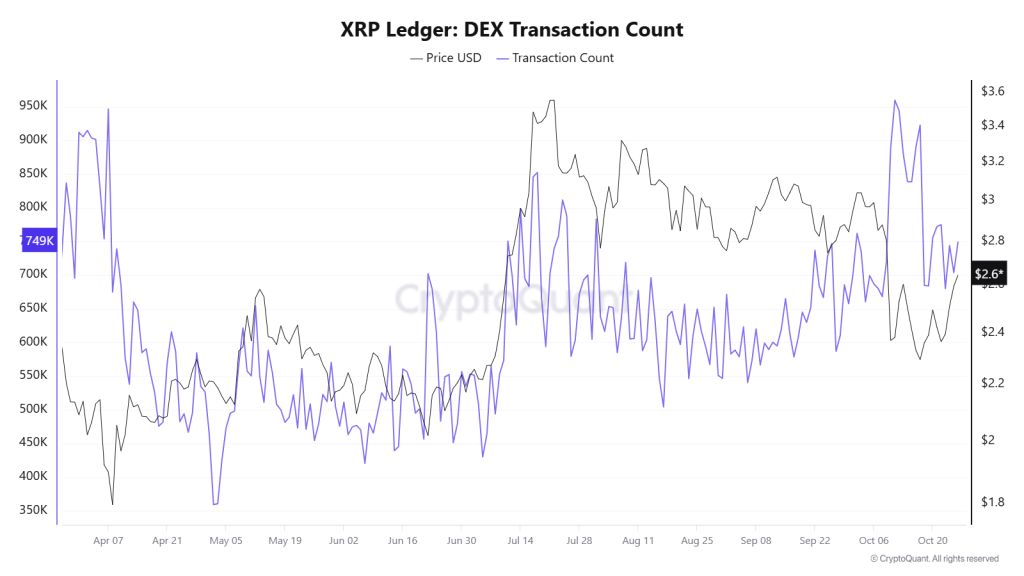

On-chain indicators are getting stronger: DEX exercise suggests upcoming rally

Apparently, the on-chain metrics of the XRP Ledger DEX are giving bullish indicators. Since Could 2025, as value consolidation continues, the variety of DEX trades has steadily elevated, indicating that order exercise and liquidity are constructing beneath the floor.

This improve in transaction involvement, together with putting and canceling orders, displays the elevated participation of superior merchants. Such patterns sometimes precede robust value actions, indicating that the market is “arising” for a pointy upside breakout as soon as the catalysts align.

ETF Momentum can redefine the XRP story

Maybe essentially the most influential upcoming driver for XRP crypto is the rising anticipation surrounding a possible XRP ETF launch. Latest discussions point out that spot crypto ETFs for XRP, Solana and Litecoin are prepared for regulatory approval as soon as Washington resumes full operations.

Market commentators describe this example as a “dam about to burst”, with approval delays the one barrier holding again institutional inflows. As soon as lifted, the wave of latest ETF merchandise may dramatically improve publicity to XRP, shifting it from an accumulation section to a sustained XRP value rally.

Incessantly requested questions

Analysts and AI predict that XRP may attain $5.05 by the tip of 2025, pushed by ETF approvals, partnerships, and regulatory readability.

Based mostly on compound progress and adoption, projections estimate that XRP may commerce round $26.50 by 2030, with averages round $19.75.

Hypothetically sure – if XRP reaches $500+ and an investor holds a big quantity (e.g. 2,000 XRP). Nonetheless, that is speculative and depending on excessive long-term progress.

XRP is taken into account a powerful funding as a result of its institutional adoption, regulatory developments, and position in cross-border funds. Nonetheless, it comes with volatility dangers, like all cryptocurrencies.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our knowledgeable panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluate coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We goal to offer well timed updates on the whole lot crypto and blockchain, from startups to trade majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market circumstances. Please do your individual analysis earlier than making any funding choices. Neither the author nor the publication accepts duty to your monetary decisions.

Sponsored and Adverts:

Sponsored content material and affiliate hyperlinks might seem on our website. Adverts are clearly marked and our editorial content material stays fully impartial from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now