Analysis

XRP Price Holds $2 as Ripple’s OCC Bank Approval Redefines Crypto’s Institutional Path

Credit : coinpedia.org

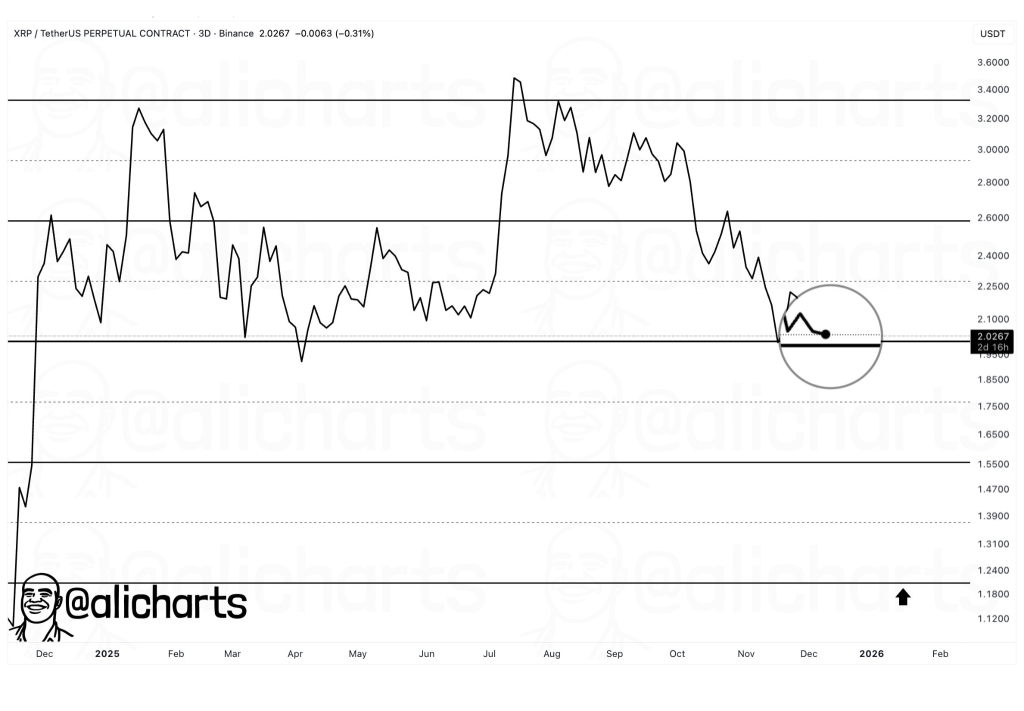

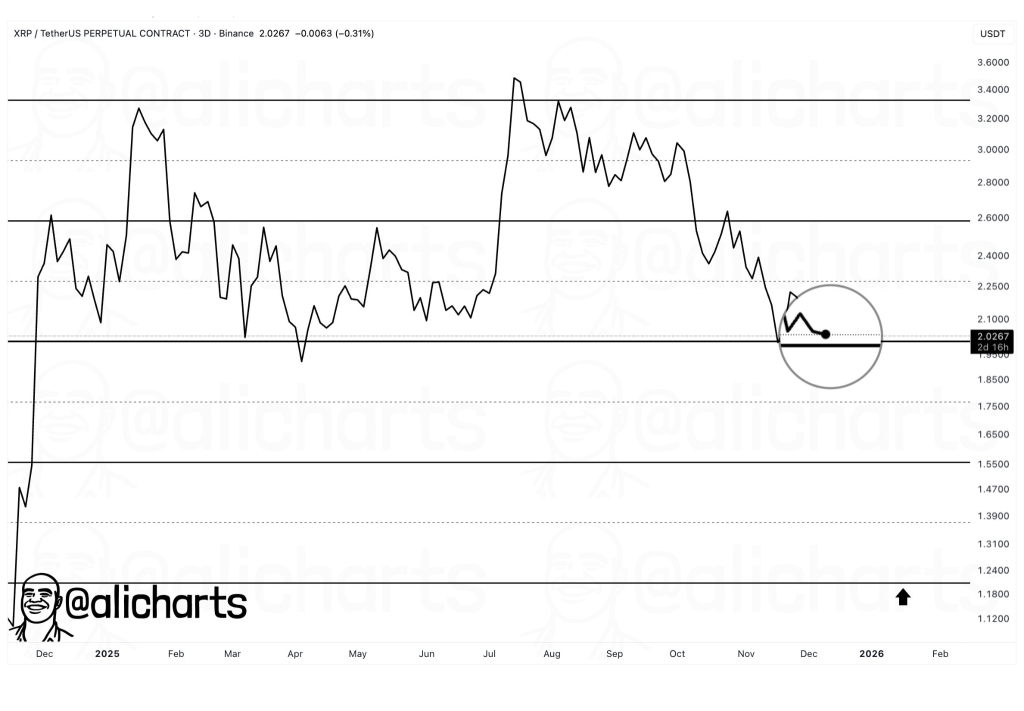

The XRP worth is at the moment at a decisive deadlock as the worth is capped regardless of sturdy fundamentals, however shaky market sentiment is stopping it from rising. Ripple’s current regulatory breakthrough represents a historic shift for the crypto panorama, however the XRP worth has but to indicate any response on the chart.

To this point it has missed important strikes from many optimistic information tales, much like different altcoins this quarter, however which mirror adverse information instantly on the chart. Nevertheless, in contrast to some other altcoin, its resilience in holding $2 continues to be commendable, and that was solely potential for XRP due to its fundamentals, constant demand, and the arrogance buyers have in it. Now persons are carefully watching to see if the $2 degree will maintain regular.

Ripple’s OCC approval alerts a structural shift

Ripple just lately obtained conditional approval from the US Workplace of the Comptroller of the Monet to constitution the Ripple Nationwide Belief Financial institution. This improvement locations Ripple straight below federal banking supervision, aligning its operations with each OCC and NYDFS requirements.

From a structural perspective, this approval elevates Ripple past a payments-focused crypto firm to a regulated monetary infrastructure. This transfer strengthens the muse for RLUSD and positions XRP as a compliant settlement asset connecting fiat trails, stablecoins and tokenized property.

Importantly, this milestone addresses long-standing criticism that crypto operates exterior conventional monetary guidelines. As an alternative, Ripple now operates inside them below direct supervision.

XRP’s utility story is strengthening regardless of worth lull

Though this announcement was intense discussion in crypto communities, however the XRP worth chart appears to have digested this as properly, displaying little rapid response. This disconnect highlights the present local weather the place macro sentiment outweighs particular person venture progress.

Beneath the brand new framework, XRP’s position continues to enhance, however markets typically delay repricing till utilization metrics and liquidity flows mirror these modifications.

For now, the XRP crypto fundamentals look like accelerating sooner than the worth.

Market sentiment retains XRP vary certain

Regardless of optimistic developments, broader market sentiment stays cautious. Danger urge for food for cryptocurrencies has weakened, limiting follow-up even on main information. Consequently, XRP costs USD continues to commerce defensively close to the $2 psychological zone.

Technically, XRP is in a consolidation part in 2025, with consumers persistently defending $2 whereas upside makes an attempt fail to draw sustainable momentum. This habits signifies distribution slightly than accumulation, which reinforces short-term uncertainty.

So long as sentiment stays subdued, XRP worth prediction fashions will stay cautious.

From a technical standpoint, the $2 degree has turn out to be an important reference level on the XRP worth chart. Repeated defenses of this zone point out longer-term investor confidence, however every failed restoration provides stress.

If sentiment doesn’t enhance, draw back threat stays. A $2 loss may expose you XRP/USD in the direction of deeper retracement ranges close to $1.20, in keeping with prevailing technical projections.

In the meantime, as Ripple’s regulatory positioning matures, the disconnect between worth motion and fundamentals places the XRP worth at a vital inflection level, and what comes subsequent relies upon purely on bettering market sentiment within the coming weeks or months.

Belief CoinPedia:

CoinPedia has been offering correct and well timed cryptocurrency and blockchain updates since 2017. All content material is created by our skilled panel of analysts and journalists, following strict editorial pointers based mostly on EEAT (Expertise, Experience, Authoritativeness, Trustworthiness). Every article is fact-checked from respected sources to make sure accuracy, transparency and reliability. Our evaluation coverage ensures unbiased evaluations when recommending exchanges, platforms or instruments. We try to offer well timed updates on the whole lot crypto and blockchain, from startups to business majors.

Funding Disclaimer:

All opinions and insights shared characterize the creator’s personal views on present market situations. Please do your personal analysis earlier than making any funding choices. Neither the author nor the publication accepts accountability on your monetary decisions.

Sponsored and Advertisements:

Sponsored content material and affiliate hyperlinks might seem on our website. Advertisements are clearly marked and our editorial content material stays fully unbiased from our promoting companions.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now