Analysis

XRP Price Poised for 10% Rally After Grayscale XRP Trust Announcement

Credit : coinpedia.org

The XRP value is poised for a major rally regardless of a 6% upside momentum up to now 4 hours. It is all due to asset administration large Grayscale. On September 12, 2024, the corporate introduced its newest single-asset crypto funding product, Grayscale XRP belief.

Grayscale’s XRP Belief is within the highlight

This announcement on X (previously Twitter) went viral and attracted numerous consideration from the crypto neighborhood. This submit obtained 350,000 impressions in lower than two hours and the quantity remains to be rising quickly.

With Grayscale’s newest funding product, traders get the chance to leverage XRP, a token that powers the XRP Ledger, a distributed, peer-to-peer community created to help cross-border monetary transactions.

Present value momentum

On the time of writing, XRP is buying and selling round $0.56 and has skilled a value enhance of over 6% within the final 24 hours. In the meantime, buying and selling quantity has skyrocketed by 75% over the identical interval, reflecting the bullish views of merchants and traders following Grayscales’ announcement.

XRP Technical Evaluation and Upcoming Ranges

In accordance with professional technical evaluation, XRP seems bullish after a week-long downturn as it’s now buying and selling above the 200 Exponential Transferring Common (EMA) on the day by day timeframe. Nonetheless, the latest value surge has pushed XRP’s Relative Power Index (RSI) into overbought territory, indicating a potential value reversal.

Primarily based on historic value momentum, XRP is dealing with sturdy resistance close to the $0.58 stage. If the day by day candle of

Statistics on the chain: Bulls in Management

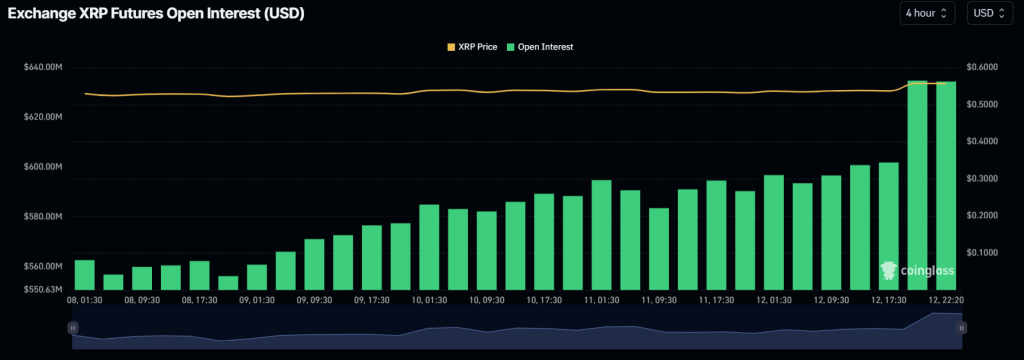

This bullish outlook is additional supported by on-chain metrics. CoinGlass The XRP lengthy/quick ratio at present stands at 1.0886, indicating bullish market sentiment from the dealer. Moreover, XRP’s ahead open curiosity has skyrocketed by 7.3%, indicating rising betting on lengthy positions.

Moreover, the Lengthy/Brief information reveals that 52.12% of the highest XRP merchants maintain lengthy positions, whereas 47.88% maintain quick positions.

-

Meme Coin7 months ago

Meme Coin7 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

NFT9 months ago

NFT9 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Solana4 months ago

Solana4 months agoSolana Price to Target $200 Amid Bullish Momentum and Staking ETF News?

-

Ethereum1 year ago

Ethereum1 year ago5 signs that the crypto bull run is coming this September

-

Gaming1 year ago

Gaming1 year agoGameFi Trends in 2024