The present XRP worth supplied merchants a rollercoaster as successive liquidations brought about a brutal sell-off throughout all the crypto market. Whereas the whole market cap fell 2.73% to $3.38 trillion, greater than $2.1 billion was worn out in huge liquidations after Bitcoin fell beneath the $100,000 mark.

Following these market-wide jitters, XRP worth fell 1.85% to $2.24 and traded 14.41% decrease on the weekly chart. Even updates within the XRP’s steep losses offered little reduction, reflecting cautious voices amongst merchants.

Liquidation affect

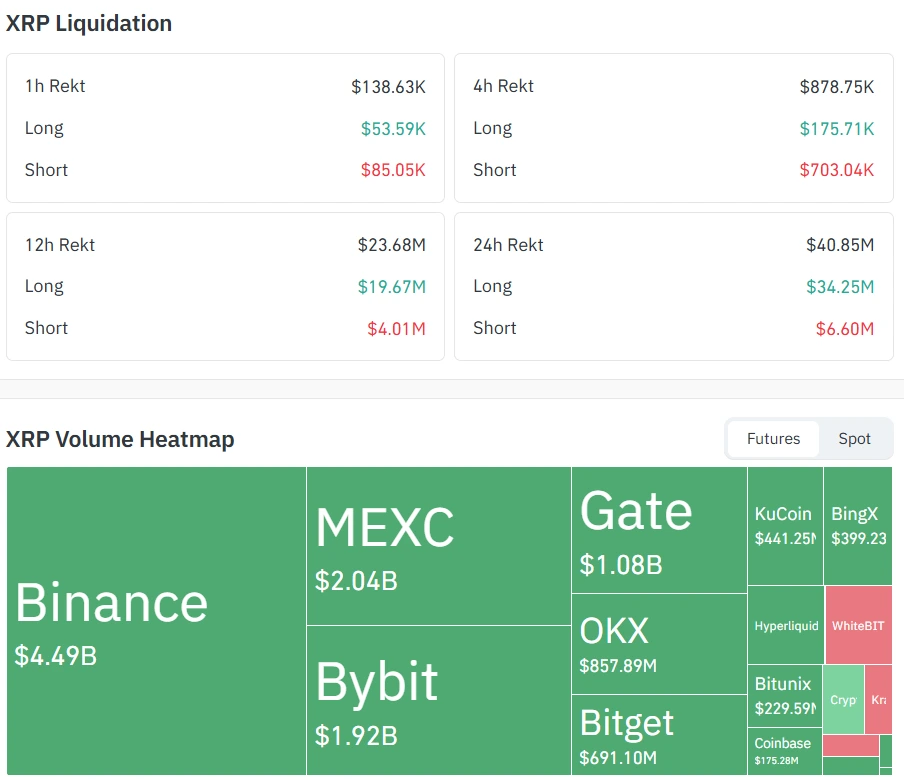

In keeping with MintGlassAt the moment, heavy liquidations dominate the XRP markets, with $40.85 million worn out and $6.6 million faraway from brief positions within the final 24 hours. The brunt of the liquidation ache fell on the bulls, with $34.25 million of longs worn out as costs failed to carry above key assist factors.

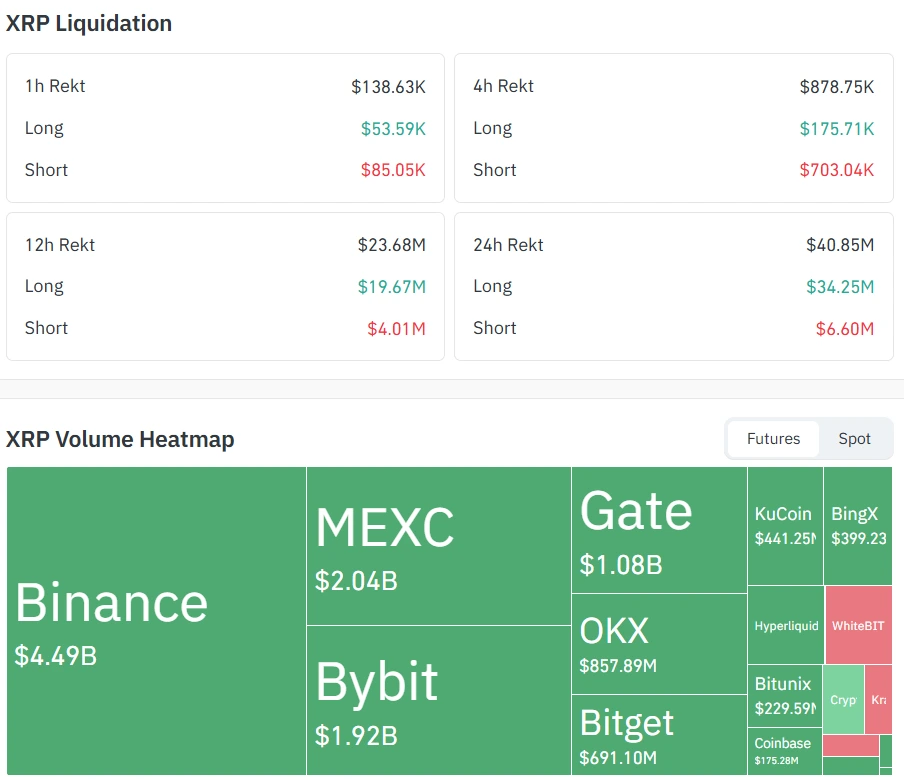

Many of the buying and selling went by way of Binance, which recorded a whopping $4.49 billion in futures quantity. Main exchanges akin to MEXC and Bybit additionally achieved billions in quantity. Affirmation that many of the motion occurred towards a backdrop of speedy foreclosures. Most merchants appeared to place themselves defensively, bracing for extra draw back threat, whereas liquidity remained deep

Ripple XRP Value Evaluation

Trying on the 4-hour chart, XRP worth began the day preventing to remain above $2.24. The token did not defend the main transferring averages, falling effectively beneath the 30-day SMA of $2.51 and the 200-day EMA of $2.60. Alternatively, $2.10 and $2.00 mark essential assist zones. After testing the low of $2.08, XRP staged a modest rebound, however momentum by no means shifted convincingly.

Sequentially, the RSI 14 stands at 36.93, highlighting the oversold situations. Bollinger Band readings present pronounced volatility stress, worth stays close to decrease bands whereas sellers stay in management. Until consumers return in drive above $2.36, the stress may proceed tomorrow. Anticipating a transfer above $2.36 may provide the primary signal of stabilization, whereas sharp dips may see fast retests of $2.1045 and $2.00 ranges.

Steadily requested questions

Present technical knowledge signifies continued bearish stress. The fast assist is at $2.10, and any bounce will want a detailed above $2.36 to draw new consumers.

Volumes stay sturdy, particularly on Binance futures. Nevertheless, with out clear bullish patterns or will increase within the RSI, elevated quantity alone doesn’t assure a reversal

RSI beneath 34 does point out oversold standing, however reversal indicators are lacking. Cautious merchants ought to await a bullish affirmation above $2.36 earlier than coming into new positions