Bitcoin

XRP Volatility Spikes With $105M in Longs Liquidated Amid ETF Jitters

Credit : www.coindesk.com

What to know

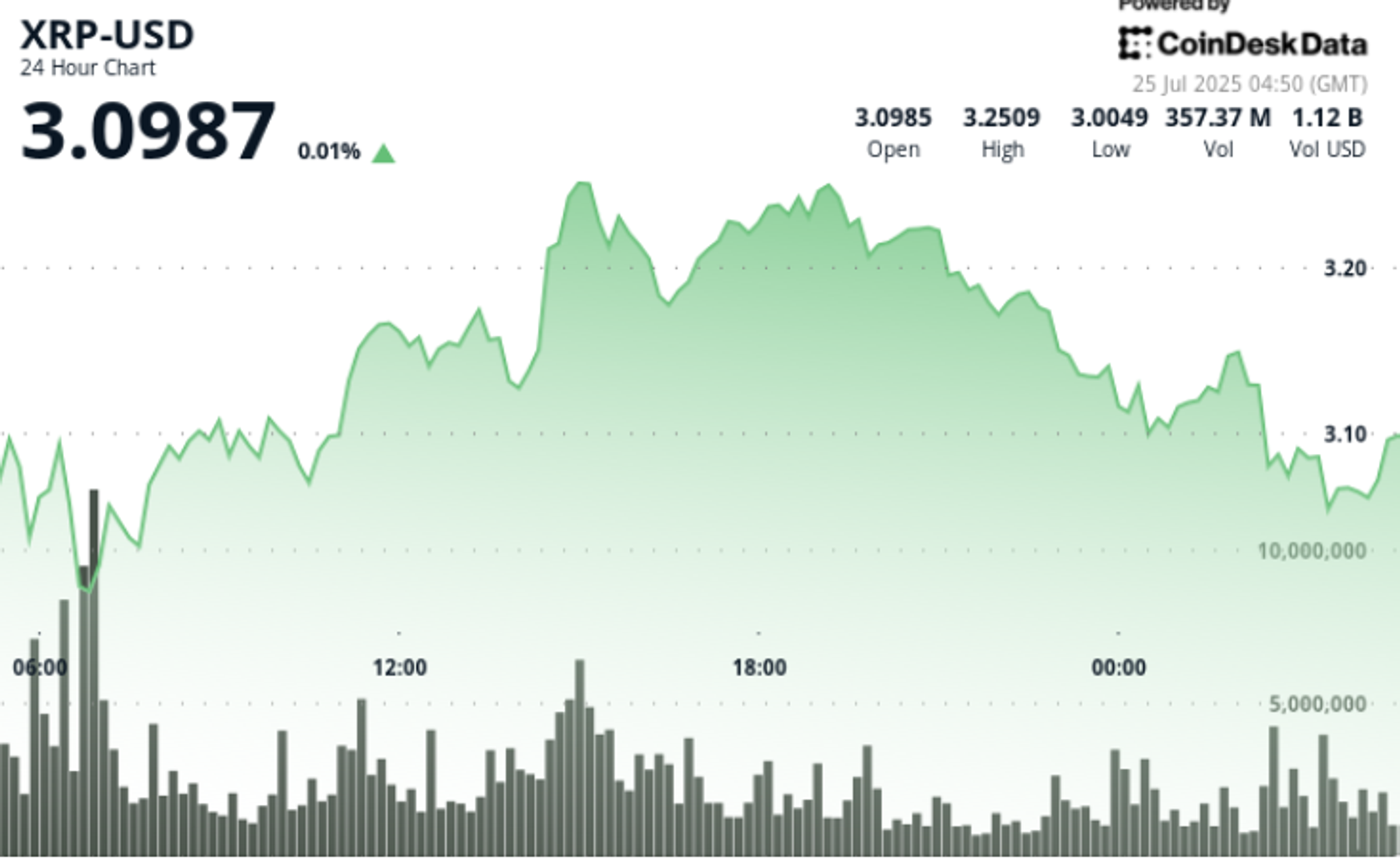

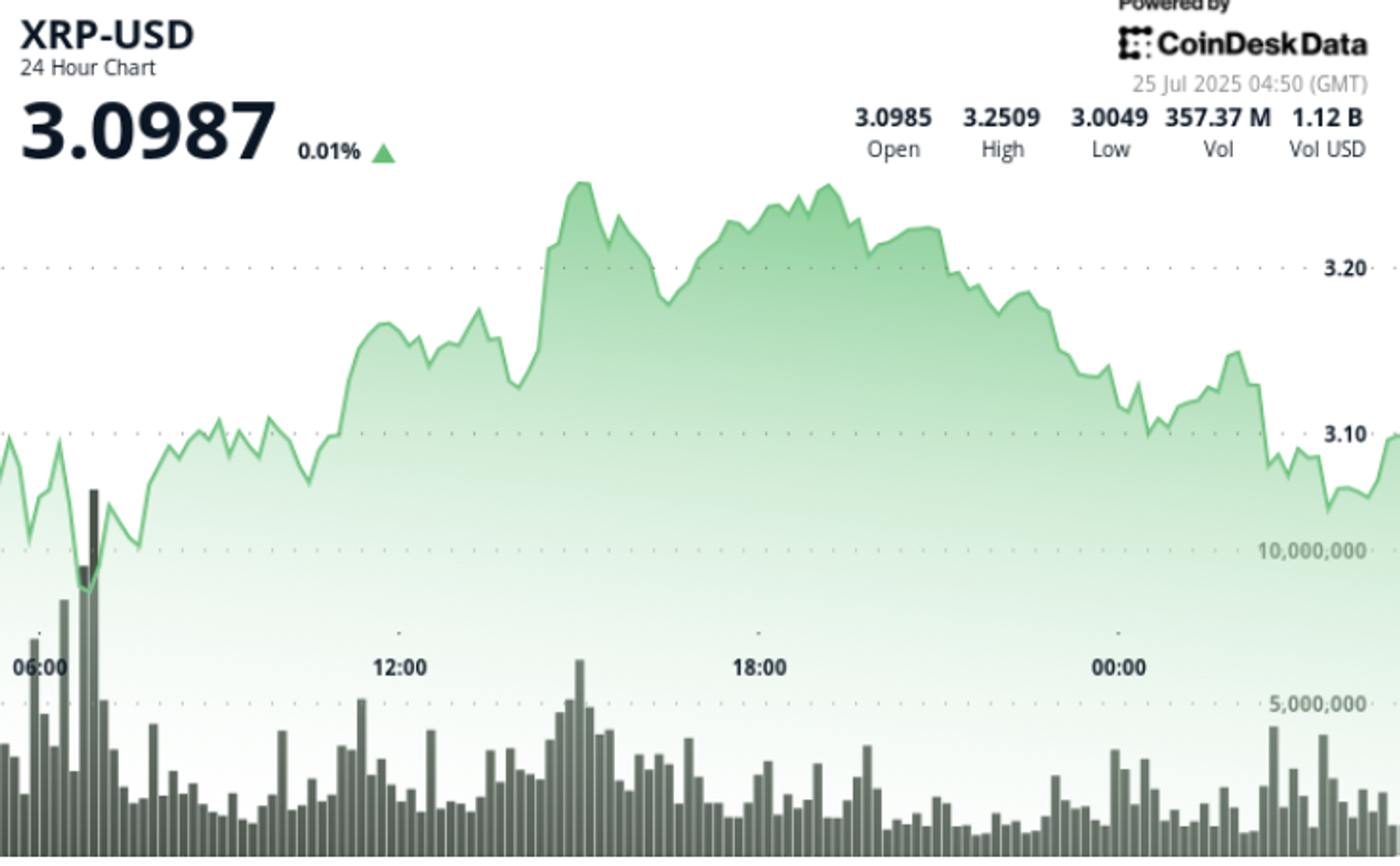

XRP positioned sharp losses in the course of the 24-25 July session and fell by 8% when it reached token in a $ 0.30, from $ 2.96 to $ 3.26.

An early session rally bustled after taking a revenue close to the resistance degree, whereas a sudden liquidation wave demonstrated greater than $ 100 million in lengthy positions.

Regardless of the sale, necessary assist at $ 3.06- $ 3.10 held by means of repeated assessments, with late session value motion that reveals indicators of potential stabilization.

Nature’s Miracle and Brazils Vert achieved headlines with new XRP-based methods, however institutional sellers dominated the tape within the midst of fears that ETF items inspections may be confronted with delays.

Information background

• XRP traded in a variety of seven.85% between $ 2.96 and $ 3.26 for twenty-four hours from July 24 at 05:00.

• Coinglass information confirmed greater than $ 18 billion in whole crypto readings in the course of the session.

• XRP lengthy liquidations amounted to $ 105 million, which contributed to speedy falls.

• The miracle by Nature introduced a $ 20 million XRP Treasury plan.

• Vert in Brazil has used a blockchain answer of $ 130 million that was constructed on the XRP whides.

Abstract of the value promotion

The session was opened for $ 3.13 and noticed a pointy fall to $ 2.96, adopted by a strout to a excessive of $ 3.26 at 15:00 at 175.94 million quantity – greater than double the typical. Resistance of $ 3.24 – $ 3.26 coated income. Value collapsed once more late within the session and dropped to $ 3.05 in the course of the window 03: 00–04: 00 on a 6.2 million quantity peak, most likely due to compelled gross sales or liquidation flows. XRP recovered modestly to shut to $ 3.08.

Technical evaluation

• Commerce vary of $ 0.30 between $ 2.96 low and $ 3.26 excessive.

• Heavy resistance confirmed at $ 3.24 – $ 3.26 after rejection after 15:00 rally.

• Important assist on $ 3.06– $ 3.10 repeatedly examined with volume-stunned bouncing yards.

• Within the final hour, the demolition reveals as much as $ 3.05 earlier than you reclaim $ 3.08 – a attainable bullish reversal sign.

• Liquidation -driven volatility suggests an elevated danger, however firm bid zones provide a brief -term construction.

Which merchants take a look at

• Whether or not XRP can maintain the $ 3.06 – $ 3.10 zone within the subsequent session.

• Affect of additional ETF-related developments of American supervisors.

• Drawing institutional return or renewed retail participation above $ 3.15.

• Wider crypto market stability after liquidations of a number of billions of {dollars}.

-

Analysis4 months ago

Analysis4 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin10 months ago

Meme Coin10 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT1 year ago

NFT1 year agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 34 months ago

Web 34 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos6 months ago

Videos6 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now