Analysis

XRP Whale Dump 18 Million Tokens, Will Price Drop?

Credit : coinpedia.org

It seems that XRP whales are pissed off with the present bearish market sentiment. At present, on September 19, 2024, blockchain transaction tracker Whale Alert posted on X (previously Twitter) that an -cryptocurrency-exchange. Nevertheless, the pockets tackle stays unknown.

XRP Whale offloads tens of millions of tokens

This vital XRP dump throughout the bearish part has the potential to create promoting strain. On the time of writing, XRP is buying and selling round $0.578 and has skilled a worth drop of over 1.8% prior to now 24 hours. Throughout the identical interval, buying and selling quantity elevated by 15%, indicating higher participation from merchants and traders throughout the market downturn.

XRP Technical Evaluation and Upcoming Ranges

Over the previous six days, the XRP worth remained consolidating between $0.56 and $0.59. In accordance with skilled technical evaluation, regardless of the huge dump and ongoing consolidation, XRP continues to be in an uptrend because it trades above the 200 Exponential Shifting Common (EMA). The 200 EMA is a technical indicator that merchants and traders use to find out whether or not an asset is in an up or down development.

Primarily based on the worth momentum, it seems that XRP might stage an upward rally as soon as it breaks out of the consolidation zone. If XRP closes a each day candle above the $0.60 degree, there’s a good likelihood that it might rise 20% in the direction of the $0.75 degree within the coming days.

Nevertheless, throughout this potential upside rally, XRP could encounter resistance close to the $0.65 degree, the place it is going to face notable promoting strain. This bullish outlook will solely maintain if XRP closes a each day candle above the $0.60 degree, in any other case it might fail.

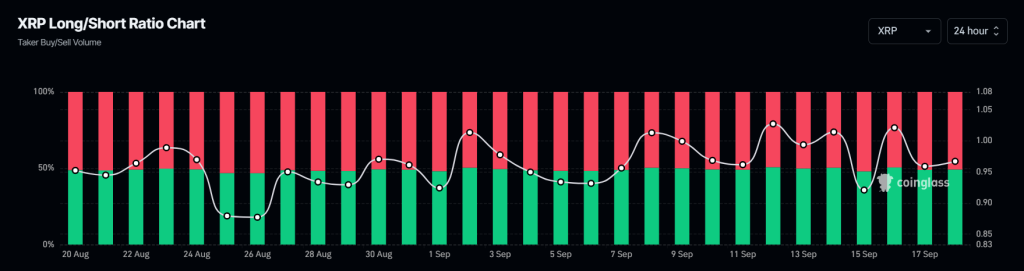

Bearish statistics within the chain

Presently, XRP’s on-chain metrics point out a bearish development. Mint glass The XRP lengthy/brief ratio at the moment stands on the degree of 0.96, indicating bearish market sentiment amongst merchants. Moreover, future open curiosity has fallen 5.5% prior to now 24 hours.

In accordance with information, 50.85% of high merchants have brief positions, whereas 49.16% have lengthy positions, indicating that bears dominate the belongings.

-

Analysis3 months ago

Analysis3 months ago‘The Biggest AltSeason Will Start Next Week’ -Will Altcoins Outperform Bitcoin?

-

Blockchain1 year ago

Blockchain1 year agoOrbler Partners with Meta Lion to Accelerate Web3 Growth

-

Meme Coin9 months ago

Meme Coin9 months agoDOGE Sees Massive User Growth: Active Addresses Up 400%

-

Videos1 year ago

Videos1 year agoShocking Truth About TRON! TRX Crypto Review & Price Predictions!

-

NFT12 months ago

NFT12 months agoSEND Arcade launches NFT entry pass for Squad Game Season 2, inspired by Squid Game

-

Web 33 months ago

Web 33 months agoHGX H200 Inference Server: Maximum power for your AI & LLM applications with MM International

-

Meme Coin1 year ago

Meme Coin1 year agoCrypto Whale Buys the Dip: Accumulates PEPE and ETH

-

Videos5 months ago

Videos5 months agoStack Sats by Gaming: 7 Free Bitcoin Apps You Can Download Now